EXHIBIT 99.2

Published on March 15, 2022

Exhibit 99.2

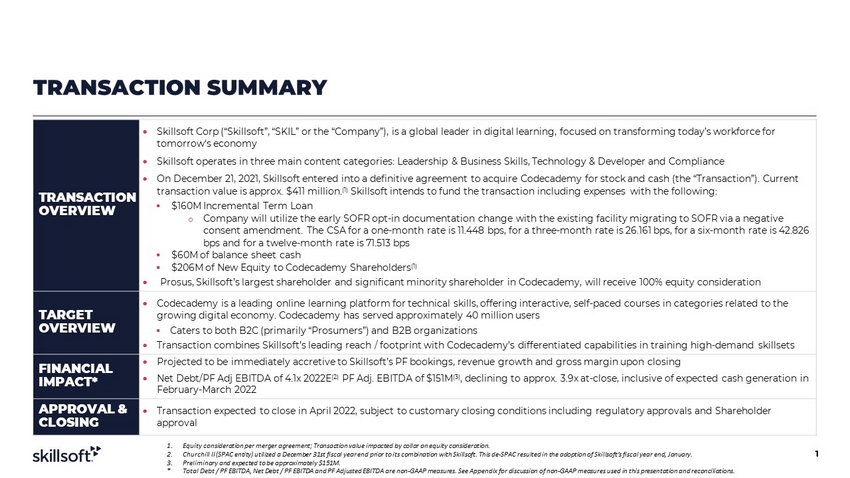

TRANSACTION SUMMARY 1 TRANSACTION OVERVIEW Skillsoft Corp (“Skillsoft”, “SKIL” or the “Company”), is a global leader in digital learning, focused on transforming today’s workforce for tomorrow‘s economy Skillsoft operates in three main content categories: Leadership & Business Skills, Technology & Developer and Compliance On December 21, 2021, Skillsoft entered into a definitive agreement to acquire Codecademy for stock and cash (the “Transactio n”) . Current transaction value is approx. $411 million. (1) Skillsoft intends to fund the transaction including expenses with the following: ▪ $160M Incremental Term Loan o Company will utilize the early SOFR opt - in documentation change with the existing facility migrating to SOFR via a negative consent amendment. The CSA for a one - month rate is 11.448 bps, for a three - month rate is 26.161 bps, for a six - month rate is 42. 826 bps and for a twelve - month rate is 71.513 bps ▪ $60M of balance sheet cash ▪ $206M of New Equity to Codecademy Shareholders (1) Prosus , Skillsoft’s largest shareholder and significant minority shareholder in Codecademy , will receive 100% equity consideration TARGET OVERVIEW Codecademy is a leading online learning platform for technical skills, offering interactive, self - paced courses in categories re lated to the growing digital economy. Codecademy has served approximately 40 million users ▪ Caters to both B2C (primarily “Prosumers”) and B2B organizations Transaction combines Skillsoft’s leading reach / footprint with Codecademy’s differentiated capabilities in training high - demand skillsets FINANCIAL IMPACT* Projected to be immediately accretive to Skillsoft’s PF bookings, revenue growth and gross margin upon closing Net Debt/PF Adj EBITDA of 4.1x 2022E (2) PF Adj. EBITDA of $151M (3) , declining to approx. 3.9x at - close, inclusive of expected cash generation in February - March 2022 APPROVAL & CLOSING Transaction expected to close in April 2022, subject to customary closing conditions including regulatory approvals and Share hol der approval 1. Equity consideration per merger agreement; Transaction value impacted by collar on equity consideration. 2. Churchill II (SPAC entity) utilized a December 31st fiscal year end prior to its combination with Skillsoft. This de - SPAC result ed in the adoption of Skillsoft’s fiscal year end, January. 3. Preliminary and expected to be approximately $151M. * Total Debt / PF EBITDA, Net Debt / PF EBITDA and PF Adjusted EBITDA are non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations.

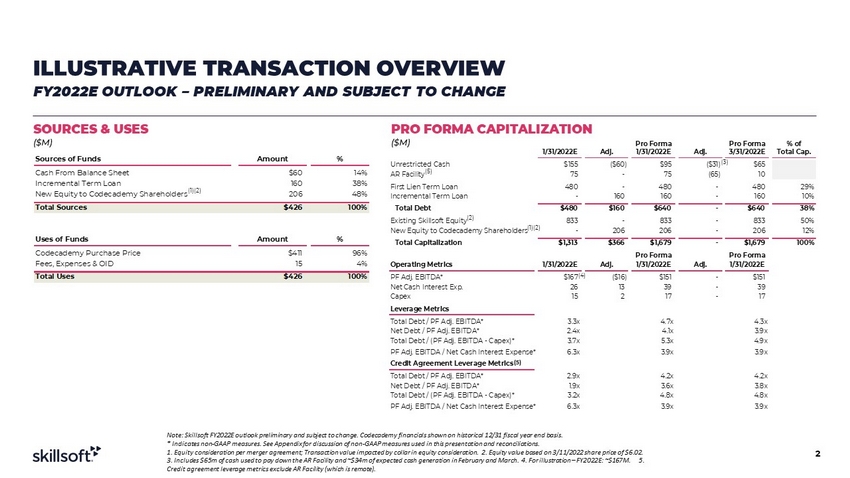

Note: Skillsoft FY2022E outlook preliminary and subject to change. Codecademy financials shown on historical 12/31 fiscal yea r e nd basis. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. 1. Equity consideration per merger agreement; Transaction value impacted by collar in equity consideration. 2. Equity value bas ed on 3/11/2022 share price of $6.02. 3. Includes $65m of cash used to pay down the AR Facility and ~$34m of expected cash generation in February and March. 4. Fo r i llustration – FY2022E: ~$167M. 5. Credit agreement leverage metrics exclude AR Facility (which is remote). SOURCES & USES ($M) PRO FORMA CAPITALIZATION ($M) ILLUSTRATIVE TRANSACTION OVERVIEW FY2022E OUTLOOK – PRELIMINARY AND SUBJECT TO CHANGE 2 (1)(2) (2) (1)(2) (3) (5) (4) (5) Sources of Funds Amount % Cash From Balance Sheet $60 14% Incremental Term Loan 160 38% New Equity to Codecademy Shareholders 206 48% Total Sources $426 100% Uses of Funds Amount % Codecademy Purchase Price $411 96% Fees, Expenses & OID 15 4% Total Uses $426 100% Pro Forma Pro Forma % of 1/31/2022E Adj. 1/31/2022E Adj. 3/31/2022E Total Cap. Unrestricted Cash $155 ($60) $95 ($31) $65 AR Facility 75 - 75 (65) 10 First Lien Term Loan 480 - 480 - 480 29% Incremental Term Loan - 160 160 - 160 10% Total Debt $480 $160 $640 - $640 38% Existing Skillsoft Equity 833 - 833 - 833 50% New Equity to Codecademy Shareholders - 206 206 - 206 12% Total Capitalization $1,313 $366 $1,679 - $1,679 100% Pro Forma Pro Forma Operating Metrics 1/31/2022E Adj. 1/31/2022E Adj. 1/31/2022E PF Adj. EBITDA* $167 ($16) $151 - $151 Net Cash Interest Exp. 26 13 39 - 39 Capex 15 2 17 - 17 Leverage Metrics Total Debt / PF Adj. EBITDA* 3.3x 4.7x 4.3x Net Debt / PF Adj. EBITDA* 2.4x 4.1x 3.9x Total Debt / (PF Adj. EBITDA - Capex)* 3.7x 5.3x 4.9x PF Adj. EBITDA / Net Cash Interest Expense* 6.3x 3.9x 3.9x Credit Agreement Leverage Metrics Total Debt / PF Adj. EBITDA* 2.9x 4.2x 4.2x Net Debt / PF Adj. EBITDA* 1.9x 3.6x 3.8x Total Debt / (PF Adj. EBITDA - Capex)* 3.2x 4.8x 4.8x PF Adj. EBITDA / Net Cash Interest Expense* 6.3x 3.9x 3.9x

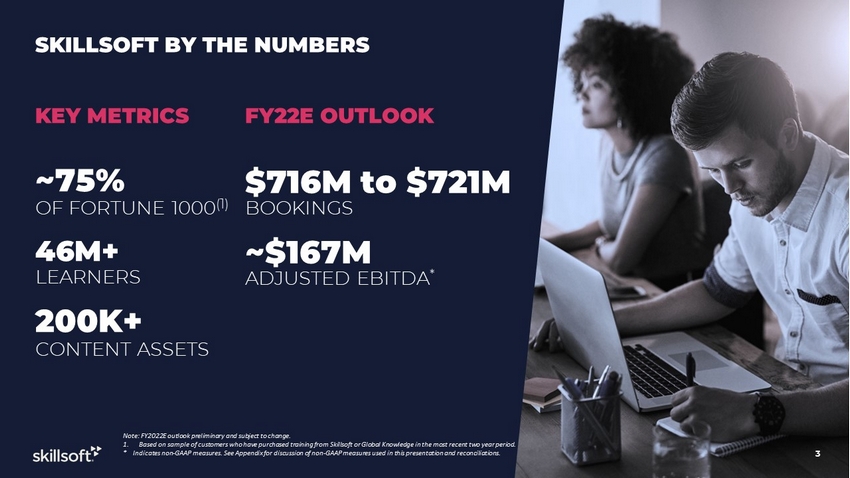

KEY METRICS ~75% OF FORTUNE 1000 (1) 46M+ LEARNERS 200K+ CONTENT ASSETS SKILLSOFT BY THE NUMBERS Note: FY2022E outlook preliminary and subject to change. 1. Based on sample of customers who have purchased training from Skillsoft or Global Knowledge in the most recent two year perio d. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations . 3 $716M to $721M BOOKINGS ~$167M ADJUSTED EBITDA * FY22E OUTLOOK

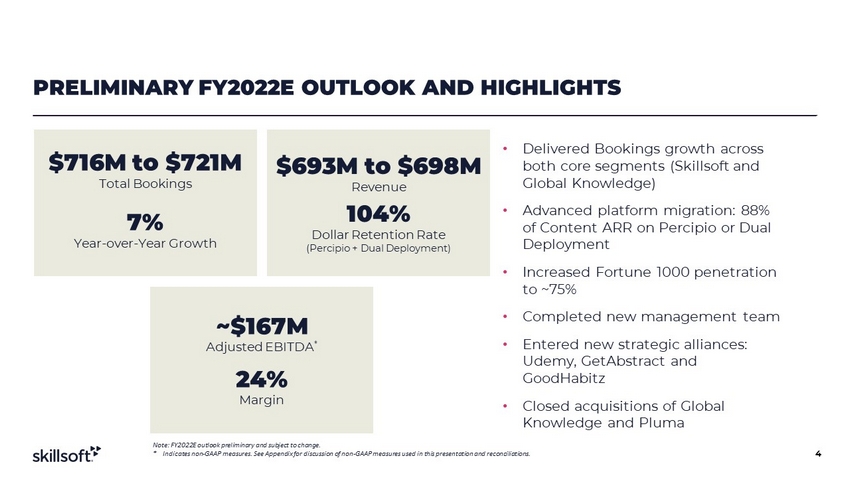

PRELIMINARY FY2022E OUTLOOK AND HIGHLIGHTS $693M to $698M Revenue 104% Dollar Retention Rate (Percipio + Dual Deployment) ~$167M Adjusted EBITDA * 24% Margin • Delivered Bookings growth across both core segments (Skillsoft and Global Knowledge) • Advanced platform migration: 88% of Content ARR on Percipio or Dual Deployment • Increased Fortune 1000 penetration to ~75% • Completed new management team • Entered new strategic alliances: Udemy, GetAbstract and GoodHabitz • Closed acquisitions of Global Knowledge and Pluma 4 Note: FY2022E outlook preliminary and subject to change. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations . $716M to $721M Total Bookings 7% Year - over - Year Growth

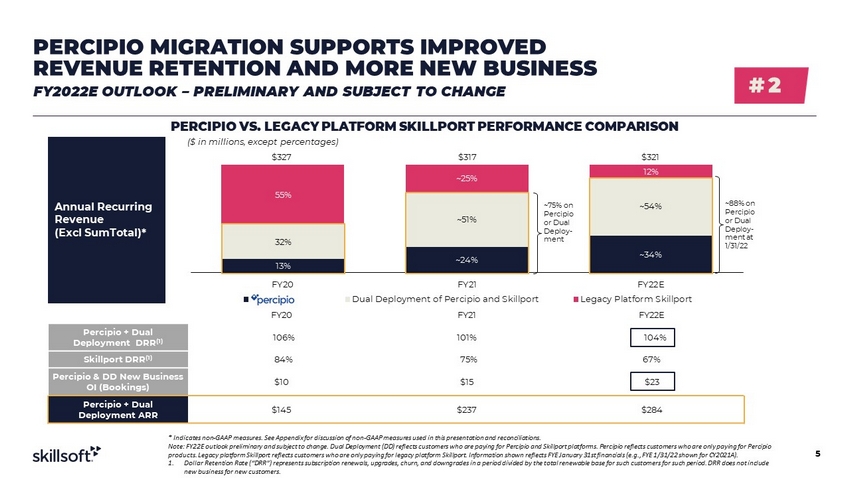

* Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. Note: FY22E outlook preliminary and subject to change. Dual Deployment (DD) reflects customers who are paying for Percipio an d S killport platforms. Percipio reflects customers who are only paying for Percipio products. Legacy platform Skillport reflects customers who are only paying for legacy platform Skillport. Information shown r efl ects FYE January 31st financials (e.g., FYE 1/31/22 shown for CY2021A). 1. Dollar Retention Rate (“DRR”) represents subscription renewals, upgrades, churn, and downgrades in a period divided by the to tal renewable base for such customers for such period. DRR does not include new business for new customers. 5 PERCIPIO VS. LEGACY PLATFORM SKILLPORT PERFORMANCE COMPARISON 13% ~24% ~34% 32% ~51% ~54% 55% ~25% 12% FY20 FY21 FY22E Dual Deployment of Percipio and Skillport Legacy Platform Skillport ($ in millions, except percentages) $327 $317 $321 FY20 FY21 FY22E Percipio + Dual Deployment DRR (1) 106% 101% 104% Skillport DRR (1) 84% 75% 67% Percipio & DD New Business OI (Bookings) $10 $15 $23 Percipio + Dual Deployment ARR $145 $237 $284 ~75% on Percipio or Dual Deploy - ment ~88% on Percipio or Dual Deploy - ment at 1/31/22 Annual Recurring Revenue (Excl SumTotal)* PERCIPIO MIGRATION SUPPORTS IMPROVED REVENUE RETENTION AND MORE NEW BUSINESS FY2022E OUTLOOK – PRELIMINARY AND SUBJECT TO CHANGE # 2

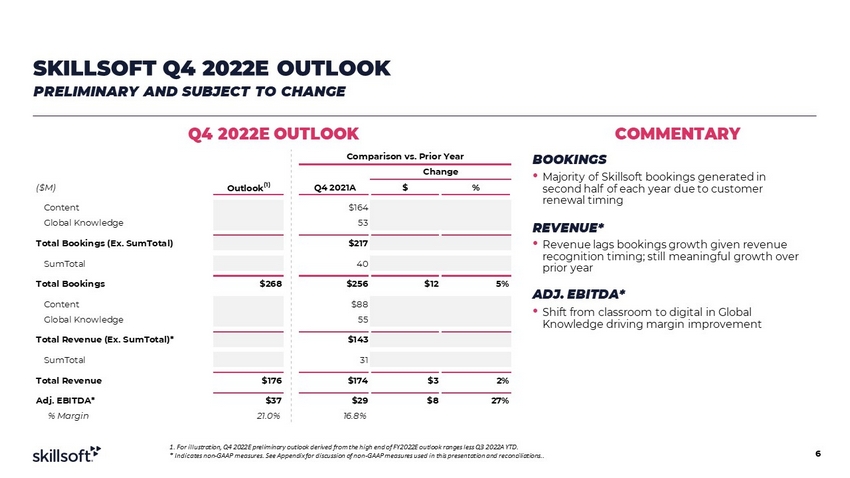

6 SKILLSOFT Q4 2022E OUTLOOK PRELIMINARY AND SUBJECT TO CHANGE Q4 2022E OUTLOOK COMMENTARY BOOKINGS REVENUE* ADJ. EBITDA* • Majority of Skillsoft bookings generated in second half of each year due to customer renewal timing • Revenue lags bookings growth given revenue recognition timing; still meaningful growth over prior year • Shift from classroom to digital in Global Knowledge driving margin improvement 1. For illustration, Q4 2022E preliminary outlook derived from the high end of FY2022E outlook ranges less Q3 2022A YTD. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations.. Comparison vs. Prior Year Change ($M) Outlook (1) Q4 2021A $ % Content $168 $164 $4 3% Global Knowledge 60 53 6 12% Total Bookings (Ex. SumTotal) 227 $217 11 0 SumTotal 41 40 1 3% Total Bookings $268 $256 $12 5% Content $86 $88 ($2) (2%) Global Knowledge 60 55 6 10% Total Revenue (Ex. SumTotal)* 146 $143 4 0 SumTotal 30 31 (1) (4%) Total Revenue $176 $174 $3 2% Adj. EBITDA* $37 $29 $8 27% % Margin 21.0% 16.8%

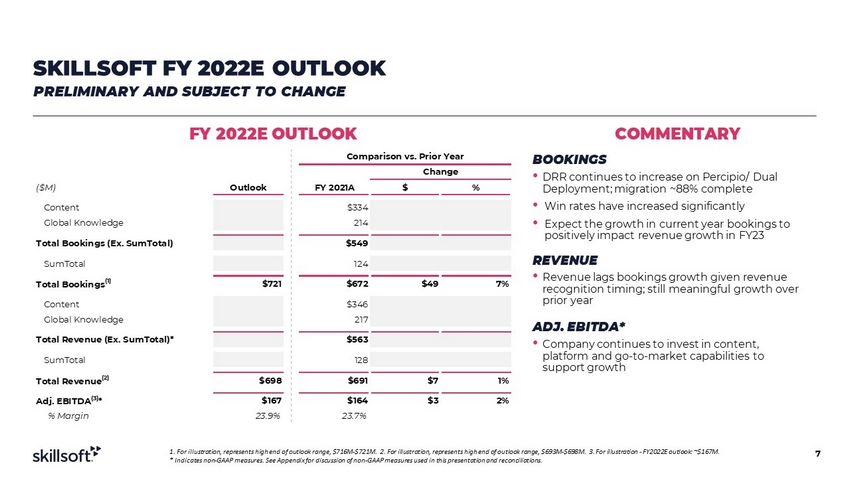

7 SKILLSOFT FY 2022E OUTLOOK PRELIMINARY AND SUBJECT TO CHANGE FY 2022E OUTLOOK COMMENTARY BOOKINGS REVENUE ADJ. EBITDA* • DRR continues to increase on Percipio/ Dual Deployment; migration ~88% complete • Win rates have increased significantly • Expect the growth in current year bookings to positively impact revenue growth in FY23 • Revenue lags bookings growth given revenue recognition timing; still meaningful growth over prior year • Company continues to invest in content, platform and go - to - market capabilities to support growth 1. For illustration, represents high end of outlook range, $716M - $721M. 2. For illustration, represents high end of outlook ran ge, $693M - $698M. 3. For illustration - FY2022E outlook: ~$167M. * Indicates non - GAAP measures. See Appendix for discussion of non - GAAP measures used in this presentation and reconciliations. Comparison vs. Prior Year Change ($M) Outlook FY 2021A $ % Content $349 $334 $14 4% Global Knowledge 250 214 36 17% Total Bookings (Ex. SumTotal) 599 $549 50 0 SumTotal 123 124 (1) (1%) Total Bookings (1) $721 $672 $49 7% Content $341 $346 ($5) (1%) Global Knowledge 237 217 21 10% Total Revenue (Ex. SumTotal)* 578 $563 16 0 SumTotal 120 128 (9) (7%) Total Revenue (2) $698 $691 $7 1% Adj. EBITDA (3) * $167 $164 $3 2% % Margin 23.9% 23.7%