424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on March 15, 2022

Filed pursuant to Rule 424(b)(3)

Registration No. 333-257718

PROSPECTUS SUPPLEMENT No. 8

(to Prospectus dated August 2, 2021)

70,250,000 Shares of Class A Common Stock

33,966,667 Warrants to Purchase Shares of Class A Common Stock

56,966,667 Shares of Class A Common Stock Underlying Warrants

This prospectus supplement updates and supplements the prospectus dated August 2, 2021, which forms a part of our registration statement on Form S-1 (No. 333-257718). This prospectus supplement is being filed to update and supplement the information in the prospectus dated August 2, 2021, the related prospectus supplement dated August 5, 2021, the prospectus supplement dated September 15, 2021, the prospectus supplement dated December 15, 2021, the prospectus supplement dated December 22, 2021, the prospectus supplement dated February 14, 2022, the prospectus supplement dated February 25, 2022, and the prospectus supplement dated March 7, 2022 (together, the “Prospectus”) with information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on March 15, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the issuance by us of up to 23,000,000 shares of our Class A common stock, par value $0.0001 per share that are issuable upon the exercise of the Public Warrants (as defined below).

In addition, the Prospectus and this prospectus supplement also relate to the offer and sale from time to time by the selling securityholders named in the Prospectus (the “Selling Securityholders”), or their permitted transferees, of (a) up to 104,216,667 shares of our Class A common stock (which includes up to 33,966,667 shares of Class A common stock issuable upon the exercise of outstanding warrants) and (b) up to 33,966,667 warrants. We will not receive any proceeds from the sale of shares of our Class A common stock or warrants by the Selling Securityholders pursuant to the Prospectus, except with respect to amounts received by us upon exercise of the warrants to the extent such warrants are exercised for cash. However, we will pay the expenses, other than underwriting discounts and commissions and expenses incurred by the Selling Securityholders for brokerage, accounting, tax or legal services or any other expenses incurred by the Selling Securityholders in disposing of the securities, associated with the sale of securities pursuant to the Prospectus.

Our registration of the securities covered by the Prospectus does not mean that either we or the Selling Securityholders will issue, offer or sell, as applicable, any of the securities. The Selling Securityholders may offer and sell the securities covered by the Prospectus in a number of different ways and at varying prices. We provide more information in the section entitled “Plan of Distribution.” In addition, certain of the securities being registered hereby are subject to vesting and/or transfer restrictions that may prevent the Selling Securityholders from offering or selling of such securities upon the effectiveness of the registration statement of which the Prospectus is a part. See “Description of Securities” for more information.

You should read the Prospectus and any prospectus supplement or amendment carefully before you invest in our securities. Our Class A common stock and warrants are traded on the New York Stock Exchange under the symbol “SKIL” and “SKIL.WS”, respectively. On March 14, 2022, the last reported sale price of our Class A common stock on the New York Stock Exchange was $5.89 per share, and the closing price of our warrants was $1.07 per warrant.

This prospectus supplement updates and supplements the information in the Prospectus, and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any subsequent amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus, and if there is any inconsistency between the information in the Prospectus, and this prospectus supplement, you should rely on the information in this prospectus supplement. The information in this prospectus supplement modifies and supersedes, in part, the information in the Prospectus. Any information in the Prospectus that is modified or superseded shall not be deemed to constitute a part of the Prospectus except as modified or superseded by this prospectus supplement. You should not assume that the information provided in this prospectus supplement or the Prospectus is accurate as of any date other than their respective dates. Neither the delivery of this prospectus supplement or the Prospectus, nor any sale made hereunder, shall under any circumstances create any implication that there has been no change in our affairs since the date of this prospectus supplement, or that the information contained in this prospectus supplement or the Prospectus is correct as of any time after the date of that information.

Investing in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 8 of the Prospectus and under similar headings in any further amendments or supplements to the Prospectus to read about factors you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this Prospectus Supplement No. 8. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is March 15, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 15, 2022

Skillsoft Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38960 | 83-4388331 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

300 Innovative Way, Suite 201 Nashua, NH |

03062 | |

| (Address of principal executive offices) | (Zip Code) |

(603) 324-3000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class | Trading Symbol |

Name of each exchange on which registered | ||

| Shares of Class A common stock, $0.0001 par value per share | SKIL | New York Stock Exchange | ||

| Warrants | SKIL WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations and Financial Condition. |

The updated full year fiscal 2022 outlook and related non-GAAP disclosure of Skillsoft Corp. (the “Company”) included in the press release furnished as Exhibit 99.1 to this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01 | Regulation FD Disclosure. |

On March 15, 2022, the Company issued a press release announcing the commencement of the Company’s syndication of a $160 million senior secured term loan B facility, which will be used to finance a portion of the cash consideration of the Company’s pending acquisition of Codecademy, a leading online learning platform for technical skills. A copy of the press release and certain related slides are furnished as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits |

| (d) | Exhibits. |

| Exhibit Number |

Description |

| 99.1 | Press release, dated March 15, 2022. |

| 99.2 | Selected Supplemental Materials. |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 15, 2022

| SKILLSOFT CORP. | ||

| By: | /s/ Gary W. Ferrera | |

| Gary W. Ferrera | ||

| Chief Financial Officer | ||

FOR IMMEDIATE RELEASE

Skillsoft Commences Incremental Term Loan Syndication to Fund Codecademy Acquisition

Transaction Expected to Close in April 2022

Raises FY 2022 Outlook

BOSTON – March 15, 2022 – Skillsoft Corp. (NYSE: SKIL) (“Skillsoft” or the “Company”), a global leader in corporate digital learning, today commenced a $160 million senior secured incremental term loan B facility syndication. This facility will be used to finance a portion of the cash consideration of Skillsoft’s pending acquisition of Codecademy, a leading online learning platform for technical skills.

Codecademy’s innovative and popular learning platform has provided high-demand technical skills to approximately 40 million registered learners in nearly every country worldwide. The platform offers interactive, self-paced courses and hands-on learning in 14 programming languages across multiple domains such as application development, data science, cloud and cybersecurity. The combination of Codecademy with Skillsoft’s existing technical skills offering is expected to create a leader in the high-demand, high-growth Technology & Developer digital learning segment.

As previously announced, the acquisition is expected to be significantly accretive to Skillsoft’s bookings and revenue growth, and accretive to gross margin upon closing. Skillsoft expects revenue synergies primarily from cross-selling Codecademy’s products to Skillsoft’s large enterprise customer base, and that the acquisition will be accretive to Skillsoft’s EBITDA over the long term.

Updated Full Year Fiscal 2022 Outlook (fiscal year ended January 31, 2022)

| Previous Outlook | Updated Outlook | |||

| Bookings | $700 million to $720 million | $716 million to $721 million | ||

| Adjusted Revenue | $685 million to $700 million | $693 million to $698 million | ||

| Adjusted EBITDA | Approximately $165 million | Approximately $167 million |

The Company will provide its fiscal year 2023 outlook when it reports its fourth quarter and full fiscal year 2022 results on April 6, 2022.

The transaction is subject to approval by Skillsoft shareholders and the satisfaction of customary closing conditions. Additional information is available in a Definitive Proxy Statement filed with U.S. Securities and Exchange Commission on February 28, 2022.

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the proposed acquisition of Codecademy by the Company. This communication does not constitute a solicitation of any vote or approval. In connection with the proposed transaction, the Company has filed with the Securities and Exchange Commission (the “SEC”) and mailed or otherwise provided to its shareholders a proxy statement regarding the proposed transaction. The Company may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy statement that has been filed or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the proposed transaction or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Company’s proxy statement. Shareholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at https://investor.skillsoft.com/ copies of materials it files with, or furnishes to, the SEC.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Report on Form 8-K and Form 8-K/A filed on June 17, 2021. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s Form 8-K filed on June 17, 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction has been included in the proxy statement relating to the proposed transaction filed with the SEC. These documents may be obtained free of charge from the SEC’s website at www.sec.gov and the investor relations page of the Company’s website at https://investor.skillsoft.com/.

Non-GAAP Financial Measures and Key Performance Metrics

We track several non-GAAP financial measures and key performance metrics that we believe are key financial measures of our success. Non-GAAP measures and key performance metrics are frequently used by securities analysts, investors, and other interested parties in their evaluation of companies comparable to us, many of which present non-GAAP measures and key performance metrics when reporting their results. These measures can be useful in evaluating our performance against our peer companies because we believe the measures provide users with valuable insight into key components of U.S. GAAP financial disclosures. For example, a company with higher U.S. GAAP net income may not be as appealing to investors if its net income is more heavily comprised of gains on asset sales. Likewise, excluding the effects of interest income and expense moderates the impact of a company’s capital structure on its performance. However, non-GAAP measures and key performance metrics have limitations as analytical tools. Because not all companies use identical calculations, our presentation of non-GAAP financial measures and key performance metrics may not be comparable to other similarly titled measures of other companies. They are not presentations made in accordance with U.S. GAAP, are not measures of financial condition or liquidity, and should not be considered as an alternative to profit or loss for the period determined in accordance with U.S. GAAP or operating cash flows determined in accordance with U.S. GAAP. As a result, these performance measures should not be considered in isolation from, or as a substitute analysis for, results of operations as determined in accordance with U.S. GAAP.

We do not reconcile the forward-looking non-GAAP financial contained in the “Updated Full Year Fiscal 2022 Outlook” in this press release measures to the corresponding U.S. GAAP measures, due to variability and difficulty in making accurate forecasts and projections, certain information not being ascertainable or accessible, and because not all of the information necessary for a quantitative reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure is available to us without unreasonable efforts. For the same reasons, we are unable to address the probable significance of the unavailable information. We provide non-GAAP financial measures that we believe will be achieved, however we cannot accurately predict all of the components of the adjusted calculations and the U.S. GAAP measures may be materially different than the non-GAAP measures.

Forward Looking Statements

This document includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations, the timing and occurrence of the closing of the transaction, anticipated transaction benefits, and our updated full year fiscal 2022 outlook including bookings, adjusted revenue, and adjusted EBITDA. All statements, other than statements of historical facts, that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, our product development and planning, our pipeline, future capital expenditures, financial results, the impact of regulatory changes, existing and evolving business strategies and acquisitions and dispositions, demand for our services and competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, our ability to successfully implement our plans, strategies, objectives, expectations and intentions are forward-looking statements. Also, when we use words such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,” “target,” goals,” “probably,” or similar expressions, we are making forward-looking statements. Such statements are based upon the current beliefs and expectations of Skillsoft’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. All forward-looking disclosure is speculative by its nature.

There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including:

| · | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; |

| · | the impact of the ongoing COVID-19 pandemic (including any variant) on our business, operating results and financial condition; |

| · | fluctuations in our future operating results; |

| · | our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition; |

| · | the demand for, and acceptance of, our products and for cloud-based technology learning solutions in general; |

| · | our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate; |

| · | our ability to market existing products and develop new products; |

| · | a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage; |

| · | future regulatory, judicial and legislative changes in our industry; |

| · | our ability to comply with laws and regulations applicable to our business; |

| · | the impact of natural disasters, public health crises, political crises, or other catastrophic events; |

| · | our ability to attract and retain key employees and qualified technical and sales personnel; |

| · | fluctuations in foreign currency exchange rates; |

| · | our ability to protect or obtain intellectual property rights; |

| · | our ability to raise additional capital; |

| · | the impact of our indebtedness on our financial position and operating flexibility; |

| · | our ability to meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| · | our ability to successfully defend ourselves in legal proceedings; and |

| · | our ability to continue to meet applicable listing standards. |

Additional factors that may cause actual results to differ materially from any forward-looking statements regarding the transaction between Skillsoft and Codecademy include, but are not limited to:

| · | our ability to timely satisfy the conditions to the closing of the transaction contemplated in the definitive agreement; |

| · | our ability to obtain financing for the cash consideration required to complete the transaction; |

| · | occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; |

| · | the possibility that the consummation of the acquisition is delayed or does not occur, including the failure to obtain stockholder approval of the transaction; |

| · | our ability to realize the benefits from the acquisition; |

| · | our ability to effectively and timely incorporate the acquired business into our business operations; |

| · | risks that the acquisition and other transactions contemplated by the definitive agreement disrupt current plans and operations that may harm the parties’ current businesses; |

| · | the amount of any costs, fees, expenses, impairments and charges related to the acquisition; and |

| · | uncertainty as to the effects of the announcement or pendency of the acquisition on the market price of the Company’s common stock and/or on the parties’ respective financial performance. |

The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For more information, please see the risk factors included in the Company’s Amendment No. 1 to its Registration Statement on Form S-1 declared effective by the SEC on July 29, 2021, and subsequent filings with the SEC.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included in this document, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this document or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above.

Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless required by applicable law. With regard to these risks, uncertainties and assumptions, the forward-looking events discussed in this document may not occur, and we caution you against unduly relying on these forward-looking statements.

About Skillsoft

Skillsoft (NYSE: SKIL) is a global leader in corporate digital learning, focused on transforming today’s workforce for tomorrow’s economy. The Company provides enterprise learning solutions designed to prepare organizations for the future of work, overcome critical skill gaps, drive demonstrable behavior-change, and unlock the potential in their people. Skillsoft offers a comprehensive suite of premium, original, and authorized partner content, including one of the broadest and deepest libraries of leadership & business skills, technology & developer, and compliance curricula. With access to a broad spectrum of learning options (including video, audio, books, bootcamps, live events, and practice labs), organizations can meaningfully increase learner engagement and retention. Skillsoft’s offerings are delivered through Percipio, its award-winning, AI-driven, immersive learning platform purpose built to make learning easier, more accessible, and more effective. Learn more at www.skillsoft.com.

Investors

Eric Boyer

eric.boyer@skillsoft.com

Media

Nancy Coleman

nancy.coleman@skillsoft.com

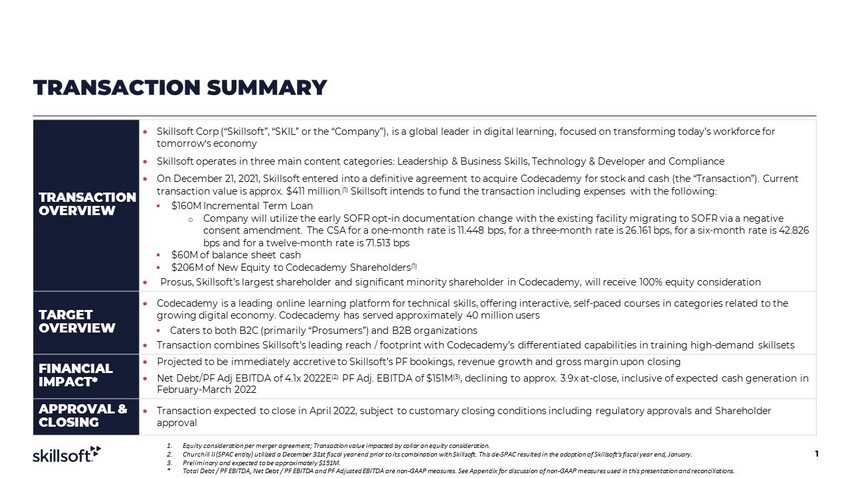

TRANSACTION SUMMARY 1 TRANSACTION OVERVIEW Skillsoft Corp (“Skillsoft”, “SKIL” or the “Company”), is a global leader in digital learning, focused on transforming today’s workforce for tomorrow‘s economy Skillsoft operates in three main content categories: Leadership & Business Skills, Technology & Developer and Compliance On December 21, 2021, Skillsoft entered into a definitive agreement to acquire Codecademy for stock and cash (the “Transactio n”) . Current transaction value is approx. $411 million. (1) Skillsoft intends to fund the transaction including expenses with the following: ▪ $160M Incremental Term Loan o Company will utilize the early SOFR opt - in documentation change with the existing facility migrating to SOFR via a negative consent amendment. The CSA for a one - month rate is 11.448 bps, for a three - month rate is 26.161 bps, for a six - month rate is 42. 826 bps and for a twelve - month rate is 71.513 bps ▪ $60M of balance sheet cash ▪ $206M of New Equity to Codecademy Shareholders (1) Prosus , Skillsoft’s largest shareholder and significant minority shareholder in Codecademy , will receive 100% equity consideration TARGET OVERVIEW Codecademy is a leading online learning platform for technical skills, offering interactive, self - paced courses in categories re lated to the growing digital economy. Codecademy has served approximately 40 million users ▪ Caters to both B2C (primarily “Prosumers”) and B2B organizations Transaction combines Skillsoft’s leading reach / footprint with Codecademy’s differentiated capabilities in training high - demand skillsets FINANCIAL IMPACT* Projected to be immediately accretive to Skillsoft’s PF bookings, revenue growth and gross margin upon closing Net Debt/PF Adj EBITDA of 4.1x 2022E (2) PF Adj. EBITDA of $151M (3) , declining to approx. 3.9x at - close, inclusive of expected cash generation in February - March 2022 APPROVAL & CLOSING Transaction expected to close in April 2022, subject to customary closing conditions including regulatory approvals and Share hol der approval 1. Equity consideration per merger agreement; Transaction value impacted by collar on equity consideration. 2. Churchill II (SPAC entity) utilized a December 31st fiscal year end prior to its combination with Skillsoft. This de - SPAC result ed in the adoption of Skillsoft’s fiscal year end, January. 3. Preliminary and expected to be approximately $151M. * Total Debt / PF EBITDA, Net Debt / PF EBITDA and PF Adjusted EBITDA are non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations.

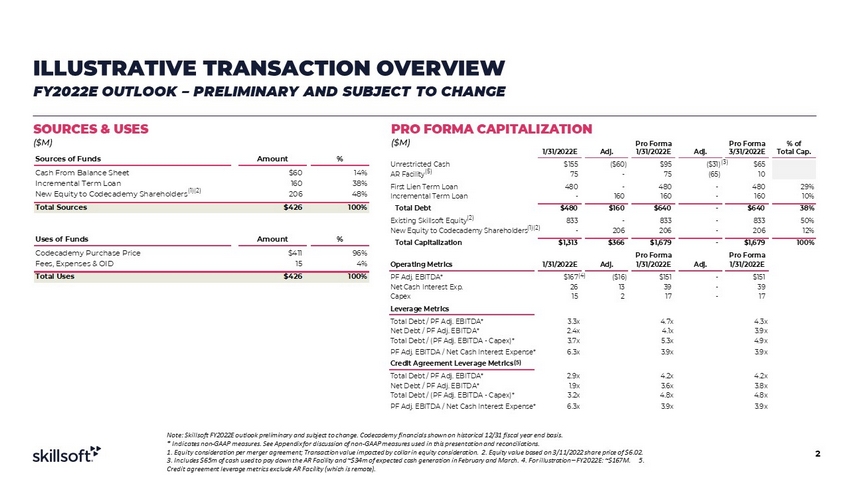

Note: Skillsoft FY2022E outlook preliminary and subject to change. Codecademy financials shown on historical 12/31 fiscal yea r e nd basis. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. 1. Equity consideration per merger agreement; Transaction value impacted by collar in equity consideration. 2. Equity value bas ed on 3/11/2022 share price of $6.02. 3. Includes $65m of cash used to pay down the AR Facility and ~$34m of expected cash generation in February and March. 4. Fo r i llustration – FY2022E: ~$167M. 5. Credit agreement leverage metrics exclude AR Facility (which is remote). SOURCES & USES ($M) PRO FORMA CAPITALIZATION ($M) ILLUSTRATIVE TRANSACTION OVERVIEW FY2022E OUTLOOK – PRELIMINARY AND SUBJECT TO CHANGE 2 (1)(2) (2) (1)(2) (3) (5) (4) (5) Sources of Funds Amount % Cash From Balance Sheet $60 14% Incremental Term Loan 160 38% New Equity to Codecademy Shareholders 206 48% Total Sources $426 100% Uses of Funds Amount % Codecademy Purchase Price $411 96% Fees, Expenses & OID 15 4% Total Uses $426 100% Pro Forma Pro Forma % of 1/31/2022E Adj. 1/31/2022E Adj. 3/31/2022E Total Cap. Unrestricted Cash $155 ($60) $95 ($31) $65 AR Facility 75 - 75 (65) 10 First Lien Term Loan 480 - 480 - 480 29% Incremental Term Loan - 160 160 - 160 10% Total Debt $480 $160 $640 - $640 38% Existing Skillsoft Equity 833 - 833 - 833 50% New Equity to Codecademy Shareholders - 206 206 - 206 12% Total Capitalization $1,313 $366 $1,679 - $1,679 100% Pro Forma Pro Forma Operating Metrics 1/31/2022E Adj. 1/31/2022E Adj. 1/31/2022E PF Adj. EBITDA* $167 ($16) $151 - $151 Net Cash Interest Exp. 26 13 39 - 39 Capex 15 2 17 - 17 Leverage Metrics Total Debt / PF Adj. EBITDA* 3.3x 4.7x 4.3x Net Debt / PF Adj. EBITDA* 2.4x 4.1x 3.9x Total Debt / (PF Adj. EBITDA - Capex)* 3.7x 5.3x 4.9x PF Adj. EBITDA / Net Cash Interest Expense* 6.3x 3.9x 3.9x Credit Agreement Leverage Metrics Total Debt / PF Adj. EBITDA* 2.9x 4.2x 4.2x Net Debt / PF Adj. EBITDA* 1.9x 3.6x 3.8x Total Debt / (PF Adj. EBITDA - Capex)* 3.2x 4.8x 4.8x PF Adj. EBITDA / Net Cash Interest Expense* 6.3x 3.9x 3.9x

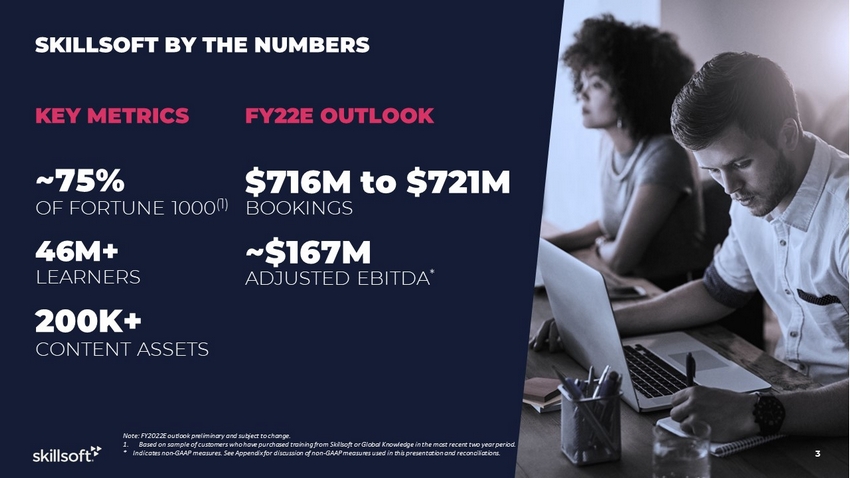

KEY METRICS ~75% OF FORTUNE 1000 (1) 46M+ LEARNERS 200K+ CONTENT ASSETS SKILLSOFT BY THE NUMBERS Note: FY2022E outlook preliminary and subject to change. 1. Based on sample of customers who have purchased training from Skillsoft or Global Knowledge in the most recent two year perio d. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations . 3 $716M to $721M BOOKINGS ~$167M ADJUSTED EBITDA * FY22E OUTLOOK

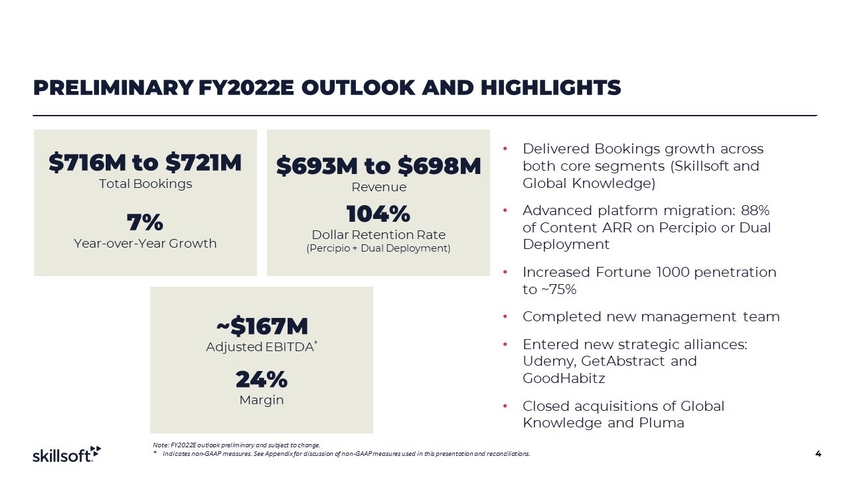

PRELIMINARY FY2022E OUTLOOK AND HIGHLIGHTS $693M to $698M Revenue 104% Dollar Retention Rate (Percipio + Dual Deployment) ~$167M Adjusted EBITDA * 24% Margin • Delivered Bookings growth across both core segments (Skillsoft and Global Knowledge) • Advanced platform migration: 88% of Content ARR on Percipio or Dual Deployment • Increased Fortune 1000 penetration to ~75% • Completed new management team • Entered new strategic alliances: Udemy, GetAbstract and GoodHabitz • Closed acquisitions of Global Knowledge and Pluma 4 Note: FY2022E outlook preliminary and subject to change. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations . $716M to $721M Total Bookings 7% Year - over - Year Growth

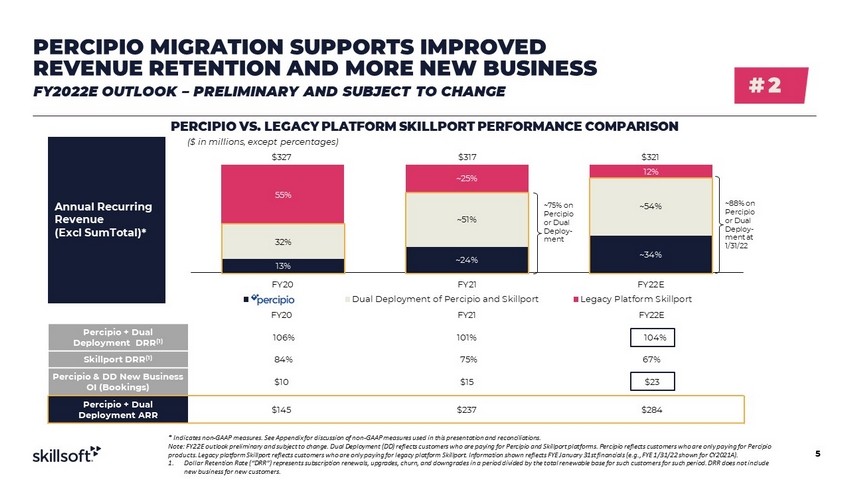

* Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. Note: FY22E outlook preliminary and subject to change. Dual Deployment (DD) reflects customers who are paying for Percipio an d S killport platforms. Percipio reflects customers who are only paying for Percipio products. Legacy platform Skillport reflects customers who are only paying for legacy platform Skillport. Information shown r efl ects FYE January 31st financials (e.g., FYE 1/31/22 shown for CY2021A). 1. Dollar Retention Rate (“DRR”) represents subscription renewals, upgrades, churn, and downgrades in a period divided by the to tal renewable base for such customers for such period. DRR does not include new business for new customers. 5 PERCIPIO VS. LEGACY PLATFORM SKILLPORT PERFORMANCE COMPARISON 13% ~24% ~34% 32% ~51% ~54% 55% ~25% 12% FY20 FY21 FY22E Dual Deployment of Percipio and Skillport Legacy Platform Skillport ($ in millions, except percentages) $327 $317 $321 FY20 FY21 FY22E Percipio + Dual Deployment DRR (1) 106% 101% 104% Skillport DRR (1) 84% 75% 67% Percipio & DD New Business OI (Bookings) $10 $15 $23 Percipio + Dual Deployment ARR $145 $237 $284 ~75% on Percipio or Dual Deploy - ment ~88% on Percipio or Dual Deploy - ment at 1/31/22 Annual Recurring Revenue (Excl SumTotal)* PERCIPIO MIGRATION SUPPORTS IMPROVED REVENUE RETENTION AND MORE NEW BUSINESS FY2022E OUTLOOK – PRELIMINARY AND SUBJECT TO CHANGE # 2

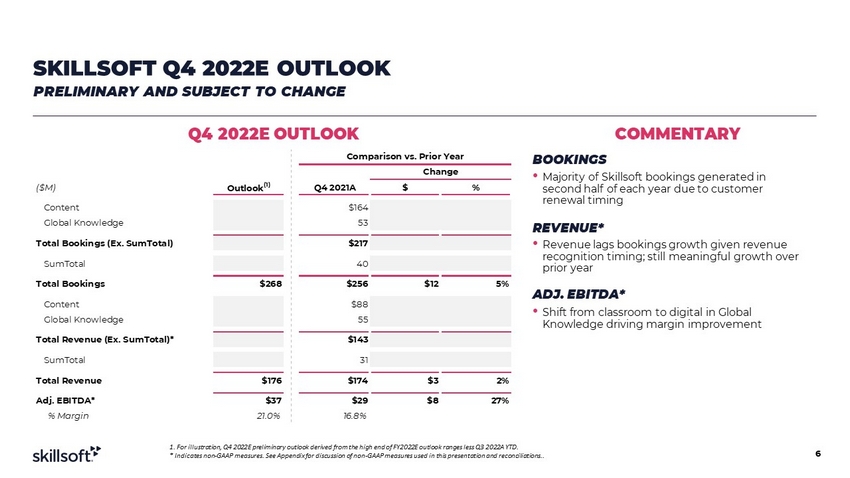

6 SKILLSOFT Q4 2022E OUTLOOK PRELIMINARY AND SUBJECT TO CHANGE Q4 2022E OUTLOOK COMMENTARY BOOKINGS REVENUE* ADJ. EBITDA* • Majority of Skillsoft bookings generated in second half of each year due to customer renewal timing • Revenue lags bookings growth given revenue recognition timing; still meaningful growth over prior year • Shift from classroom to digital in Global Knowledge driving margin improvement 1. For illustration, Q4 2022E preliminary outlook derived from the high end of FY2022E outlook ranges less Q3 2022A YTD. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations.. Comparison vs. Prior Year Change ($M) Outlook (1) Q4 2021A $ % Content $168 $164 $4 3% Global Knowledge 60 53 6 12% Total Bookings (Ex. SumTotal) 227 $217 11 0 SumTotal 41 40 1 3% Total Bookings $268 $256 $12 5% Content $86 $88 ($2) (2%) Global Knowledge 60 55 6 10% Total Revenue (Ex. SumTotal)* 146 $143 4 0 SumTotal 30 31 (1) (4%) Total Revenue $176 $174 $3 2% Adj. EBITDA* $37 $29 $8 27% % Margin 21.0% 16.8%

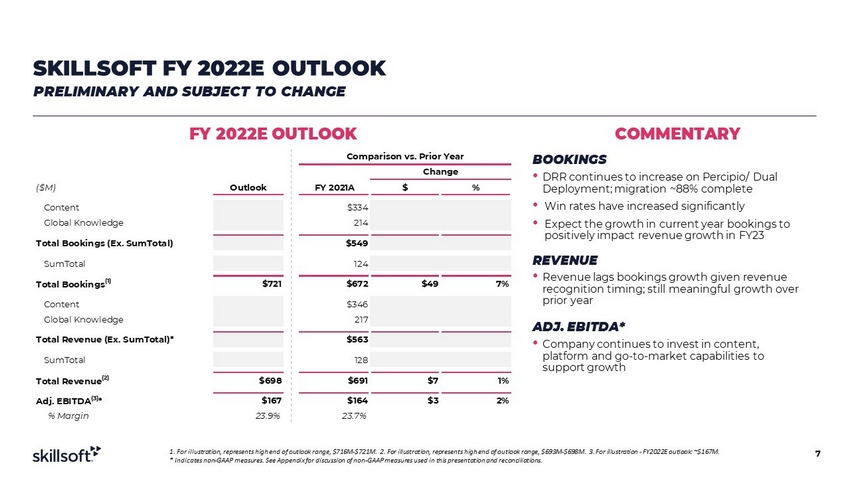

7 SKILLSOFT FY 2022E OUTLOOK PRELIMINARY AND SUBJECT TO CHANGE FY 2022E OUTLOOK COMMENTARY BOOKINGS REVENUE ADJ. EBITDA* • DRR continues to increase on Percipio/ Dual Deployment; migration ~88% complete • Win rates have increased significantly • Expect the growth in current year bookings to positively impact revenue growth in FY23 • Revenue lags bookings growth given revenue recognition timing; still meaningful growth over prior year • Company continues to invest in content, platform and go - to - market capabilities to support growth 1. For illustration, represents high end of outlook range, $716M - $721M. 2. For illustration, represents high end of outlook ran ge, $693M - $698M. 3. For illustration - FY2022E outlook: ~$167M. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. Comparison vs. Prior Year Change ($M) Outlook FY 2021A $ % Content $349 $334 $14 4% Global Knowledge 250 214 36 17% Total Bookings (Ex. SumTotal) 599 $549 50 0 SumTotal 123 124 (1) (1%) Total Bookings (1) $721 $672 $49 7% Content $341 $346 ($5) (1%) Global Knowledge 237 217 21 10% Total Revenue (Ex. SumTotal)* 578 $563 16 0 SumTotal 120 128 (9) (7%) Total Revenue (2) $698 $691 $7 1% Adj. EBITDA (3) * $167 $164 $3 2% % Margin 23.9% 23.7%