UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement | ||

| ¨ | Definitive Additional Materials | ||

| x | Soliciting Material Pursuant to Section 240.14a-12 |

Skillsoft Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No. |

| (3) | Filing Party: |

| (4) | Date Filed: |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 22, 2021

Skillsoft Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38960 | 83-4388331 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

300 Innovative Way, Suite 201 Nashua, NH |

03062 | |

| (Address of principal executive offices) | (Zip Code) |

(603) 324-3000

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of each class | Trading Symbol |

Name of each exchange on which registered | ||

| Shares of Class A common stock, $0.0001 par value per share | SKIL | New York Stock Exchange | ||

| Warrants | SKIL WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On December 22, 2021, Skillsoft Corp., a Delaware corporation (“Skillsoft” or the “Company”), and Ryzac, Inc., a Delaware corporation (“Codecademy”), issued a joint press release announcing their entry into an Agreement and Plan of Merger, dated as of December 22, 2021 (the “Merger Agreement”), by and among the Company, Codecademy, Skillsoft Finance II, Inc., a Delaware corporation and indirect wholly-owned subsidiary of the Company (“Borrower”), Skillsoft Newco I, Inc., a Delaware corporation and direct wholly-owned subsidiary of Borrower (“Merger Sub I”), Skillsoft Newco II, LLC, a Delaware limited liability company and direct wholly-owned subsidiary of Borrower (“Merger Sub II”), and Fortis Advisors LLC, a Delaware limited liability company, solely in its capacity as the representative of the equity holders of Codecademy, pursuant to which, subject to the terms and conditions set forth therein, Merger Sub I will merge with and into Codecademy (the “First Merger”), with Codecademy being the surviving corporation of the First Merger (the “Surviving Corporation”), and immediately following the First Merger and as part of the same overall transaction, the Surviving Corporation will merge with and into Merger Sub II, with Merger Sub II being the surviving company and an indirect wholly-owned subsidiary of the Company. A copy of the joint press release announcing the transaction is filed as Exhibit 99.1 hereto. The terms of the Merger Agreement will be described in a subsequent filing by the Company on Form 8-K.

Item 9.01. Financial Statement and Exhibits.

(d) Exhibits.

The list of exhibits is set forth on the Exhibit Index of this Current Report on Form 8-K and is incorporated herein by reference.

| Exhibit Number |

Description | |

| 99.1 | Joint Press Release, dated December 22, 2021. | |

| 99.2 | Skillsoft Investor Presentation, dated December 22, 2021. | |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL and included as Exhibit 101). |

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the proposed acquisition of Codecademy by the Company. This communication does not constitute a solicitation of any vote or approval. In connection with the proposed transaction, the Company plans to file with the Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its shareholders a proxy statement regarding the proposed transaction. The Company may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the proposed transaction or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Company’s proxy statement. Shareholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at https://investor.skillsoft.com/ copies of materials it files with, or furnishes to, the SEC.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Report on Form 8-K and Form 8-K/A filed on June 17, 2021. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s Form 8-K filed on June 17, 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to the proposed transaction when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the investor relations page of the Company’s website at https://investor.skillsoft.com/.

Forward Looking Statements

This document includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations, the timing and occurrence of the closing of the transaction, and the anticipated transaction benefits. All statements, other than statements of historical facts, that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, our product development and planning, our pipeline, future capital expenditures, financial results, the impact of regulatory changes, existing and evolving business strategies and acquisitions and dispositions, demand for our services and competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, our ability to successfully implement our plans, strategies, objectives, expectations and intentions are forward-looking statements. Also, when we use words such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,” “target,” goals,” “probably,” or similar expressions, we are making forward-looking statements. Such statements are based upon the current beliefs and expectations of Skillsoft’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. All forward-looking disclosure is speculative by its nature.

There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this document, including:

| · | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; |

| · | the impact of the ongoing COVID-19 pandemic (including any variant) on our business, operating results and financial condition; |

| · | fluctuations in our future operating results; |

| · | our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition; |

| · | the demand for, and acceptance of, our products and for cloud-based technology learning solutions in general; |

| · | our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate; |

| · | our ability to market existing products and develop new products; |

| · | a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage; |

| · | future regulatory, judicial and legislative changes in our industry; |

| · | our ability to comply with laws and regulations applicable to our business; |

| · | the impact of natural disasters, public health crises, political crises, or other catastrophic events; |

| · | our ability to attract and retain key employees and qualified technical and sales personnel; |

| · | fluctuations in foreign currency exchange rates; |

| · | our ability to protect or obtain intellectual property rights; |

| · | our ability to raise additional capital; |

| · | the impact of our indebtedness on our financial position and operating flexibility; |

| · | our ability to meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| · | our ability to successfully defend ourselves in legal proceedings; and |

| · | our ability to continue to meet applicable listing standards. |

Additional factors that may cause actual results to differ materially from any forward-looking statements regarding the transaction between Skillsoft and Codecademy include, but are not limited to:

| · | our ability to timely satisfy the conditions to the closing of the transaction contemplated in the definitive agreement; |

| · | occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; |

| · | the possibility that the consummation of the acquisition is delayed or does not occur, including the failure to obtain stockholder approval of the transaction; |

| · | our ability to realize the benefits from the acquisition; |

| · | our ability to effectively and timely incorporate the acquired business into our business operations; |

| · | risks that the acquisition and other transactions contemplated by the definitive agreement disrupt current plans and operations that may harm the parties’ current businesses; and |

| · | the amount of any costs, fees, expenses, impairments and charges related to the acquisition; and |

| · | uncertainty as to the effects of the announcement or pendency of the acquisition on the market price of the Company’s common stock and/or on the parties’ respective financial performance. |

The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For more information, please see the risk factors included in the Company’s Amendment no. 1 to its Registration Statement on Form S-1 declared effective by the SEC on July 29, 2021, and subsequent filings with the SEC.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included in this document, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this document or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above.

Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless required by applicable law. With regard to these risks, uncertainties and assumptions, the forward-looking events discussed in this document may not occur, and we caution you against unduly relying on these forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: December 22, 2021

| SKILLSOFT CORP. | ||

| By: | /s/ Gary W. Ferrera | |

| Gary W. Ferrera | ||

| Chief Financial Officer | ||

Exhibit 99.1

Skillsoft to Acquire Codecademy, a Leading Platform for Learning High-Demand Technical Skills, Creating a Worldwide Community of More Than 85 Million Learners

Codecademy’s entrepreneurial team, led by founder Zach Sims, to join Skillsoft with focus on accelerating growth in Technology & Developer Business

Transaction expected to be immediately and significantly accretive to revenue and bookings growth with substantial cross-selling opportunities

Conference call and webcast today at 8:30 a.m. ET

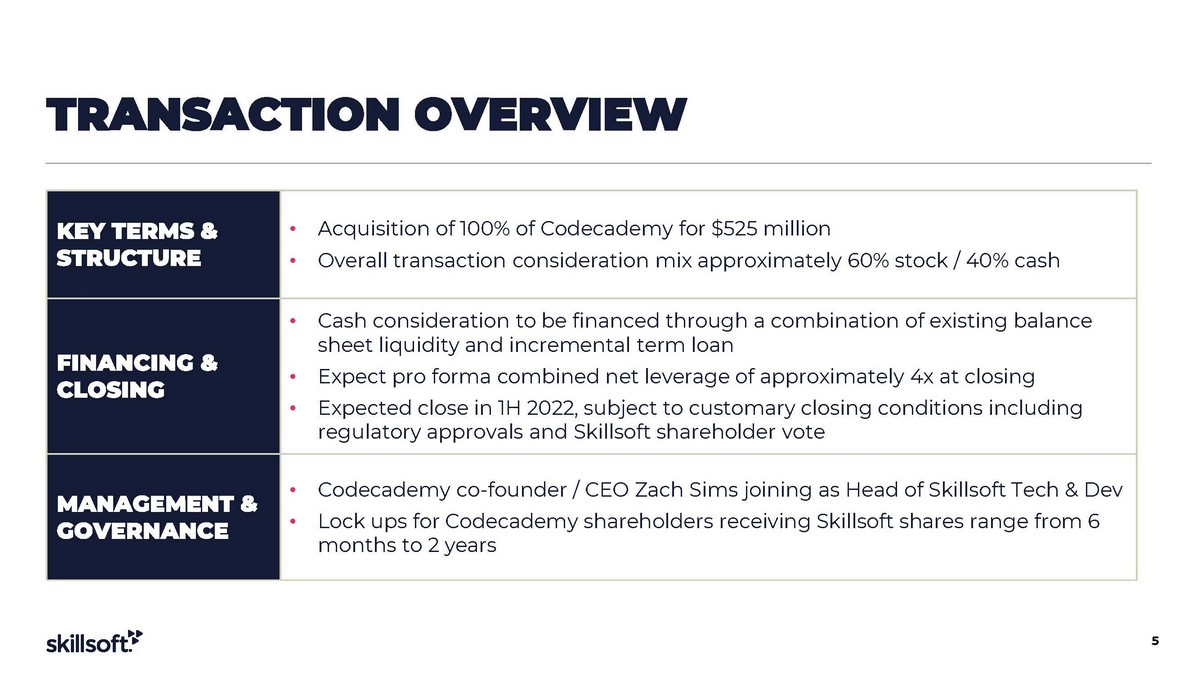

Boston – December 22, 2021 – Skillsoft (NYSE:SKIL), a global leader in corporate digital learning, today announced it has entered into a definitive agreement to acquire Codecademy, a leading online learning platform for technical skills, for approximately $525 million in cash and stock.

Codecademy is an innovative and popular learning platform providing high-demand technical skills to approximately 40 million registered learners in nearly every country worldwide. The platform offers interactive, self-paced courses and hands-on learning in 14 programming languages across multiple domains such as application development, data science, cloud and cybersecurity. In addition, the Codecademy platform can rapidly expand to deliver new skills at scale, making it highly adaptable to the evolving technical needs of learners and their employers. Codecademy, which was founded in 2011 and is headquartered in New York, is led by a proven entrepreneurial team that has built one of the most admired technical skills learning platforms in the industry.

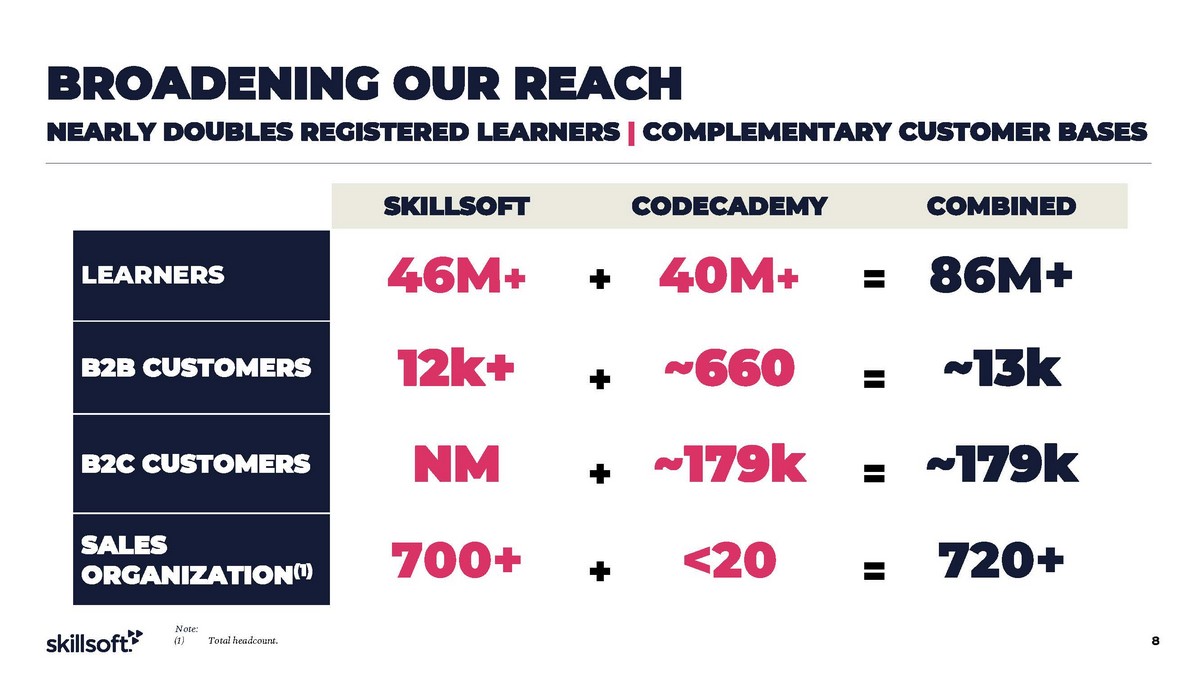

“Codecademy will significantly expand Skillsoft’s capabilities in the high-growth Tech & Dev segment,” said Jeffrey R. Tarr, Chief Executive Officer of Skillsoft. “Strategic acquisitions are an important part of our growth strategy. We acquired virtual instructor-led training capabilities with Global Knowledge and coaching with Pluma earlier this year. With the addition of Codecademy’s innovative capabilities, we will create an even more immersive online learning experience. When we combine Skillsoft’s enterprise customer base of more than 12,000 corporate customers and over 46 million learners with Codecademy’s 40 million learners, sophisticated digital marketing capability and influential brand, we expect to unlock significant revenue synergies.”

Following the close of the transaction, the Codecademy team will join Skillsoft to help further build out the leading technical skills training solution for learners globally.

“Since our founding, Codecademy has been focused on empowering our learners to build inspiring careers in technology,” said Zach Sims, founder and CEO of Codecademy. “We have helped tens of millions of people around the world learn new technology skills. Together with Skillsoft, we will have the opportunity to rapidly increase the size of our content library and scale Codecademy across the millions of learners and thousands of companies – including approximately 75% of the Fortune 1000 – that work with Skillsoft worldwide. With additional resources and opportunities to drive growth, we are excited to embark on this important next chapter.”

Strategic Rationale and Benefits

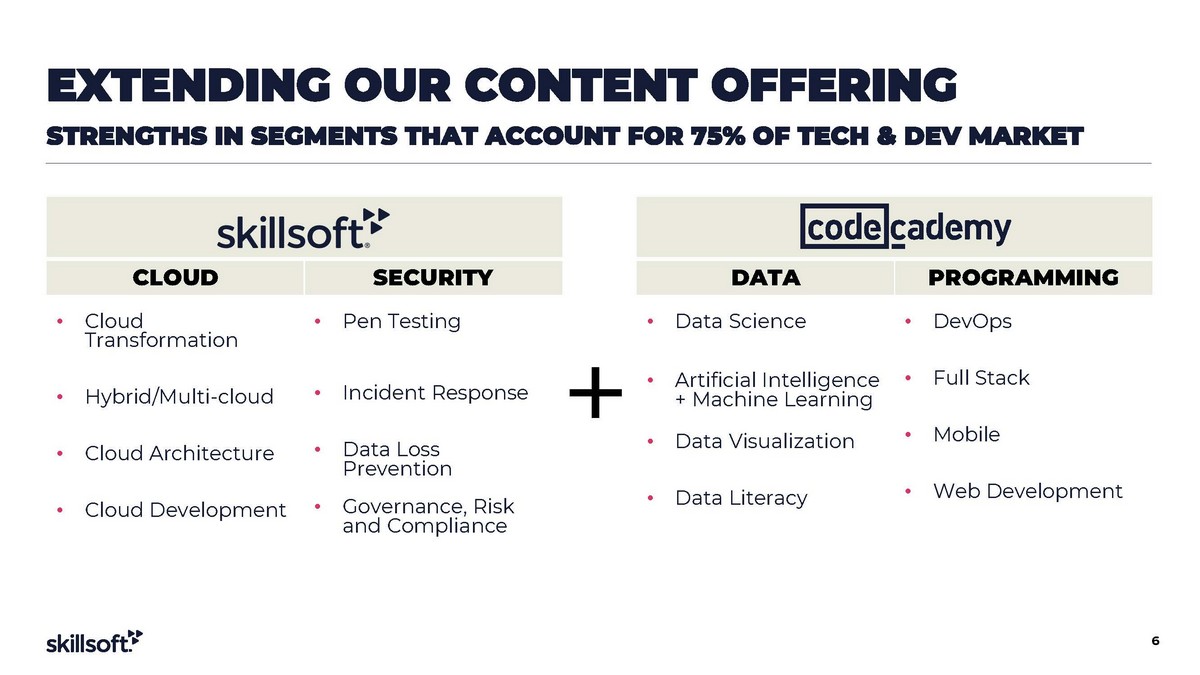

| · | Creates a Leading Technology & Developer Offering. Adding Codecademy’s expertise in 14 programming languages across multiple domains to Skillsoft’s existing technical skills offering will create a leader in the high-demand, high-growth Tech & Dev segment. In addition, the capability of the Codecademy platform to rapidly add new programming languages and technical skills at scale will further enhance Skillsoft’s ability to meet the evolving demands of learners worldwide as it helps organizations address the critical technical skills gap. |

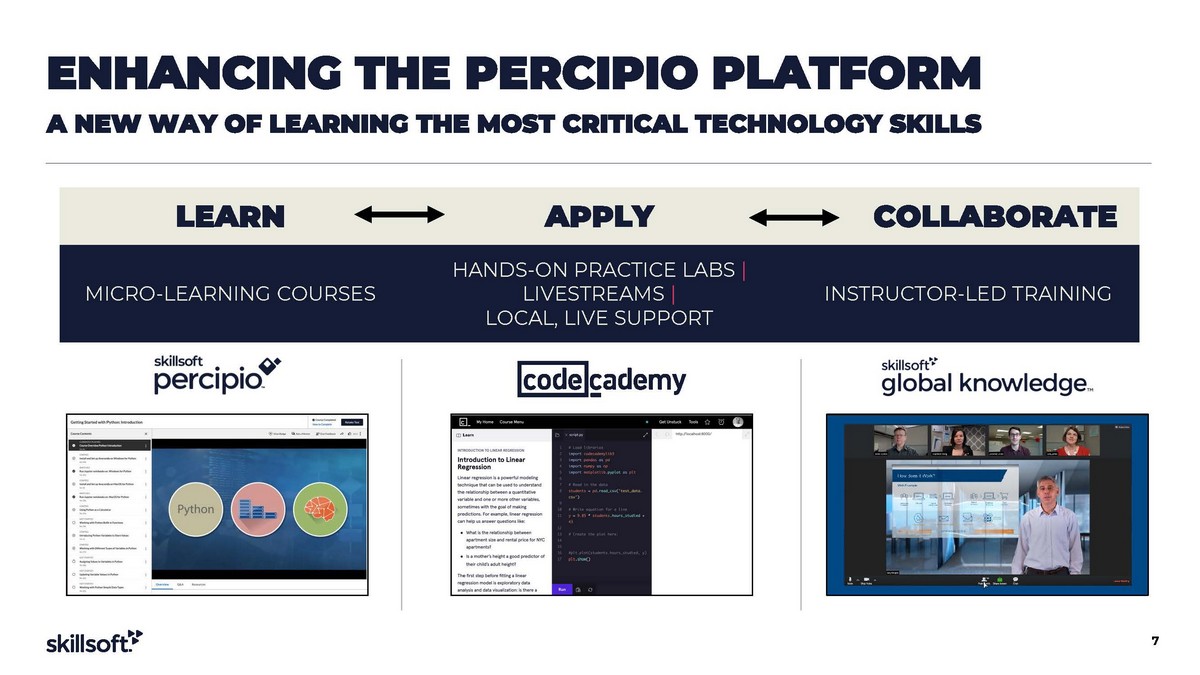

| · | Expands Immersive Platform with New Ways of Learning. Skillsoft has already assembled an expansive set of learning options, including virtual instructor-led training, coaching, micro videos, audio, books, bootcamps, live events, assessments and badges. Together with Codecademy’s interactive, self-paced courses and hands-on learning, Skillsoft will be able to deliver even more immersive experiences through its AI-driven platform, Percipio. |

| 1 |

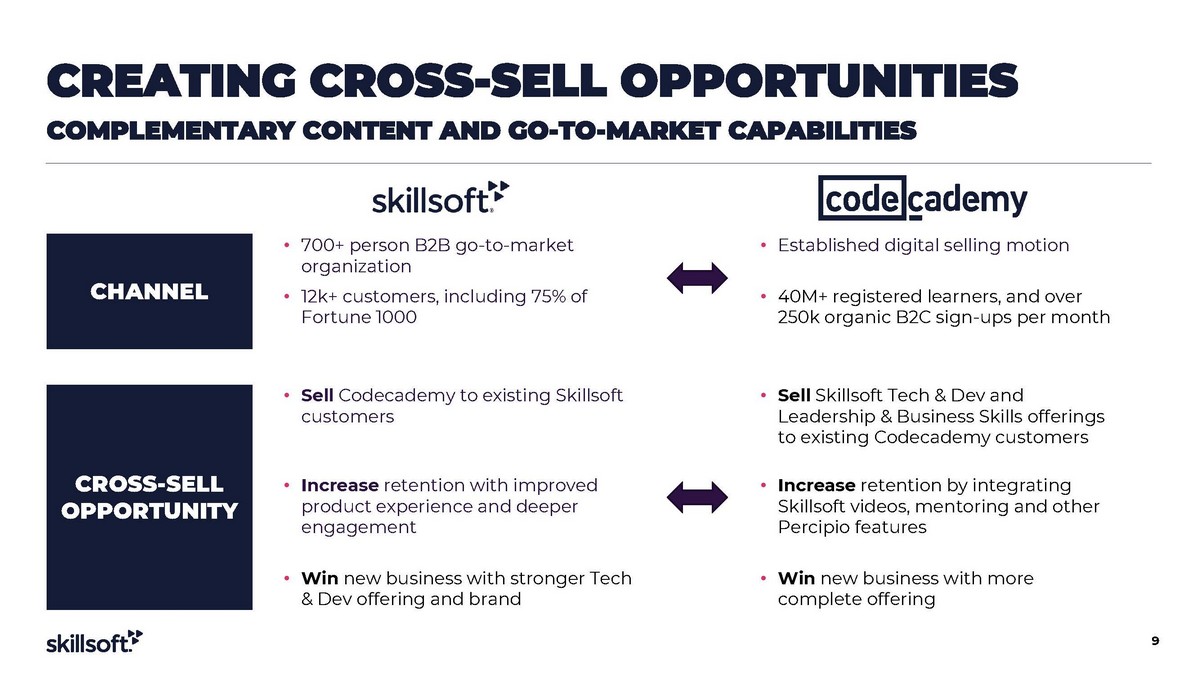

| · | Creates Substantial Cross-Selling and Upselling Opportunities by Adding a Strong Brand and Powerful Digital Sales and Marketing Engine to Global Enterprise Sales Force. The acquisition will bring together Codecademy’s sophisticated direct-to-learner digital sales and marketing engine and Skillsoft’s enterprise sales organization, creating new opportunities to upsell and cross-sell across each company’s customer base, which is expected to drive customer growth and revenue synergies. |

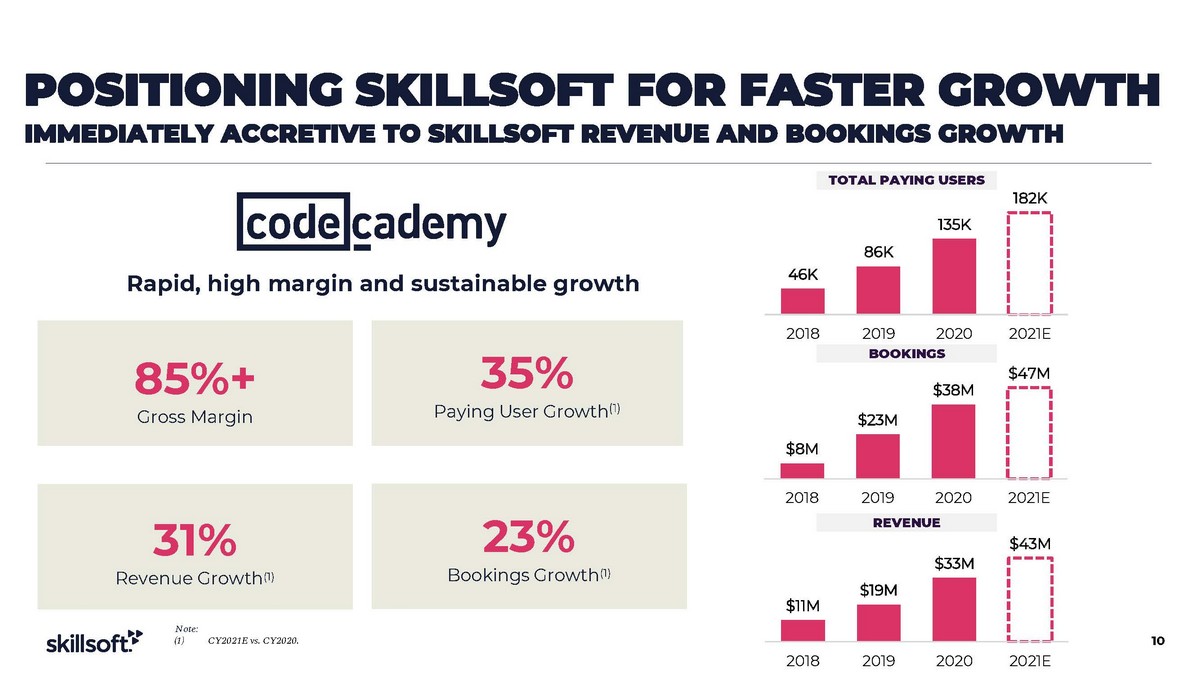

| · | Expected to Be Significantly Accretive to Bookings and Revenue Growth Immediately Upon Closing. Codecademy is expected to deliver approximately $47 million in bookings and approximately $42 million in revenue for the calendar year ended December 31, 2021, up 23% and 31%, respectively, over the prior year. Codecademy is entirely a SaaS business and is expected to deliver gross margins of more than 85% in 2021 and be accretive to Skillsoft’s gross margin immediately upon closing. Codecademy is investing to fuel growth and, accordingly, is expected to generate negative EBITDA of approximately $20 million in 2021. Skillsoft expects it will accelerate Codecademy’s growth in its first year of ownership and that the acquisition will be accretive to EBITDA over the long term. |

Transaction Details

Under the terms of the agreement, which has been approved by the boards of directors of both companies, Codecademy shareholders will receive total consideration of approximately $525 million. The consideration for the transaction is approximately 40% cash and 60% equity. In connection with the transaction, Skillsoft has secured committed financing from Barclays and Citigroup. The Company expects pro-forma net leverage at closing to be approximately 4x, consistent with Skillsoft’s previous statements regarding leverage following a transformative acquisition.

The transaction is expected to close in the first half of 2022, subject to approval by Skillsoft shareholders, the satisfaction of customary closing conditions and the receipt of regulatory approvals, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Fiscal Year 2023 Outlook

Skillsoft reiterates its full year fiscal 2022 outlook provided on December 14, 2021, with bookings in the range of $700 million to $720 million; adjusted revenue in the range of $685 million to $700 million; and adjusted EBITDA of approximately $165 million. The Company will provide fiscal 2023 outlook, pro forma for the acquisition, when it reports its fourth quarter and full year 2022 results.

Conference Call and Webcast

Skillsoft will host a conference call and webcast today at 8:30 a.m. Eastern Time to discuss the transaction. To access the conference call, dial (877) 413-9278 from the United States and Canada or (215) 268-9914 from international locations. The live webcast can be accessed from the Investor Relations page of Skillsoft’s website at investor.skillsoft.com, and a replay will be available for six months.

Advisors

Barclays is serving as the exclusive financial advisor to Skillsoft, Citigroup is serving as capital markets advisor and Weil, Gotshal & Manges LLP is serving as legal counsel to Skillsoft.

| 2 |

About Codecademy

Codecademy is a leading online learning platform for technical skills, empowering approximately 40 million people worldwide to lead inspiring careers in technology. Codecademy’s innovative, scalable approach to online coding education makes it possible for anyone to master the skills needed to succeed in our tech-enabled workforce. Since 2011, learners from more than 150 countries have accessed Codecademy’s extensive course offerings on web development, data science, cybersecurity, and more, as well as in-demand programming languages like Python, CSS, and JavaScript. In addition to helping individuals unlock the full power of technology, Codecademy for Business supports companies like General Motors and Kayak as they train and upskill their teams for the future. Codecademy is headquartered in New York City.

About Skillsoft

Skillsoft (NYSE:SKIL) is a global leader in corporate digital learning, focused on transforming today’s workforce for tomorrow’s economy. The Company provides enterprise learning solutions designed to prepare organizations for the future of work, overcome critical skill gaps, drive demonstrable behavior-change, and unlock the potential in their people. Skillsoft offers a comprehensive suite of premium, original, and authorized partner content, including one of the broadest and deepest libraries of leadership & business skills, technology & developer, and compliance curricula. With access to a broad spectrum of learning options (including video, audio, books, bootcamps, live events, and practice labs), organizations can meaningfully increase learner engagement and retention. Skillsoft’s offerings are delivered through Percipio, its award-winning, AI-driven, immersive learning platform purpose built to make learning easier, more accessible, and more effective. Learn more at www.skillsoft.com.

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the proposed acquisition of Codecademy by the Company. This communication does not constitute a solicitation of any vote or approval. In connection with the proposed transaction, the Company plans to file with the Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its shareholders a proxy statement regarding the proposed transaction. The Company may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the proposed transaction or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Company’s proxy statement. Shareholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at https://investor.skillsoft.com/ copies of materials it files with, or furnishes to, the SEC.

No Offer or Solicitation

This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Report on Form 8-K and Form 8-K/A filed on June 17, 2021. To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s Form 8-K filed on June 17, 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to the proposed transaction when it is filed with the SEC. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the investor relations page of the Company’s website at https://investor.skillsoft.com/.

| 3 |

Forward-Looking Statements

This press release includes statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations, the timing and occurrence of the closing of the transaction, and the anticipated transaction benefits. All statements, other than statements of historical facts, that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook (including books, adjusted revenue and adjusted EBITDA), our product development and planning, our pipeline, future capital expenditures, financial results, the impact of regulatory changes, existing and evolving business strategies and acquisitions and dispositions, demand for our services and competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, our ability to successfully implement our plans, strategies, objectives, expectations and intentions are forward-looking statements. Also, when we use words such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,” “target,” goals,” “probably,” or similar expressions, we are making forward-looking statements. Such statements are based upon the current beliefs and expectations of Skillsoft’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. All forward-looking disclosure is speculative by its nature.

There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward-looking statements contained in this press release, including:

| · | the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; |

| · | the impact of the ongoing COVID-19 pandemic (including any variant) on our business, operating results and financial condition; |

| · | fluctuations in our future operating results; |

| · | our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition; |

| · | the demand for, and acceptance of, our products and for cloud-based technology learning solutions in general; |

| · | our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate; |

| · | our ability to market existing products and develop new products; |

| · | a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage; |

| · | future regulatory, judicial and legislative changes in our industry; |

| · | our ability to comply with laws and regulations applicable to our business; |

| · | the impact of natural disasters, public health crises, political crises, or other catastrophic events; |

| · | our ability to attract and retain key employees and qualified technical and sales personnel; |

| · | fluctuations in foreign currency exchange rates; |

| · | our ability to protect or obtain intellectual property rights; |

| · | our ability to raise additional capital; |

| · | the impact of our indebtedness on our financial position and operating flexibility; |

| 4 |

| · | our ability to meet future liquidity requirements and comply with restrictive covenants related to long-term indebtedness; |

| · | our ability to successfully defend ourselves in legal proceedings; and |

| · | our ability to continue to meet applicable listing standards. |

Additional factors that may cause actual results to differ materially from any forward-looking statements regarding the transaction between Skillsoft and Codecademy include, but are not limited to:

| · | our ability to timely satisfy the conditions to the closing of the transaction contemplated in the definitive agreement; |

| · | occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement; |

| · | the possibility that the consummation of the acquisition is delayed or does not occur, including the failure to obtain stockholder approval of the transaction; |

| · | our ability to realize the benefits from the acquisition; |

| · | our ability to effectively and timely incorporate the acquired business into our business operations; |

| · | risks that the acquisition and other transactions contemplated by the definitive agreement disrupt current plans and operations that may harm the parties’ current businesses; and |

| · | the amount of any costs, fees, expenses, impairments and charges related to the acquisition; and |

| · | uncertainty as to the effects of the announcement or pendency of the acquisition on the market price of the Company’s common stock and/or on the parties’ financial performance. |

The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results. For more information, please see the risk factors included in the Company’s Amendment no. 1 to its Registration Statement on Form S-1 declared effective by the SEC on July 29, 2021, and subsequent filings with the SEC.

Although we believe that the assumptions underlying our forward-looking statements are reasonable, any of these assumptions, and therefore also the forward-looking statements based on these assumptions, could themselves prove to be inaccurate. Given the significant uncertainties inherent in the forward-looking statements included in this press release, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this press release or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above.

Our forward-looking statements speak only as of the date made and we will not update these forward-looking statements unless required by applicable law. With regard to these risks, uncertainties and assumptions, the forward-looking events discussed in this press release may not occur, and we caution you against unduly relying on these forward-looking statements.

Investors

James Gruskin

james.gruskin@skillsoft.com

Media

Caitlin Leddy

caitlin.leddy@skillsoft.com

| 5 |

Exhibit 99.2

DECEMBER 2021 INVESTOR PRESENTATION

2 DISCLAIMER Additional Information and Where to Find It This communication may be deemed solicitation material in respect of the proposed acquisition of Codecademy by the Company . This communication does not constitute a solicitation of any vote or approval . In connection with the proposed transaction, the Company plans to file with the Securities and Exchange Commission (the “ SEC ”) and mail or otherwise provide to its shareholders a proxy statement regarding the proposed transaction . The Company may also file other documents with the SEC regarding the proposed transaction . This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC . BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE PROPOSED TRANSACTION BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION . Any vote in respect of resolutions to be proposed at the Company’s stockholder meeting to approve the proposed transaction or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Company’s proxy statement . Shareholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www . sec . gov . The Company makes available free of charge on its investor relations website at https : //investor . skillsoft . com/ copies of materials it files with, or furnishes to, the SEC . No Offer or Solicitation This communication is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law . Participants in the Solicitation The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the proposed transaction . Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Report on Form 8 - K and Form 8 - K/A filed on June 17 , 2021 . To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s Form 8 - K filed on June 17 , 2021 , such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC . Additional information regarding the interests of such individuals in the proposed transaction will be included in the proxy statement relating to the proposed transaction when it is filed with the SEC . These documents (when available) may be obtained free of charge from the SEC’s website at www . sec . gov and the investor relations page of the Company’s website at https : //investor . skillsoft . com/ .

DISCLAIMER (CONTINUED) 3 Forward Looking Statements This document includes statements that are, or may be deemed to be, “forward - looking statements” within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended, which are intended to be covered by the safe harbors created by those laws . These forward - looking statements include information about possible or assumed future results of our operations, the timing and occurrence of the closing of the transaction, and the anticipated transaction benefits . All statements, other than statements of historical facts, that address activities, events or developments that we expect or anticipate may occur in the future, including such things as our outlook, our product development and planning, our pipeline, future capital expenditures, financial results, the impact of regulatory changes, existing and evolving business strategies and acquisitions and dispositions, demand for our services and competitive strengths, goals, the benefits of new initiatives, growth of our business and operations, our ability to successfully implement our plans, strategies, objectives, expectations and intentions are forward - looking statements . Also, when we use words such as “may,” “will,” “would,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “projects,” “forecasts,” “seeks,” “outlook,” “target,” goals,” “probably,” or similar expressions, we are making forward - looking statements . Such statements are based upon the current beliefs and expectations of Skillsoft’s management and are subject to significant risks and uncertainties . Actual results may differ from those set forth in the forward - looking statements . All forward - looking disclosure is speculative by its nature . There are important risks, uncertainties, events and factors that could cause our actual results or performance to differ materially from those in the forward - looking statements contained in this document, including : the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability ; the impact of the ongoing COVID - 19 pandemic (including any variant) on our business, operating results and financial condition ; fluctuations in our future operating results ; our ability to successfully identify, consummate and achieve strategic objectives in connection with our acquisition opportunities and realize the benefits expected from the acquisition ; the demand for, and acceptance of, our products and for cloud - based technology learning solutions in general ; our ability to compete successfully in competitive markets and changes in the competitive environment in our industry and the markets in which we operate ; our ability to market existing products and develop new products ; a failure of our information technology infrastructure or any significant breach of security, including in relation to the migration of our key platforms from our systems to cloud storage ; future regulatory, judicial and legislative changes in our industry ; our ability to comply with laws and regulations applicable to our business ; the impact of natural disasters, public health crises, political crises, or other catastrophic events ; our ability to attract and retain key employees and qualified technical and sales personnel ; fluctuations in foreign currency exchange rates ; our ability to protect or obtain intellectual property rights ; our ability to raise additional capital ; the impact of our indebtedness on our financial position and operating flexibility ; our ability to meet future liquidity requirements and comply with restrictive covenants related to long - term indebtedness ; our ability to successfully defend ourselves in legal proceedings ; and our ability to continue to meet applicable listing standards . Additional factors that may cause actual results to differ materially from any forward - looking statements regarding the transaction between Skillsoft and Codecademy include, but are not limited to : our ability to timely satisfy the conditions to the closing of the transaction contemplated in the definitive agreement ; occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement ; the possibility that the consummation of the acquisition is delayed or does not occur, including the failure to obtain stockholder approval of the transaction ; our ability to realize the benefits from the acquisition ; our ability to effectively and timely incorporate the acquired business into our business operations ; risks that the acquisition and other transactions contemplated by the definitive agreement disrupt current plans and operations that may harm the parties’ current businesses ; and the amount of any costs, fees, expenses, impairments and charges related to the acquisition ; and uncertainty as to the effects of the announcement or pendency of the acquisition on the market price of the Company’s common stock and/or on the parties’ respective financial performance . The foregoing list of factors is not exhaustive and new factors may emerge from time to time that could also affect actual performance and results . For more information, please see the risk factors included in the Company’s Amendment no . 1 to its Registration Statement on Form S - 1 declared effective by the SEC on July 29 , 2021 , and subsequent filings with the SEC . Although we believe that the assumptions underlying our forward - looking statements are reasonable, any of these assumptions, and therefore also the forward - looking statements based on these assumptions, could themselves prove to be inaccurate . Given the significant uncertainties inherent in the forward - looking statements included in this document, our inclusion of this information is not a representation or guarantee by us that our objectives and plans will be achieved . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results . Additionally, statements as to market share, industry data and our market position are based on the most currently available data available to us and our estimates regarding market position or other industry data included in this document or otherwise discussed by us involve risks and uncertainties and are subject to change based on various factors, including as set forth above . Our forward - looking statements speak only as of the date made and we will not update these forward - looking statements unless required by applicable law . With regard to these risks, uncertainties and assumptions, the forward - looking events discussed in this document may not occur, and we caution you against unduly relying on these forward - looking statements .

Extending Our Content Offering Across Critical Technologies Enhancing The Percipio Platform With New Learning Capabilities Broadening Our Reach Creating Significant Cross - Sell Opportunities Positioning Skillsoft For Faster Growth # 1 4 FASTEST GROWING SEGMENT IN DIGITAL LEARNING #2 #3 #4 #5 CREATING A LEADER IN TECH & DEV

TRANSACTION OVERVIEW KEY TERMS & STRUCTURE • Acquisition of 100% of Codecademy for $525 million • Overall transaction consideration mix approximately 60% stock / 40% cash FINANCING & CLOSING • Cash consideration to be financed through a combination of existing balance sheet liquidity and incremental term loan • Expect pro forma combined net leverage of approximately 4x at closing • Expected close in 1H 2022, subject to customary closing conditions including regulatory approvals and Skillsoft shareholder vote MANAGEMENT & GOVERNANCE • Codecademy co - founder / CEO Zach Sims joining as Head of Skillsoft Tech & Dev • Lock ups for Codecademy shareholders receiving Skillsoft shares range from 6 months to 2 years 5

DATA PROGRAMMING • Data Science • Artificial Intelligence + Machine Learning • Data Visualization • Data Literacy • DevOps • Full Stack • Mobile • Web Development CLOUD SECURITY • Cloud Transformation • Hybrid/Multi - cloud • Cloud Architecture • Cloud Development • Pen Testing • Incident Response • Data Loss Prevention • Governance, Risk and Compliance EXTENDING OUR CONTENT OFFERING 6 STRENGTHS IN SEGMENTS THAT ACCOUNT FOR 75% OF TECH & DEV MARKET +

LEARN APPLY COLLABORATE MICRO - LEARNING COURSES HANDS - ON PRACTICE LABS | LIVESTREAMS | LOCAL, LIVE SUPPORT INSTRUCTOR - LED TRAINING ENHANCING THE PERCIPIO PLATFORM 7 A NEW WAY OF LEARNING THE MOST CRITICAL TECHNOLOGY SKILLS

BROADENING OUR REACH 8 SKILLSOFT CODECADEMY COMBINED LEARNERS 46M + 40M + 86M+ B2B CUSTOMERS 12k+ ~660 ~13k B2C CUSTOMERS NM ~179k ~179k SALES ORGANIZATION (1) 700+ <20 720+ + + + + = = = = NEARLY DOUBLES REGISTERED LEARNERS | COMPLEMENTARY CUSTOMER BASES Note: (1) Total headcount.

• 700+ person B2B go - to - market organization • Established digital selling motion • 12k+ customers, including 75% of Fortune 1000 • 40M+ registered learners, and over 250k organic B2C sign - ups per month • Sell Codecademy to existing Skillsoft customers • Sell Skillsoft Tech & Dev and Leadership & Business Skills offerings to existing Codecademy customers • Increase retention with improved product experience and deeper engagement • Increase retention by integrating Skillsoft videos, mentoring and other Percipio features • Win new business with stronger Tech & Dev offering and brand • Win new business with more complete offering CREATING CROSS - SELL OPPORTUNITIES 9 COMPLEMENTARY CONTENT AND GO - TO - MARKET CAPABILITIES CHANNEL CROSS - SELL OPPORTUNITY

$11M $19M $33M $43M 2018 2019 2020 2021E POSITIONING SKILLSOFT FOR FASTER GROWTH 10 $8M $23M $38M $47M 2018 2019 2020 2021E 46K 86K 135K 182K 2018 2019 2020 2021E IMMEDIATELY ACCRETIVE TO SKILLSOFT REVENUE AND BOOKINGS GROWTH REVENUE BOOKINGS TOTAL PAYING USERS Note: (1) CY2021E vs. CY2020. 85%+ Gross Margin 35 % Paying User Growth (1) 31% Revenue Growth ( 1 ) 23 % Bookings Growth ( 1 ) Rapid, high margin and sustainable growth

Extending Our Content Offering Across Critical Technologies Enhancing The Percipio Platform With New Learning Capabilities Broadening Our Reach Creating Significant Cross - Sell Opportunities Positioning Skillsoft For Faster Growth # 1 11 FASTEST GROWING SEGMENT IN DIGITAL LEARNING #2 #3 #4 #5 CREATING A LEADER IN TECH & DEV

12 12 Thank You