EX-99.2

Published on June 21, 2022

Exhibit 99.2

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

On April 4, 2022, upon the completion of the mergers (“Mergers”) pursuant to that certain Agreement and Plan of Merger, by and among Skillsoft Corp. (the “Company”), Ryzac, Inc., a Delaware corporation (“Codecademy”), Skillsoft Finance II, Inc., a Delaware corporation (the “Borrower”), Skillsoft Newco I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Borrower (“Merger Sub I”), Skillsoft Newco II, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of Borrower (“Merger Sub II”), and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the representative of the equity holders of Codecademy. Pursuant to the completion of the Mergers, the Company acquired Codecademy. The Codecademy acquisition was completed on April 4, 2022 for total consideration of approximately $386.0 million, consisting of the issuance of 30.4 million common shares and a net cash payment of $203.4 million.

In connection with the Mergers, the Borrower entered into Amendment No. 1 to the Credit Agreement, dated as of April 4, 2022 (the “First Amendment”), among Skillsoft Finance II, Holdings, certain subsidiaries of Skillsoft Finance II, as guarantors, Citibank N.A., as administrative agent, and the financial institutions parties thereto as Term B-1 Lenders, which amended the Credit Agreement (as amended by the First Amendment, the “Amended Credit Agreement”). The senior secured incremental term loan is referred to as the “Codecademy Financing Transaction.”

The First Amendment provides for the incurrence of up to $160 million of Term B-1 Loans (the “Term B-1 Loans”) under the Amended Credit Agreement. In addition, the First Amendment, among other things, (a) provides for early opt-in to the Secured Overnight Financing Rate (SOFR) for the existing term loans under the Credit Agreement (such existing term loans together with the Term B-1 Loans, the “Initial Term Loans”) and (b) provides for the applicable margin for the Initial Term Loans at 4.25% with respect to base rate borrowings and 5.25% with respect to SOFR borrowings.

Prior to the maturity thereof, the Initial Term Loans will be subject to quarterly amortization payments of 0.25% of the principal amount. The Amended Credit Agreement requires that any prepayment of the Initial Term Loans in connection with a repricing transaction shall be subject to (i) a 2.00% premium on the amount of Initial Term Loans prepaid if such prepayment occurs prior to July 16, 2022 and (ii) a 1.00% premium on the amount of Initial Term Loans prepaid in connection with a Repricing Transaction (as defined in the Amended Credit Agreement), if such prepayment occurs on or after July 16, 2022 but on or prior to January 16, 2023. The proceeds of the Term B-1 Loans were used by the Company to finance, in part, the Codecademy acquisition, and to pay costs, fees, and expenses related thereto.

The unaudited pro forma condensed combined financial information (“Unaudited Pro Forma Financial Information”) included herein presents the unaudited pro forma condensed combined balance sheet (“Pro Forma Balance Sheet”) and unaudited pro forma condensed combined statement of operations (“Pro Forma Statement of Operations”) based upon the historical financial statements of Skillsoft and Codecademy, after giving effect to the Mergers and the Codecademy Financing Transaction (collectively, the “Codecademy Transaction”), and the adjustments described in the accompanying notes.

The Pro Forma Balance Sheet as of January 31, 2022 gives effect to the Mergers and the Codecademy Financing Transaction as if each of them had occurred on January 31, 2022. The Pro Forma Statements of Operations give effect to the Mergers and the Codecademy Financing Transaction as if each of them had occurred on February 1, 2021.

The Unaudited Pro Forma Financial Information set out below has been prepared in accordance with Article 11 of Regulation S-X, as amended by the SEC Final Rule Release No. 33 10786, Amendments to Financial Disclosures About Acquired and Disposed Businesses (“Regulation S-X”), using accounting policies in accordance with GAAP.

The Unaudited Pro Forma Financial Information reflects Codecademy Transaction accounting adjustments that Skillsoft management believes are necessary to present fairly the Pro Forma Balance Sheet and Pro Forma Statement of Operations.

The Unaudited Pro Forma Financial Information has been prepared for illustrative purposes only. The hypothetical financial position included in the Unaudited Pro Forma Financial Information may differ from Skillsoft’s actual financial position following the Mergers. The Unaudited Pro Forma Financial Information has been prepared on the basis set out in the notes below and has been prepared in a manner consistent with the accounting policies applied by Skillsoft in its historical financial statements for the year ended January 31, 2022. In preparing the Unaudited Pro Forma Financial Information, no adjustments have been made to reflect the potential operating synergies, dis-synergies, and administrative cost savings or the costs of integration activities that could result from the combination of Skillsoft and Codecademy.

1

Unaudited Condensed Pro Forma Combined Balance Sheet | |||||||||||||||

As of January 31, 2022 | |||||||||||||||

(in thousands) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Historical As of |

|

Historical As of |

|

|

|

|

|

|

|

|

As of |

||

|

|

|

|

|

|

|

|

|

Codecademy |

|

Codecademy |

|

|

|

|

|

|

Skillsoft Corp. |

|

Codecademy |

|

Financing |

|

Accounting |

|

Pro Forma |

|||||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

154,672 |

|

$ |

45,005 |

|

$ |

157,088 |

3A |

$ |

(42,005) |

4A |

$ |

107,814 |

|

|

|

|

|

|

|

|

|

- |

|

|

(203,434) |

4B |

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

(3,512) |

4F |

|

|

Restricted cash |

|

|

14,251 |

|

|

- |

|

|

- |

|

|

- |

|

|

14,251 |

Accounts receivable, net |

|

|

212,463 |

|

|

311 |

|

|

- |

|

|

- |

|

|

212,774 |

Prepaid expenses and other current assets |

|

|

45,837 |

|

|

2,338 |

|

|

- |

|

|

- |

|

|

48,175 |

Total Current Assets |

|

|

427,223 |

|

|

47,654 |

|

|

157,088 |

|

|

(248,951) |

|

|

383,014 |

Property and equipment, net |

|

|

18,084 |

|

|

443 |

|

|

- |

|

|

- |

|

|

18,527 |

Goodwill |

|

|

871,504 |

|

|

- |

|

|

- |

|

|

309,146 |

4E |

|

1,180,650 |

Intangible assets, net |

|

|

869,487 |

|

|

2,373 |

|

|

- |

|

|

109,627 |

4E |

|

981,487 |

Right of use assets |

|

|

19,925 |

|

|

1,238 |

|

|

- |

|

|

- |

|

|

21,163 |

Deferred tax assets |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

Other assets |

|

|

15,725 |

|

|

766 |

|

|

- |

|

|

- |

|

|

16,491 |

TOTAL ASSETS |

|

$ |

2,221,948 |

|

$ |

52,474 |

|

$ |

157,088 |

|

$ |

169,822 |

|

$ |

2,601,332 |

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current maturities of long-term debt |

|

$ |

4,800 |

|

$ |

- |

|

$ |

1,600 |

3A |

$ |

- |

|

$ |

6,400 |

Borrowings under accounts receivable facility |

|

|

74,629 |

|

|

- |

|

|

- |

|

|

|

|

|

74,629 |

Accounts payable |

|

|

25,661 |

|

|

- |

|

|

- |

|

|

- |

|

|

25,661 |

Accrued compensation |

|

|

51,115 |

|

|

- |

|

|

- |

|

|

- |

|

|

51,115 |

Accrued expenses and other current liabilities |

|

|

51,017 |

|

|

3,661 |

|

|

- |

|

|

- |

|

|

54,678 |

Lease liability |

|

|

6,895 |

|

|

1,238 |

|

|

- |

|

|

- |

|

|

8,133 |

Deferred revenue |

|

|

331,605 |

|

|

16,744 |

|

|

- |

|

|

- |

|

|

348,349 |

Total Current Liabilities |

|

|

545,722 |

|

|

21,643 |

|

|

1,600 |

|

|

- |

|

|

568,965 |

Long-term Debt |

|

|

462,185 |

|

|

- |

|

|

155,488 |

3A |

|

- |

|

|

617,673 |

Warrant liabilities |

|

|

28,199 |

|

|

- |

|

|

- |

|

|

- |

|

|

28,199 |

Deferred tax liabilities |

|

|

99,911 |

|

|

- |

|

|

- |

|

|

21,615 |

4G |

|

121,526 |

Long-term lease liabilities |

|

|

13,355 |

|

|

- |

|

|

- |

|

|

- |

|

|

13,355 |

Deferred revenue -non-current |

|

|

1,248 |

|

|

- |

|

|

- |

|

|

- |

|

|

1,248 |

Other long-term liabilities |

|

|

11,430 |

|

|

- |

|

|

- |

|

|

- |

|

|

11,430 |

Total Liabilities |

|

|

1,162,050 |

- |

|

21,643 |

|

|

157,088 |

|

|

21,615 |

|

|

1,362,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common stock |

|

|

11 |

|

|

- |

|

|

- |

|

|

3 |

4C |

|

14 |

Common stock and additional paid-in capital |

|

|

- |

|

|

91,191 |

|

|

- |

|

|

(91,191) |

4D |

|

- |

Additional paid-in capital |

|

|

1,306,146 |

|

|

- |

|

|

- |

|

|

182,547 |

4C |

|

1,488,693 |

Accumulated deficit |

|

|

(247,229) |

|

|

(60,360) |

|

|

- |

|

|

60,360 |

4D |

|

(250,741) |

|

|

|

|

|

|

|

|

|

|

|

|

(3,512) |

4F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accum. other comprehensive income (loss) |

|

|

970 |

|

|

- |

|

|

- |

|

|

|

|

|

970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

Total Stockholders' Equity |

|

|

1,059,898 |

|

|

30,831 |

|

|

- |

|

|

148,207 |

|

|

1,238,936 |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

2,221,948 |

|

$ |

52,474 |

|

$ |

157,088 |

|

$ |

169,822 |

|

$ |

2,601,332 |

2

Unaudited Pro Forma Condensed Combined Statement of Operations | |||||||||||||||

For the Year Ended January 31, 2022 | |||||||||||||||

(in thousands, except per share amounts) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended |

|

For the Year Ended |

|

|

|

|

|

|

|

For the Year Ended |

|||

|

|

Skillsoft |

|

Codecademy |

|

Codecademy Financing Transaction |

|

Codecademy Transaction Accounting Adjustments |

|

Pro Forma |

|||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

662,570 |

|

$ |

41,853 |

|

$ |

- |

|

$ |

- |

|

$ |

704,423 |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

196,846 |

|

|

5,284 |

|

|

- |

|

|

- |

|

|

202,130 |

Content and software development |

|

|

71,258 |

|

|

26,084 |

|

|

- |

|

|

- |

|

|

97,342 |

Selling and marketing |

|

|

161,629 |

|

|

19,336 |

|

|

- |

|

|

- |

|

|

180,965 |

General and administrative |

|

|

108,986 |

|

|

12,826 |

|

|

- |

|

|

8,258 |

4H |

|

130,070 |

Amortization of intangible assets |

|

|

164,947 |

|

|

- |

|

|

- |

|

|

18,063 |

4I |

|

183,010 |

Recapitalization and transaction-related costs |

|

|

118,352 |

|

|

- |

|

|

|

|

|

3,512 |

4F |

|

121,864 |

Restructuring |

|

|

5,757 |

|

|

- |

|

|

- |

|

|

- |

|

|

5,757 |

Operating and formation costs |

|

|

2,952 |

|

|

- |

|

|

- |

|

|

- |

|

|

2,952 |

Total operating expenses |

|

|

830,727 |

|

|

63,530 |

|

|

- |

|

|

29,833 |

|

|

924,090 |

Operating income (loss): |

|

$ |

(168,157) |

|

$ |

(21,677) |

|

$ |

- |

|

$ |

(29,833) |

|

$ |

(219,667) |

Other income (expense), net |

|

|

(1,719) |

|

|

(291) |

|

|

- |

|

|

- |

|

|

(2,010) |

Gain on derivative liabilities |

|

|

(4,160) |

|

|

- |

|

|

- |

|

|

- |

|

|

(4,160) |

Interest income |

|

|

158 |

|

|

2 |

|

|

- |

|

|

- |

|

|

160 |

Interest expense |

|

|

(30,381) |

|

|

- |

|

|

(13,600) |

3B |

|

- |

|

|

(43,981) |

Income (loss) before provision (benefit) for income taxes |

|

|

(204,259) |

|

|

(21,966) |

|

|

(13,600) |

|

|

(29,833) |

|

|

(269,658) |

Provision for (benefit from) income taxes |

|

|

(8,192) |

|

|

(67) |

|

|

(2,856) |

|

|

(6,265) |

4G |

|

(17,380) |

Net loss |

|

$ |

(196,067) |

|

$ |

(21,899) |

|

$ |

(10,744) |

|

$ |

(23,568) |

|

$ |

(252,278) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average Class A shares outstanding |

|

|

133,143 |

|

|

|

|

|

|

|

|

30,374 |

|

|

163,517 |

Loss per share (basic and diluted) attributable to Class A common stockholders |

|

$ |

(1.47) |

|

|

|

|

|

|

|

|

|

|

$ |

(1.54) |

3

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

($ in thousands)

1. Basis of Presentation

The Unaudited Pro Forma Financial Information has been prepared based on GAAP and pursuant to Regulation S-X and presents the Pro Forma Balance Sheet and Pro Forma Statement of Operations of Skillsoft based upon the historical financial information of Skillsoft and Codecademy, after giving effect to the Mergers.

The Unaudited Pro Forma Financial Information is not necessarily indicative of what Skillsoft’s consolidated balance sheet and statement of operations would have been had the Codecademy Transaction been completed as of the date indicated or will be for any future periods. The Unaudited Pro Forma Financial Information does not purport to project the future financial position of Skillsoft following the Codecademy Transaction. The Unaudited Pro Forma Financial Information reflects accounting adjustments related to the Codecademy Transaction management believes are necessary to present fairly the Skillsoft Pro Forma Balance Sheet assuming the Codecademy Transaction had been consummated as of January 31, 2022 and Pro Forma Statement of Operations assuming the Mergers and the Codecademy Financing Transaction had occurred on February 1, 2021. The accounting related Codecademy Transaction adjustments are based on currently available information and assumptions management believes are, under the circumstances and given the information available at this time, reasonable, and reflective of adjustments necessary to report Skillsoft financial condition as a result of the closing of the Codecademy Transaction.

The acquisition of Codecademy is treated as a business combination and accounted for using the acquisition method of accounting, with goodwill and other intangible assets recorded, in accordance with ASC 805, Business Combinations. Accordingly, for accounting purposes, the net assets of Skillsoft are stated at historical cost, with the acquired assets and assumed liabilities of Codecademy stated at fair value in accordance with the acquisition method of accounting. As of the date of this filing, the calculations necessary to estimate the fair values of the assets acquired and liabilities assumed have been performed based on a preliminary purchase price valuation. Skillsoft will continue to refine its identification and valuation of assets acquired and the liabilities assumed as further information becomes available, including refinement of inputs and estimates inherent in (i) the valuation of intangible assets, (ii) deferred income taxes, (iii) realization of tangible assets and (iv) the accuracy and completeness of liabilities.

The Unaudited Pro forma Financial Information and related notes have been prepared utilizing period ends that differ by fewer than one fiscal quarter, as permitted by Regulation S-X. The unaudited Pro forma condensed combined balance sheet as of January 31, 2022 combines the historical balance sheet of Skillsoft as of January 31, 2022 and the historical balance sheet of Codecademy as of December 31, 2021, on a Pro forma basis as if the Codecademy Transaction had been consummated on January 31, 2022. The unaudited Pro forma condensed statement of operations for the year ended January 31, 2022 combines the historical statement of operations of Skillsoft for the year ended January 31, 2022 and the historical statement of operations of Codecademy for the year ended December 31, 2021, on a Pro forma basis as if the Codecademy Transaction had been consummated on February 1, 2021.

The Unaudited Pro Forma Financial Information has been compiled in a manner consistent with the accounting policies adopted by Skillsoft and reflects certain adjustments to the historical financial information of Codecademy to conform to the accounting policies of Skillsoft based on a preliminary review of the accounting policies of Codecademy.

The Unaudited Pro Forma Financial Information should be read in conjunction with the audited consolidated financial statements of Skillsoft as of and for the year ended January 31, 2022 appearing in Skillsoft’s Form 10-K filed with the SEC on April 18, 2022, the unaudited interim financial statements as of and for the period ended April 30, 2022 appearing in Skillsoft’s Form 10-Q filed with the SEC on April 9, 2022 and the audited consolidated financial statements of Codecademy as of and for the year ended December 31, 2021 attached as Exhibit 99.1 to this 8-K/A filing.

The Unaudited Pro Forma Financial Information does not reflect adjustments for any other consummated or probable acquisition or disposition by Skillsoft that is significant in accordance with Regulation S-X Rule 3-05, as amended by Release No. 33-10786, Amendments to Financial Disclosures About Acquired and Disposed Businesses, as adopted by the SEC on May 20, 2020 because no significant transactions were identified as of the date of the Codecademy acquisition.

4

2. Codecademy Accounting Policies and Reclassifications

In the preparation of these unaudited pro forma condensed combined financial statements, certain reclassifications were made to align the combined company financial statement presentations. Management will continue to perform a comprehensive review of Codecademy’s accounting policies following the completion of the Codecademy acquisition. As a result of the review, management may identify differences between the accounting policies of these entities which, when conformed, could have a material impact on the financial statements of the post-combination company. Based on its initial analysis, Skillsoft has identified differences between Skillsoft and Codecademy that would have an impact on the unaudited pro forma condensed combined financial information.

A summary of necessary pro forma adjustment in the unaudited pro forma condensed combined balance sheet as of January 31, 2022 is as follows:

|

|

As of |

|

|

|

|

As of |

||

|

|

Codecademy |

|

Accounting Policies |

|

Codecademy |

|||

ASSETS |

|

|

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

45,005 |

|

$ |

- |

|

$ |

45,005 |

Restricted cash |

|

|

- |

|

|

- |

|

|

- |

Accounts receivable, net |

|

|

311 |

|

|

- |

|

|

311 |

Prepaid expenses and other current assets |

|

|

2,338 |

|

|

- |

|

|

2,338 |

Total Current Assets |

|

|

47,654 |

|

|

- |

|

|

47,654 |

Property and equipment, net |

|

|

443 |

|

|

- |

|

|

443 |

Goodwill |

|

|

- |

|

|

- |

|

|

- |

Intangible assets, net |

|

|

4,293 |

|

|

(1,920) |

2A |

|

2,373 |

Right of use assets |

|

|

- |

|

|

1,238 |

2B |

|

1,238 |

Other assets |

|

|

766 |

|

|

- |

|

|

766 |

TOTAL ASSETS |

|

$ |

53,156 |

|

$ |

(682) |

|

$ |

52,474 |

Current liabilities |

|

|

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

$ |

3,661 |

|

$ |

- |

|

$ |

3,661 |

Lease liability |

|

|

- |

|

|

1,238 |

2B |

|

1,238 |

Deferred revenue |

|

|

16,744 |

|

|

- |

|

|

16,744 |

Total Current Liabilities |

|

|

20,405 |

|

|

1,238 |

|

|

21,643 |

Deferred tax liabilities |

|

|

- |

|

|

- |

|

|

- |

Long-term lease liabilities |

|

|

- |

|

|

- |

|

|

- |

Total Liabilities |

|

|

20,405 |

|

|

1,238 |

|

|

21,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity |

|

|

|

|

|

|

|

|

|

Common stock, preferred stock and paid-in capital |

|

|

91,191 |

|

|

- |

|

|

91,191 |

Accumulated deficit |

|

|

(58,440) |

|

|

(1,920) |

2A |

|

(60,360) |

Total Stockholders' Equity |

|

|

32,751 |

|

|

(1,920) |

|

|

30,831 |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

$ |

53,156 |

|

$ |

(682) |

|

$ |

52,474 |

5

A summary of necessary pro forma adjustment in the unaudited pro forma condensed combined statement of operations for the year ended January 31, 2022 as follows:

|

|

For the Fiscal Year |

|

|

|

|

For the Fiscal Year |

||

|

|

Codecademy Historical Condensed |

|

Accounting Policies, Reclassifications, and Eliminations |

|

Pro Forma |

|||

Revenues: |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

41,853 |

|

$ |

- |

|

$ |

41,853 |

Operating expenses |

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

5,284 |

|

|

- |

|

|

5,284 |

Content and software development |

|

|

24,598 |

|

|

1,486 |

2A |

|

26,084 |

Selling and marketing |

|

|

19,336 |

|

|

- |

|

|

19,336 |

General and administrative |

|

|

12,826 |

|

|

- |

|

|

12,826 |

Amortization of intangible assets |

|

|

- |

|

|

- |

|

|

- |

Recapitalization and transaction-related costs |

|

|

- |

|

|

|

|

|

- |

Restructuring |

|

|

- |

|

|

- |

|

|

- |

Operating and formation costs |

|

|

- |

|

|

- |

|

|

- |

Total operating expenses |

|

|

62,044 |

|

|

1,486 |

|

|

63,530 |

Operating income (loss): |

|

$ |

(20,191) |

|

$ |

(1,486) |

|

$ |

(21,677) |

Other income (expense), net |

|

|

(291) |

|

|

- |

|

|

(291) |

Gain on derivative liabilities |

|

|

- |

|

|

- |

|

|

- |

Interest income |

|

|

2 |

|

|

- |

|

|

2 |

Interest expense |

|

|

- |

|

|

- |

|

|

- |

Loss before provision for income taxes |

|

|

(20,480) |

|

|

(1,486) |

|

|

(21,966) |

Provision for income taxes |

|

|

(67) |

|

|

- |

|

|

(67) |

Net loss |

|

$ |

(20,413) |

|

$ |

(1,486) |

|

$ |

(21,899) |

2A. |

Skillsoft’s accounting policy with respect to content development costs is to expense such costs as incurred whereas Codecademy capitalized certain content development costs. This adjustment conforms Codecademy’s financial statements to Skillsoft’s policy. |

2B. |

Skillsoft adopted ASC 842, Leases (“ASC 842”) as of February 1, 2020 and it is reflected in its historical financial statements for all periods subsequent to date of adoption. Codecademy did not adopt ASC 842 and was not required to adopt the standard in Codecademy’s December 31, 2021 consolidated financial statements. To conform Codecademy, a pro forma adjustment was made to reflect the adoption impact of ASC 842 on its financial statements as if it had adopted this standard at the beginning of its fiscal year ended December 31, 2021. |

6

3. Codecademy Financing Transactions

The adjustments included in the unaudited pro forma condensed combined balance sheet as of January 31, 2022 are as follows:

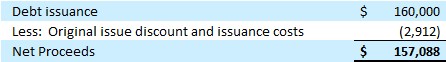

3A. |

Reflects debt issuance necessary to fund a portion of the cash consideration of the Codecademy Transaction, the components of which are as follows:

The incremental term loan is assumed to bear interest at a rate of 6.0% per year, payable quarterly in arrears and has an effective interest rate of 7.0% when including the impact of debt issuance costs and original issue discount. The incremental term loan is assumed to amortize at 1% per year and mature in July 2028. |

3B. |

Reflects additional interest expense for the incremental term loan necessary to fund the cash portion of consideration. The interest rate is variable and indexed to SOFR. A 50 basis point change in SOFR would increase or decrease interest expense on the incremental $160 million in borrowings by approximately $0.8 million. |

4. Codecademy Transaction Accounting Adjustments

The estimated consideration for the Codecademy acquisition is as follows:

Cash consideration |

$ |

203,434 |

||

Equity consideration (1) |

182,550 |

|||

Total estimated consideration |

$ |

385,984 |

(1) |

Based on the issuance of 30.4 million shares at a closing price on April 4, 2022 of $6.01 per share. |

Under the acquisition method of accounting, the identifiable assets acquired and liabilities assumed of Codecademy are recorded at the acquisition date fair values. The pro forma adjustments are preliminary and based on estimates of the fair value and useful lives of the assets acquired and liabilities assumed and have been prepared to illustrate the estimated effects of the Mergers.

For assets acquired and liabilities assumed, other than right of use assets and lease liabilities, identified intangible assets, goodwill, and deferred revenue, the carrying values were assumed to equal fair value. The final determination of the fair value of certain assets and liabilities will be completed within the one-year measurement period subsequent to the closing of the Codecademy Transaction as required by ASC 805. The acquisition of Codecademy may necessitate the use of this measurement period to adequately analyze and assess a number of the factors used in establishing the asset and liability fair values as of the acquisition date, including the significant contractual and operational factors underlying the tradename, developed technology and customer relationship intangible assets and the assumptions underpinning the related tax impacts of any changes made. Any potential adjustments made could be material in relation to the preliminary values presented. Accordingly, the pro forma purchase price allocation is subject to further adjustment as additional information becomes available and as additional analyses and final valuations are completed. There can be no assurances that these additional analyses and final valuations will not result in significant changes to the estimates of fair value set forth below.

7

The following table sets forth a preliminary allocation of the estimated consideration for the Codecademy Transaction to the identifiable tangible and intangible assets acquired and liabilities assumed based on Codecademy’s December 31, 2021 balance sheet, with the excess recorded as goodwill:

Codecademy Estimated Goodwill |

||||

Cash. cash equivalents and restricted cash |

$ |

3,766 |

||

Current assets |

|

|

2,649 |

|

Property and equipment, net |

443 |

|||

Intangible assets |

112,000 |

|||

Total assets acquired |

118,858 |

|||

Accrued expenses and other current liabilities |

3,660 |

|||

Deferred revenues |

|

|

16,744 |

|

Deferred tax liabilities |

|

|

21,615 |

|

Total liabilities acquired |

42,019 |

|||

Net assets acquired (a) |

76,839 |

|||

Estimated purchase consideration (b) |

385,984 |

|||

Estimated goodwill (b) - (a) |

$ |

309,145 |

In accordance with ASC Topic 350, Goodwill and Other Intangible Assets, goodwill will not be amortized, but instead will be tested for impairment at least annually or more frequently if certain impairment indicators are present. In the event management determines that the value of goodwill has become impaired, an accounting charge for the amount of impairment during the quarter in which the determination is made may be recognized. Goodwill is primarily attributable to the assembled workforce of Codecademy and opportunity for Skillsoft to penetrate the enterprise market with Codecademy products. Goodwill recognized is not expected to be deductible for tax purposes. The table below indicates the estimated fair value of each of the identifiable intangible assets associated with the Mergers:

|

|

Preliminary Estimated Asset Fair Value |

|

Preliminary |

|

|

|

|

|

|

|

Trade name |

$ |

44,000 |

14 years |

||

Developed Technology |

|

|

40,000 |

|

5 years |

Content |

18,000 |

5 years |

|||

Customer Relationships |

|

|

10,000 |

|

6 years |

Total |

$ |

112,000 |

|||

Less: net intangible assets reported on Codecademy's historical financial statements as of December 31, 2021 |

4,293 |

||||

Pro forma adjustment |

$ |

107,707 |

|||

The preliminary fair values reflected above were determined in accordance with ASC 820, Fair Value Measurement. The Codecademy customer relationship fair value was determined using an income approach under a multi-period excess earnings approach whereby the cash flows in excess of those needed to operate contributory assets over a period of time are otherwise attributed to the fair value of the asset. The Codecademy trade name fair value was determined using an income approach with an estimate developed from the relief-from-royalty method and the projected cash savings over an estimated period of time that would otherwise be required to license this asset. The developed technology and content fair assets were valued using a replacement cost approach. Excess purchase price was allocated to goodwill.

The estimated useful lives were determined based on a review of the time period over which economic benefit is estimated to be generated as well as additional factors. Factors considered include contractual life, the period over which a majority of cash flow is expected to be generated or management’s view based on historical experience with similar assets.

8

The pro forma adjustments included in the unaudited pro forma condensed combined financial statements for the purchase price allocation and other transaction adjustments are as follows:

4A. |

Represents estimated cash that will be retained by the seller in accordance with the terms of the merger agreement whereby any cash in excess of $3 million at the closing date will not be transferred to the buyer. |

4B. |

Reflects payment of approximately $203.4 million, representing the cash consideration component of the purchase price. |

4C. |

Reflects issuance of 30.4 million shares of Common Stock representing equity consideration of $182.5 million based and a closing price of Common Stock of $6.01 per share on the April 4, 2022 acquisition date. |

4D. |

Reflects the elimination of previously issued and outstanding shares of common stock of Codecademy at the date of the Codecademy Transaction and accumulated deficit balance. |

4E. |

Reflects the increase in intangible assets and goodwill due to the step up in fair value adjustments recognized as part of the Codecademy Transaction based on the preliminary purchase price allocation. |

4F. |

Reflects the settlement and payment of estimated transaction costs related to the Mergers, including, among others, fees paid for financial advisors, legal services, and professional accounting services. These transaction costs are not reflected in the historical consolidated balance sheet of Skillsoft or Codecademy. |

4G. |

Reflects adjustments for the tax impact on the pro forma adjustments at the U.S. federal statutory tax rate of 21% as of January 31, 2022 resulting from the acquisition. The effective tax rate of Skillsoft following the Mergers could be significantly different than what is presented within the unaudited pro forma financial information based on several factors including geographic mix of our taxable income or legal entity structure, among others. |

4H. |

Reflects additional stock-based compensation expense that would have been recognized had the Mergers occurred as of February 1, 2021. |

4I. |

Reflects additional amortization expense as if the Mergers had occurred as of February 1, 2021. Amortization expense is based on the fair value of the amortizable assets and the estimated economic useful life of the identified intangible assets. |

9

5. Predecessor Pro Forma Statement of Operations

On October 12, 2020, Software Luxembourg Holding S.A. (“Software Luxembourg”) and Churchill Capital Corp II, a Delaware corporation (“Churchill”), entered into an Agreement and Plan of Merger (the “Skillsoft Merger Agreement”) by and between Churchill and Software Luxembourg. Pursuant to the terms of the Skillsoft Merger Agreement, a business combination between Churchill and Software Luxembourg was effected through the merger of Software Luxembourg with and into Churchill (the “Skillsoft Merger”), with Churchill being the surviving company. On June 11, 2021, Churchill completed its acquisition of Software Luxembourg, and changed its corporate name from Churchill to Skillsoft Corp. In addition, the Company changed its fiscal year end from December 31 to January 31. On June 11, 2021, the Company completed the acquisition of Albert DE Holdings Inc. (“Global Knowledge” and such acquisition, the “Global Knowledge Merger”). The unaudited condensed consolidated statement of operations included herein have been calculated on a pro forma basis as if each of these transactions occurred on February 1, 2021.

A summary of the Pro Forma Statement of Operations for predecessor entities for the year ended January 31, 2022 is as follows:

|

|

Predecessor Companies |

|

Successor Company for the Period from June 12, 2021 to January 31, 2022 |

|

For the Fiscal Year Ended January 31, 2022 |

|||||||||

|

|

Churchill Capital |

|

Software |

|

Global Knowledge |

|

Skillsoft Corp. |

|

Skillsoft Pro |

|||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

- |

|

$ |

163,031 |

|

$ |

71,785 |

|

$ |

427,754 |

|

$ |

662,570 |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

- |

|

|

35,881 |

|

|

34,551 |

|

|

126,414 |

|

|

196,846 |

Content and software development |

|

|

- |

|

|

24,084 |

|

|

492 |

|

|

46,682 |

|

|

71,258 |

Selling and marketing |

|

|

- |

|

|

36,198 |

|

|

16,404 |

|

|

109,028 |

|

|

161,629 |

General and administrative |

|

|

- |

|

|

17,217 |

|

|

19,765 |

|

|

72,004 |

|

|

108,986 |

Amortization of intangible assets |

|

|

- |

|

|

51,384 |

|

|

17,034 |

|

|

96,529 |

|

|

164,947 |

Recapitalization and transaction-related costs |

|

|

59,121 |

|

|

47,760 |

|

|

- |

|

|

11,471 |

|

|

118,352 |

Restructuring |

|

|

- |

|

|

(703) |

|

|

2,764 |

|

|

3,696 |

|

|

5,757 |

Operating and formation costs |

|

|

2,952 |

|

|

- |

|

|

- |

|

|

- |

|

|

2,952 |

Total operating expenses |

|

|

62,073 |

|

|

211,820 |

|

|

91,010 |

|

|

465,824 |

|

|

830,727 |

Operating income (loss): |

|

$ |

(62,073) |

|

$ |

(48,789) |

|

$ |

(19,225) |

|

$ |

(38,070) |

|

$ |

(168,157) |

Other income (expense), net |

|

|

- |

|

|

(493) |

|

|

624 |

|

|

(1,850) |

|

|

(1,719) |

Gain on derivative liabilities |

|

|

(22,501) |

|

|

900 |

|

|

- |

|

|

17,441 |

|

|

(4,160) |

Interest income |

|

|

- |

|

|

64 |

|

|

- |

|

|

94 |

|

|

158 |

Interest expense |

|

|

- |

|

|

(10,904) |

|

|

- |

|

|

(19,477) |

|

|

(30,381) |

Income (loss) before provision (benefit) for income taxes |

|

|

(84,574) |

|

|

(59,222) |

|

|

(18,601) |

|

|

(41,862) |

|

|

(204,259) |

Provision (benefit) for income taxes |

|

|

2 |

|

|

(5,021) |

|

|

(149) |

|

|

(3,025) |

|

|

(8,192) |

Net income (loss) |

|

$ |

(84,576) |

|

$ |

(54,202) |

|

$ |

(18,452) |

|

$ |

(38,837) |

|

$ |

(196,067) |

10

6. Churchill Capital Corp II Pro forma Adjustments

A summary a pro forma adjustments to the Churchill Capital Corp II historical financial statements for the year ended January 31, 2022 is as follows:

|

|

For the period from February 1, 2021 to June 11, 2021 |

|||||||

|

|

Churchill Capital |

|

Pro Forma |

|

Pro Forma |

|||

Revenues: |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

- |

|

|

|

|

$ |

- |

Operating expenses |

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

- |

|

|

|

|

|

- |

Content and software development |

|

|

- |

|

|

- |

|

|

- |

Selling and marketing |

|

|

- |

|

|

- |

|

|

- |

General and administrative |

|

|

- |

|

|

- |

|

|

- |

Amortization of intangible assets |

|

|

- |

|

|

- |

|

|

- |

Impairment of goodwill |

|

|

- |

|

|

- |

|

|

- |

Recapitalization and transaction-related costs |

|

|

59,121 |

|

|

- |

|

|

59,121 |

Restructuring |

|

|

- |

|

|

- |

|

|

- |

Operating and formation costs |

|

|

2,952 |

|

|

- |

|

|

2,952 |

Total operating expenses |

|

|

62,073 |

|

|

- |

|

|

62,073 |

Operating income (loss): |

|

$ |

(62,073) |

|

$ |

- |

|

$ |

(62,073) |

Other income (expense), net |

|

|

60 |

|

|

(60) |

6A |

|

- |

(Loss) gain on derivative liabilities |

|

|

(51,282) |

|

|

28,781 |

6B |

|

(22,501) |

Reorganization items, net |

|

|

- |

|

|

- |

|

|

- |

Interest income |

|

|

- |

|

|

- |

|

|

- |

Interest expense |

|

|

- |

|

|

- |

|

|

- |

(Loss) income before provision (benefit) for income taxes |

|

|

(113,295) |

|

|

28,721 |

|

|

(84,574) |

Provision (benefit) for income taxes |

|

|

2 |

|

|

- |

|

|

2 |

Net (loss) income |

|

$ |

(113,297) |

|

$ |

28,721 |

|

$ |

(84,576) |

The pro forma adjustments above consist of the following:

6A. |

Reflects the removal of interest income earned on Churchill’s marketable securities |

6B. |

Reflects (i) the recognition of a $27.7 million and $0.2 million loss related to a subscription agreement with a PIPE investor for the year ended January 31, 2022 and for the period from February 1, 2021 to June 11, 2021, respectively, and (ii) a $1.0 million loss and $0.6 million gain on a conversion feature of a note receivable used to fund working capital for the year ended January 31, 2022 and for the period from February 1, 2021 to June 11, 2021, respectively. |

11

7. Software Luxembourg Pro forma Adjustments

A summary a pro forma adjustments to the Software Luxembourg historical financial statements for the year ended January 31, 2022 is as follows:

|

|

For the period from February 1, 2021 |

|||||||||

(amounts in thousands) |

|

Skillsoft |

|

|

Pro Forma Adjustments |

|

Pro Forma |

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

139,636 |

|

|

$ |

23,395 |

7A |

$ |

163,031 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

35,881 |

|

|

|

- |

|

|

35,881 |

|

Content and software development |

|

|

24,084 |

|

|

|

- |

|

|

24,084 |

|

Selling and marketing |

|

|

41,940 |

|

|

|

(5,742) |

7B |

|

36,198 |

|

General and administrative |

|

|

17,217 |

|

|

|

- |

|

|

17,217 |

|

Amortization of intangible assets |

|

|

50,902 |

|

|

|

482 |

7C |

|

51,384 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

- |

|

Recapitalization and transaction-related costs |

|

|

6,938 |

|

|

|

40,822 |

7D |

|

47,760 |

|

Restructuring |

|

|

(703) |

|

|

|

- |

|

|

(703) |

|

Total operating expenses |

|

|

176,259 |

|

|

|

35,561 |

|

|

211,820 |

|

Operating loss: |

|

$ |

(36,623) |

|

|

$ |

(12,166) |

|

$ |

(48,789) |

|

Other expense, net |

|

|

(493) |

|

|

|

- |

|

|

(493) |

|

Reorganization items, net |

|

|

- |

|

|

|

- |

|

|

- |

|

Loss on derivative instruments |

|

|

900 |

|

|

|

- |

|

|

900 |

|

Interest income |

|

|

64 |

|

|

|

- |

|

|

64 |

|

Interest expense, net |

|

|

(16,820) |

|

|

|

5,916 |

7E |

|

(10,904) |

|

Income (loss) before provision for income taxes |

|

|

(52,972) |

|

|

|

(6,250) |

|

|

(59,222) |

|

Provision for income taxes |

|

|

(3,708) |

|

|

|

(1,313) |

7F |

|

(5,021) |

|

Net income (loss) |

|

$ |

(49,264) |

|

|

$ |

(4,938) |

|

$ |

(54,202) |

|

7A. |

Reflects the elimination of deferred revenue “fresh start reporting” and fair value adjustments recorded in Skillsoft’s historical periods based on the assumed adoption of ASU 2021-08 – Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers (“ASU 2021-08”) as of February 1, 2021, which requires deferred revenue to be recognized using the revenue recognition guidance in Accounting Standards Codification Topic 606 rather than fair value. |

7B. |

Reflects the reduction of commissions expense based due to the assumed elimination of Skillsoft’s deferred contract acquisition costs as of February 1, 2021 which were replaced by the establishment of customer relationship assets and corresponding increases to amortization expense. |

7C. |

Reflects adjustments to amortization expense assuming as if the Skillsoft Merger had occurred as of February 1, 2021. Amortization expense is based on the fair value of the amortizable assets and the estimated economic useful life of the identified intangible assets. |

7D. |

Reflects transaction costs incurred by Skillsoft related to the acquisition by Churchill Capital Corp II. including, among others, fees paid for financial advisors, legal services and professional accounting services. These transaction costs were incurred during the period from June 11, 2021 to January 31, 2022 but have been reclassified to the earliest period presented as if the acquisitions had occurred on February 1, 2021. |

7E. |

Reflects adjustment to interest expense based on the current capital structure in place after completion of the Skillsoft Merger and Global Knowledge Merger. |

7F. |

Reflects adjustments for the tax impact on the pro forma adjustments at the US federal statutory tax rate of 21%. The prospective effective tax rate of the combined company could be significantly different than what is presented within the unaudited pro forma financial information based on several factors including geographic mix of our taxable income or legal entity structure and tax planning strategies, among other things. |

12

8. Global Knowledge Pro Forma Adjustments

A summary of pro forma adjustments to the Global Knowledge historical financial statements for the year ended January 31, 2022 is as follows:

|

|

For the period from February 1, 2021 |

|||||||||

(amounts in thousands) |

|

Global |

|

|

Pro Forma |

|

Pro Forma |

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

71,932 |

|

|

$ |

(147) |

8A |

$ |

71,785 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

34,698 |

|

|

|

(147) |

8A |

|

34,551 |

|

Content and software development |

|

|

492 |

|

|

|

- |

|

|

492 |

|

Selling and marketing |

|

|

16,404 |

|

|

|

- |

|

|

16,404 |

|

General and administrative |

|

|

19,765 |

|

|

|

- |

|

|

19,765 |

|

Amortization of intangible assets |

|

|

2,646 |

|

|

|

14,388 |

8B |

|

17,034 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

- |

|

Recapitalization and transaction-related costs |

|

|

- |

|

|

|

- |

|

|

- |

|

Restructuring |

|

|

2,764 |

|

|

|

- |

|

|

2,764 |

|

Total operating expenses |

|

|

76,769 |

|

|

|

14,241 |

|

|

91,010 |

|

Operating loss: |

|

$ |

(4,837) |

|

|

$ |

(14,388) |

|

$ |

(19,225) |

|

Other expense, net |

|

|

624 |

|

|

|

- |

|

|

624 |

|

Reorganization items, net |

|

|

- |

|

|

|

- |

|

|

- |

|

Loss on derivative instruments |

|

|

- |

|

|

|

- |

|

|

- |

|

Interest income |

|

|

- |

|

|

|

- |

|

|

- |

|

Interest expense, net |

|

|

(11,970) |

|

|

|

11,970 |

8C |

|

- |

|

Income (loss) before provision for income taxes |

|

|

(16,183) |

|

|

|

(2,418) |

|

|

(18,601) |

|

Provision for income taxes |

|

|

359 |

|

|

|

(508) |

8D |

|

(149) |

|

Net income (loss) |

|

$ |

(16,542) |

|

|

$ |

(1,910) |

|

$ |

(18,452) |

|

8A. |

Reflects the elimination of historical intercompany revenues and cost of revenues between Skillsoft and Global Knowledge. |

8B. |

Reflects adjustments to amortization expense assuming as if the Global Knowledge Merger had occurred as of February 1, 2021. Amortization expense is based on the fair value of the amortizable assets and the estimated economic useful life of the identified intangible assets. |

8C. |

Reflects the elimination of interest expense for historical periods. See Note 5 for pro forma interest of the combined company. |

8D. |

Reflects adjustments for the tax impact on the pro forma adjustments at the US federal statutory tax rate of 21%. The prospective effective tax rate of the combined company could be significantly different than what is presented within the unaudited pro forma financial information based on several factors including geographic mix of our taxable income or legal entity structure and tax planning strategies, among other things. |

13

9. Skillsoft Corp Pro forma Adjustments

A summary a pro forma adjustments to the Skillsoft Corp historical financial statements for the period from February 1, 2021 to June 11, 2021 is as follows:

|

|

For the period from June 12, 2021 |

|||||||||

(amounts in thousands) |

|

Skillsoft |

|

|

Pro Forma |

|

Pro Forma |

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

$ |

427,754 |

|

|

$ |

- |

|

$ |

427,754 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

126,414 |

|

|

|

- |

|

|

126,414 |

|

Content and software development |

|

|

46,682 |

|

|

|

- |

|

|

46,682 |

|

Selling and marketing |

|

|

106,110 |

|

|

|

2,918 |

9A |

|

109,028 |

|

General and administrative |

|

|

72,004 |

|

|

|

- |

|

|

72,004 |

|

Amortization of intangible assets |

|

|

95,922 |

|

|

|

607 |

9B |

|

96,529 |

|

Impairment of goodwill |

|

|

- |

|

|

|

- |

|

|

- |

|

Recapitalization and transaction-related costs |

|

|

20,194 |

|

|

|

(8,723) |

9C |

|

11,471 |

|

Restructuring |

|

|

3,696 |

|

|

|

- |

|

|

3,696 |

|

Total operating expenses |

|

|

471,022 |

|

|

|

(5,198) |

|

|

465,824 |

|

Operating loss: |

|

$ |

(43,268) |

|

|

$ |

5,198 |

|

$ |

(38,070) |

|

Other expense, net |

|

|

(1,850) |

|

|

|

- |

|

|

(1,850) |

|

Reorganization items, net |

|

|

- |

|

|

|

- |

|

|

- |

|

Loss on derivative instruments |

|

|

17,441 |

|

|

|

- |

|

|

17,441 |

|

Interest income |

|

|

94 |

|

|

|

- |

|

|

94 |

|

Interest expense, net |

|

|

(24,366) |

|

|

|

4,889 |

9D |

|

(19,477) |

|

Income (loss) before provision for income taxes |

|

|

(51,946) |

|

|

|

10,087 |

|

|

(41,862) |

|

Provision for (benefit from) income taxes |

|

|

(5,143) |

|

|

|

2,118 |

9E |

|

(3,025) |

|

Net income (loss) |

|

$ |

(46,806) |

|

|

$ |

7,969 |

|

$ |

(38,837) |

|

9A. |

Reflects the increase in commissions expense due to the assumed elimination of Skillsoft’s deferred contract acquisition costs as of February 1, 2021 which were replaced by the establishment of customer relationship assets and corresponding increases to amortization expense. |

9B. |

Reflects adjustments to amortization expense assuming as if the Skillsoft Merger had occurred as of February 1, 2021. Amortization expense is based on the fair value of the amortizable assets and the estimated economic useful life of the identified intangible assets. |

9C. |

Reflects transaction costs incurred by Skillsoft related to the acquisition by Churchill Capital Corp II. including, among others, fees paid for financial advisors, legal services and professional accounting services. These transaction costs were incurred during the period from June 11, 2021 to January 31, 2022 but have been reclassified to the earliest period presented as if the acquisitions had occurred on February 1, 2021. |

9D. |

Reflects adjustment to interest expense based on the current capital structure in place after completion of the Skillsoft Merger and Global Knowledge Merger. |

9E. |

Reflects adjustments for the tax impact on the pro forma adjustments at the US federal statutory tax rate of 21%. The prospective effective tax rate of the combined company could be significantly different than what is presented within the unaudited pro forma financial information based on several factors including geographic mix of our taxable income or legal entity structure and tax planning strategies, among other things. |

14