UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement | ||

| ¨ | Definitive Additional Materials | ||

| x | Soliciting Material Pursuant to Section 240.14a-12 |

Skillsoft Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No. | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

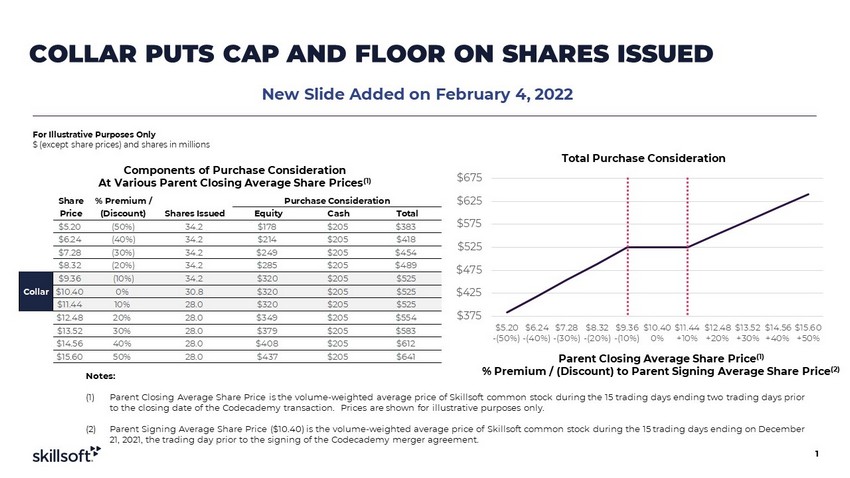

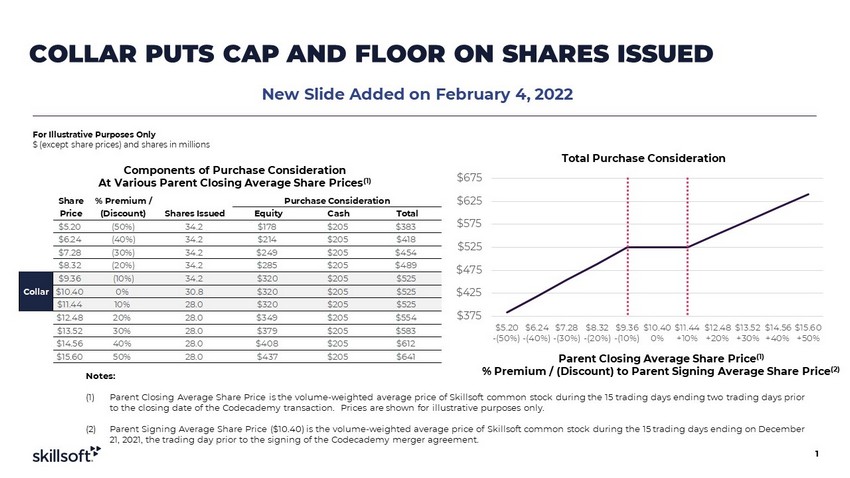

The attached updates the Investor Presentation filed by Skillsoft Corp. (“Skillsoft” or the “Company”) on December 22, 2021 with an additional slide describing the effects of the collar mechanism on the number of shares that may be issued and the value of total consideration in connection with the consummation of the transactions contemplated by that certain Agreement and Plan of Merger, dated as of December 22, 2021, by and among the Company, Ryzac, Inc., a Delaware corporation (“Codecademy”), Skillsoft Finance II, Inc., a Delaware corporation and indirect wholly-owned subsidiary of the Company (“Borrower”), Skillsoft Newco I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Borrower, Skillsoft Newco II, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of Borrower, and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the representative of the equity holders of Codecademy.

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the proposed acquisition of Codecademy by the Company. This communication does not constitute a solicitation of any vote or approval. In connection with the proposed transaction, the Company plans to file with the Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its shareholders a proxy statement regarding the proposed transaction. The Company may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the proposed transaction or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Company’s proxy statement. Shareholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at https://investor.skillsoft.com/ copies of materials it files with, or furnishes to, the SEC.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Report on Form 8-K and Form 8-K/A filed on June 17, 2021. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s Form 8-K filed on June 17, 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to the proposed transaction when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the investor relations page of the Company’s website at https://investor.skillsoft.com/.

Forward Looking Statements

This document includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations, the timing and occurrence of the closing of the transaction, and the anticipated transaction benefits. All statements, other than statements of historical facts, that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, our product development and planning, our pipeline, future capital expenditures, financial results, the impact of regulatory changes, existing and evolving business strategies and acquisitions and dispositions, demand for our services and competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, our ability to successfully implement our plans, strategies, objectives, expectations and intentions are forward-looking statements. Also, when we use words such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,” “target,” goals,” “probably,” or similar expressions, we are making forward-looking statements. Such statements are based upon the current beliefs and expectations of Skillsoft’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. All forward-looking disclosure is speculative by its nature.

There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including:

| · | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; |

| · | the impact of the ongoing COVID-19 pandemic (including any variant) on our business, operating results and financial condition; |

| · | fluctuations in our future operating results; |

| · | our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition; |

| · | the demand for, and acceptance of, our products and for cloud-based technology learning solutions in general; |

| · | our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate; |

| · | our ability to market existing products and develop new products; |

| · | a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage; |

| · | future regulatory, judicial and legislative changes in our industry; |

| · | our ability to comply with laws and regulations applicable to our business; |

| · | the impact of natural disasters, public health crises, political crises, or other catastrophic events; |

| · | our ability to attract and retain key employees and qualified technical and sales personnel; |

| · | fluctuations in foreign currency exchange rates; |

| · | our ability to protect or obtain intellectual property rights; |

| · | our ability to raise additional capital; |

| · | the impact of our indebtedness on our financial position and operating flexibility; |

| · | our ability to meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| · | our ability to successfully defend ourselves in legal proceedings; and |

| · | our ability to continue to meet applicable listing standards. |

Additional factors that may cause actual results to differ materially from any forward-looking statements regarding the transaction between Skillsoft and Codecademy include, but are not limited to:

| · | our ability to timely satisfy the conditions to the closing of the transaction contemplated in the definitive agreement; |

| · | occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; |

| · | the possibility that the consummation of the acquisition is delayed or does not occur, including the failure to obtain stockholder approval of the transaction; |

| · | our ability to realize the benefits from the acquisition; |

| · | our ability to effectively and timely incorporate the acquired business into our business operations; |

| · | risks that the acquisition and other transactions contemplated by the definitive agreement disrupt current plans and operations that may harm the parties’ current businesses; and |

| · | the amount of any costs, fees, expenses, impairments and charges related to the acquisition; and |

| · | uncertainty as to the effects of the announcement or pendency of the acquisition on the market price of the Company’s common stock and/or on the parties’ respective financial performance. |

The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For more information, please see the risk factors included in the Company’s Amendment No. 1 to its Registration Statement on Form S-1 declared effective by the SEC on July 29, 2021, and subsequent filings with the SEC.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included in this document, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this document or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above.

Components of Purchase Consideration At Various Parent Closing Average Share Prices (1) 1 Parent Closing Average Share Price (1) % Premium / (Discount) to Parent Signing Average Share Price (2) $375 $425 $475 $525 $575 $625 $675 $5.20 -(50%) $6.24 -(40%) $7.28 -(30%) $8.32 -(20%) $9.36 -(10%) $10.40 0% $11.44 +10% $12.48 +20% $13.52 +30% $14.56 +40% $15.60 +50% Total Purchase Consideration For Illustrative Purposes Only $ (except share prices) and shares in millions Share % Premium / Purchase Consideration Price (Discount) Shares Issued Equity Cash Total $5.20 (50%) 34.2 $178 $205 $383 $6.24 (40%) 34.2 $214 $205 $418 $7.28 (30%) 34.2 $249 $205 $454 $8.32 (20%) 34.2 $285 $205 $489 $9.36 (10%) 34.2 $320 $205 $525 Collar $10.40 0% 30.8 $320 $205 $525 $11.44 10% 28.0 $320 $205 $525 $12.48 20% 28.0 $349 $205 $554 $13.52 30% 28.0 $379 $205 $583 $14.56 40% 28.0 $408 $205 $612 $15.60 50% 28.0 $437 $205 $641 Notes: (1) Parent Closing Average Share Price is the volume - weighted average price of Skillsoft common stock during the 15 trading days end ing two trading days prior to the closing date of the Codecademy transaction. Prices are shown for illustrative purposes only. (2) Parent Signing Average Share Price ($10.40) is the volume - weighted average price of Skillsoft common stock during the 15 trading days ending on December 21, 2021, the trading day prior to the signing of the Codecademy merger agreement. COLLAR PUTS CAP AND FLOOR ON SHARES ISSUED New Slide Added on February 4, 2022