Filed by Churchill Capital Corp II

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Churchill Capital Corp II

Commission File No. 001-38960

Date: October 13, 2020

CHURCHILL CAPITAL October 13, 2020 Investor Presentation

2 Disclaimer IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication is being made in respect of the proposed merger transaction involving Churchill II and Skillsoft. Churchil l I I intends to file a registration statement on Form S - 4 with the SEC, which will include a proxy statement of Churchill II and a prospectus of Churchill II, and Churchill II will file other documents regarding the proposed transaction with the SEC. A definitive proxy statement/prospectus will also be sent to the stockholders of Churchill II and Skillsoft, seeking any required stockholder approval. Before making any voting or investment decision, investors and security holders of Churchill I I a nd Skillsoft are urged to carefully read the entire registration statement and proxy statement/prospectus, when they become available, and any other relevant documents filed with the SEC, as well as any amendments or supplements to these docu men ts, because they will contain important information about the proposed transaction. The documents filed by Churchill II with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents file d b y Churchill II may be obtained free of charge from Churchill II at www.churchillcapitalcorp.com. Alternatively, these documents, when available, can be obtained free of charge from Churchill II upon written request to Churchill Capital Corp II , 6 40 Fifth Avenue, 12th Floor, New York, New York 10019, Attn: Secretary, or by calling (212) 380 - 7500. Churchill II, Skillsoft and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Churchill II, in favor of the approval of the merger. Information regarding Churchill II’s directors and executive officers is contained in Churchill II’s Annual Report on Form 10 K for the year ended Dec ember 31, 2019 and its Quarterly Report on Form 10 - Q for the quarterly periods ended March 31, 2020, and June 30, 2020, which are filed with the SEC. Additional information regarding the interests of those participants, the directors and e xec utive officers of Skillsoft and other persons who may be deemed participants in the transaction may be obtained by reading the registration statement and the proxy statement/prospectus and other relevant documents filed with the SEC when th ey become available. Free copies of these documents may be obtained as described in the preceding paragraph. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such other jurisd ict ion. FORWARD - LOOKING STATEMENTS This communication contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 199 5 including, but not limited to, Churchill’s, Skillsoft’s and Global Knowledge’s expectations or predictions of future financial or business performance or conditions. Forward - looking statements are inherently subject to risks, uncertainties and a ssumptions. Generally, statements that are not historical facts, including statements concerning our possible or assumed future actions, business strategies, events or results of operations, are forward - looking statements. These statements m ay be preceded by, followed by or include the words “believes,” “estimates,” “expects,” “projects,” “forecasts,” “may,” “will,” “should,” “seeks,” “plans,” “scheduled,” “anticipates” or “intends” or similar expressions. Such forward - looking stateme nts involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. Certain of these risks are identified and discussed in Churchill’s Form 10 - K for the year ended De cember 31, 2019 under Risk Factors in Part I, Item 1A. These risk factors will be important to consider in determining future results and should be reviewed in their entirety. These forward - looking statements are expressed in good faith, and Churc hill, Skillsoft and Global Knowledge believe there is a reasonable basis for them. However, there can be no assurance that the events, results or trends identified in these forward - looking statements will occur or be achieved. Forward - l ooking statements speak only as of the date they are made, and none of Churchill, Skillsoft or Global Knowledge is under any obligation, and expressly disclaim any obligation, to update, alter or otherwise revise any forward - looking statement, whether as a result of new information, future events or otherwise, except as required by law. Readers should carefully review the statements set forth in the reports, which Churchill has filed or will file from time to time with the S EC. In addition to factors previously disclosed in Churchill’s reports filed with the SEC and those identified elsewhere in this com munication, the following factors, among others, could cause actual results to differ materially from forward - looking statements or historical performance: ability to meet the closing conditions to the Skillsoft merger, including approval by s toc kholders of Churchill and Skillsoft, and the Global Knowledge merger on the expected terms and schedule and the risk that regulatory approvals required for the Skillsoft merger and the Global Knowledge merger are not obtained or are obtained sub ject to conditions that are not anticipated; delay in closing the Skillsoft merger and the Global Knowledge merger; failure to realize the benefits expected from the proposed transactions; the effects of pending and future legislation; risks re lated to disruption of management time from ongoing business operations due to the proposed transactions; business disruption following the transactions; risks related to the impact of the COVID - 19 pandemic on the financial condition and resul ts of operations of Churchill, Skillsoft and Global Knowledge; risks related to Churchill’s, Skillsoft’s or Global Knowledge’s indebtedness; other consequences associated with mergers, acquisitions and divestitures and legislative and regul ato ry actions and reforms; and risks of demand for, and acceptance of, our products and for cloud - based technology learning solutions in general; our ability to compete successfully in competitive markets and changes in the competitive envi ron ment in our industry and the markets in which we operate; our ability to develop new products; failure of our information technology infrastructure or any significant breach of security; future regulatory, judicial and legislative chan ges in our industry; the impact of natural disasters, public health crises, political crises, or other catastrophic events; our a bi lity to attract and retain key employees and qualified technical and sales personnel; fluctuations in foreign currency exchange ra tes ; our ability to protect or obtain intellectual property rights; our ability to raise additional capital; the impact of our indebtedness on our financial position and operating flexibility; and our ability to successfully defend ourselves in legal p roc eedings. Any financial projections in this communication are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Churchill’s, Skillsoft’s and Global Knowledge’s control. While all projections are necessarily speculative, Churchill, Skillsoft and Global Knowledge believe tha t t he preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection extends from the date of preparation. The assumptions and estimates underlying the projected results are inherentl y u ncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The inclusion of projections in th is communication should not be regarded as an indication that Churchill, Skillsoft and Global Knowledge, or their representatives, considered or consider the projections to be a reliable prediction of future events. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not ref lect actual results. This communication is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in Churchill and is not intended to form the basis of an investment decision in Churchill. All subsequent written and oral forward - looking statements concerning Churchill, Skillsoft and Global Knowledge, the proposed transactions or o ther matters and attributable to Churchill, Skillsoft and Global Knowledge or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

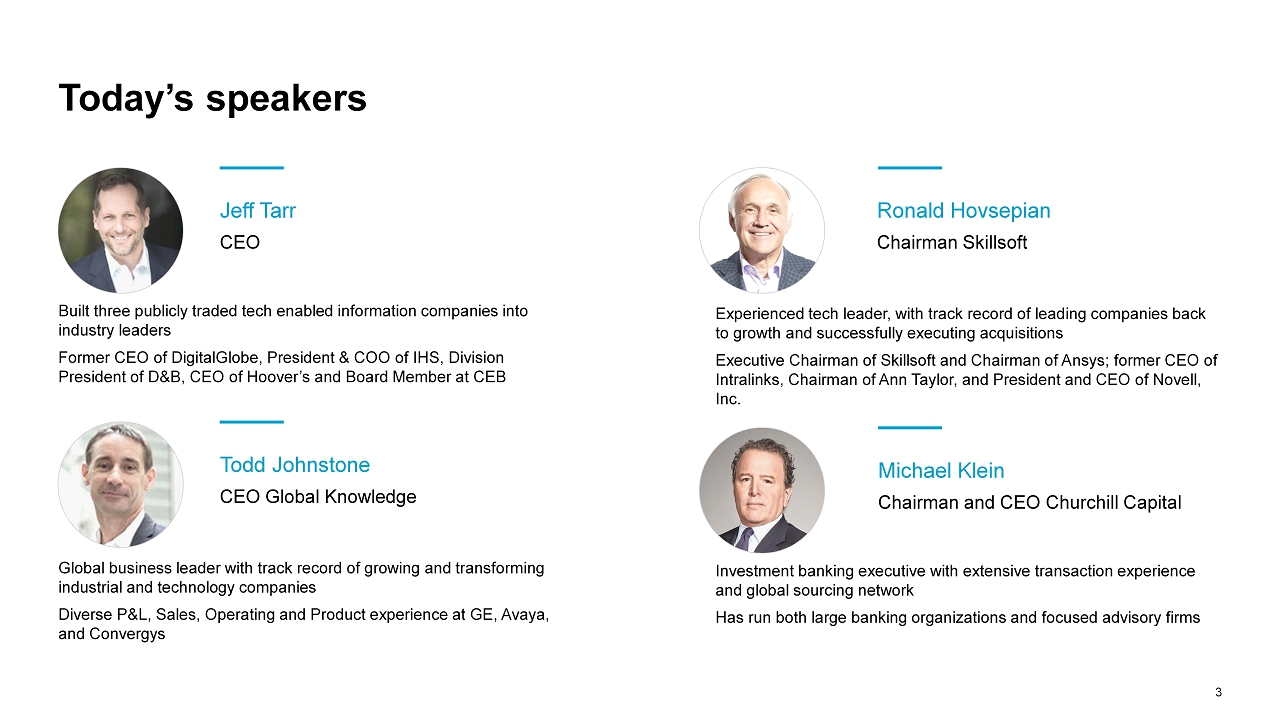

3 Today’s speakers Global business leader with track record of growing and transforming industrial and technology companies Diverse P&L, Sales, Operating and Product experience at GE, Avaya, and Convergys Todd Johnstone CEO Global Knowledge Jeff Tarr CEO Built three publicly traded tech enabled information companies into industry leaders Former CEO of DigitalGlobe , President & COO of IHS, Division President of D&B, CEO of Hoover’s and Board Member at CEB Investment banking executive with extensive transaction experience and global sourcing network Has run both large banking organizations and focused advisory firms Michael Klein Chairman and CEO Churchill Capital Experienced tech leader, with track record of leading companies back to growth and successfully executing acquisitions Executive Chairman of Skillsoft and Chairman of Ansys; former CEO of Intralinks, Chairman of Ann Taylor, and President and CEO of Novell, Inc. Ronald Hovsepian Chairman Skillsoft

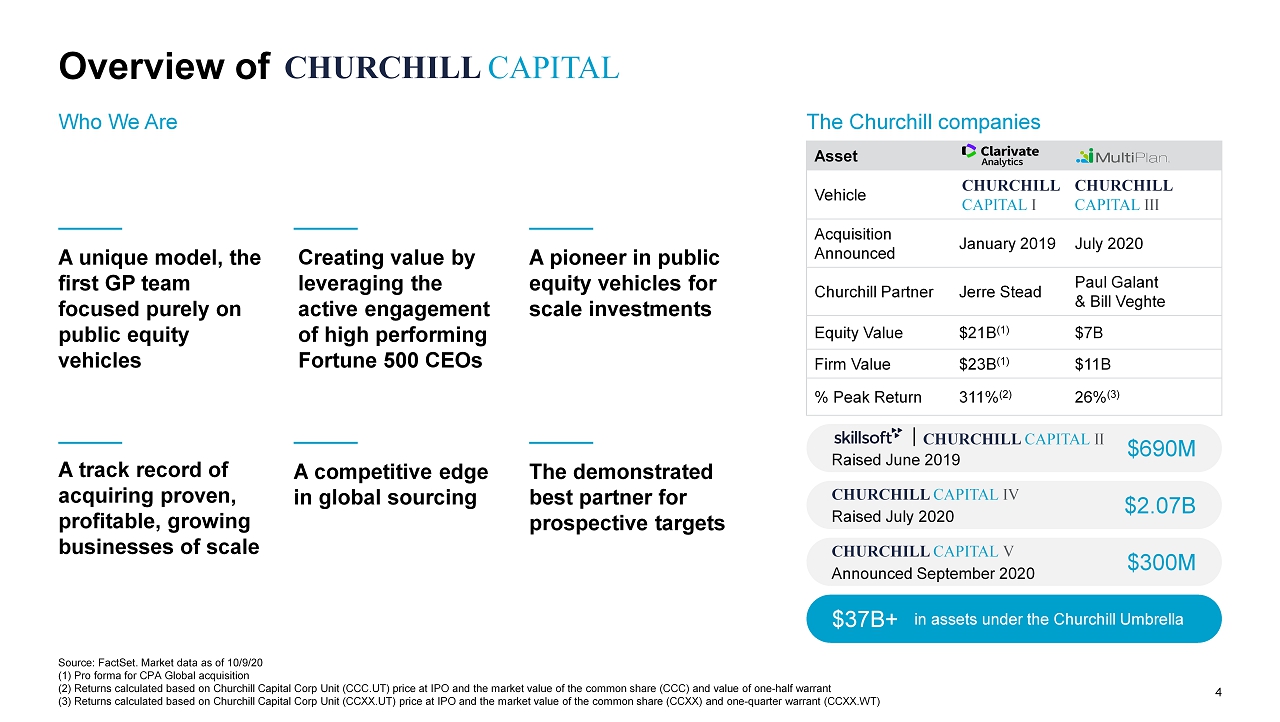

4 Overview of Asset Vehicle Acquisition Announced January 2019 July 2020 Churchill Partner Jerre Stead Paul Galant & Bill Veghte Equity Value $21B (1) $7B Firm Value $23B (1) $11B % Peak Return 311% (2) 26% (3) CHURCHILL CAPITAL III CHURCHILL CAPITAL I The Churchill companies Who We Are Source: FactSet. Market data as of 10/9/20 (1) Pro forma for CPA Global acquisition (2) Returns calculated based on Churchill Capital Corp Unit (CCC.UT) price at IPO and the market value of the common share (C CC) and value of one - half warrant (3) Returns calculated based on Churchill Capital Corp Unit (CCXX.UT) price at IPO and the market value of the common share ( CCX X) and one - quarter warrant (CCXX.WT) A unique model, the first GP team focused purely on public equity vehicles A pioneer in public equity vehicles for scale investments The demonstrated best partner for prospective targets Creating value by leveraging the active engagement of high performing Fortune 500 CEOs A track record of acquiring proven, profitable, growing businesses of scale A competitive edge in global sourcing $2.07B Raised July 2020 CHURCHILL CAPITAL IV $300M Announced September 2020 CHURCHILL CAPITAL V $690M Raised June 2019 CHURCHILL CAPITAL II $37B+ in assets under the Churchill Umbrella CHURCHILL CAPITAL

5 Introducing the new t he new is leading provider of comprehensive digital corporate learning content and tools world leader in IT and business skills training

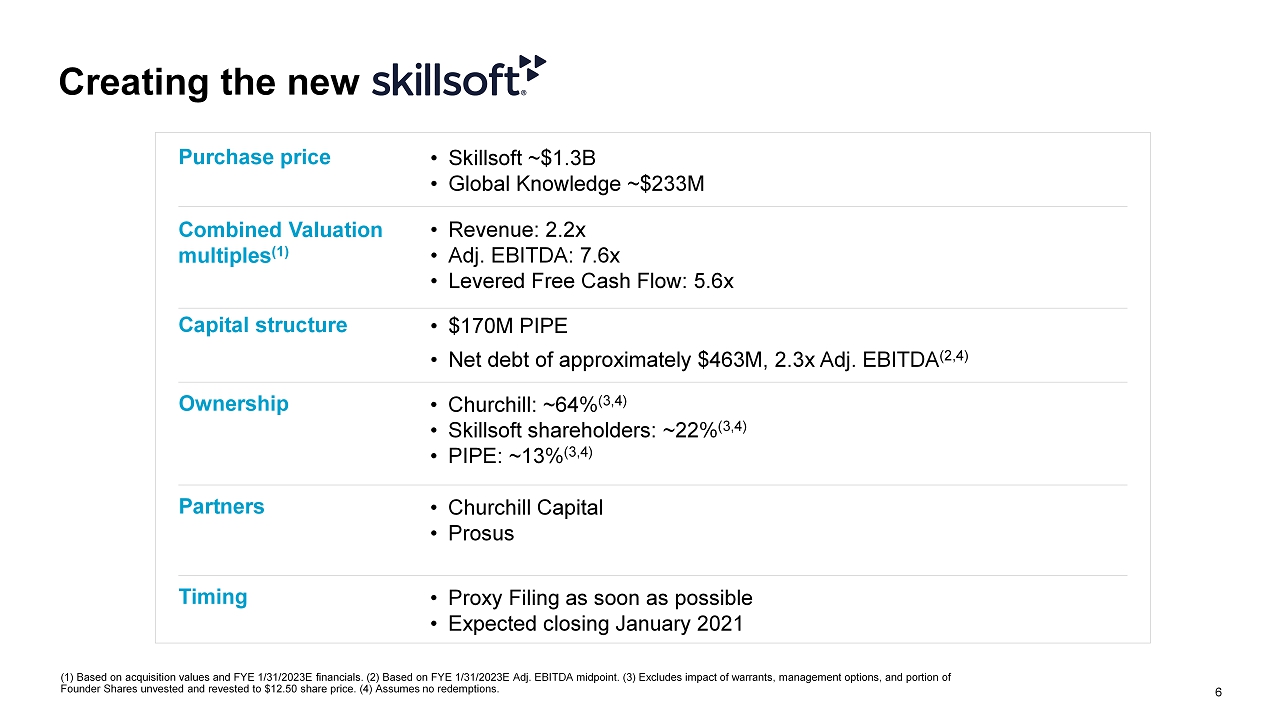

6 Creating the new Combined Valuation multiples (1) • Revenue: 2.2x • Adj. EBITDA: 7.6x • Levered Free Cash Flow: 5.6x Purchase price • Skillsoft ~$1.3B • Global Knowledge ~$233M Capital structure • $170M PIPE • Net debt of approximately $463M, 2.3x Adj. EBITDA (2,4) Ownership • Churchill: ~64% (3,4) • Skillsoft shareholders: ~22% (3,4) • PIPE: ~13% (3,4) Partners • Churchill Capital • Prosus Timing • Proxy Filing as soon as possible • Expected closing January 2021 (1) Based on acquisition values and FYE 1/31/2023E financials. (2) Based on FYE 1/31/2023E Adj. EBITDA midpoint. (3) Excludes im pact of warrants, management options, and portion of Founder Shares unvested and revested to $12.50 share price. (4) Assumes no redemptions.

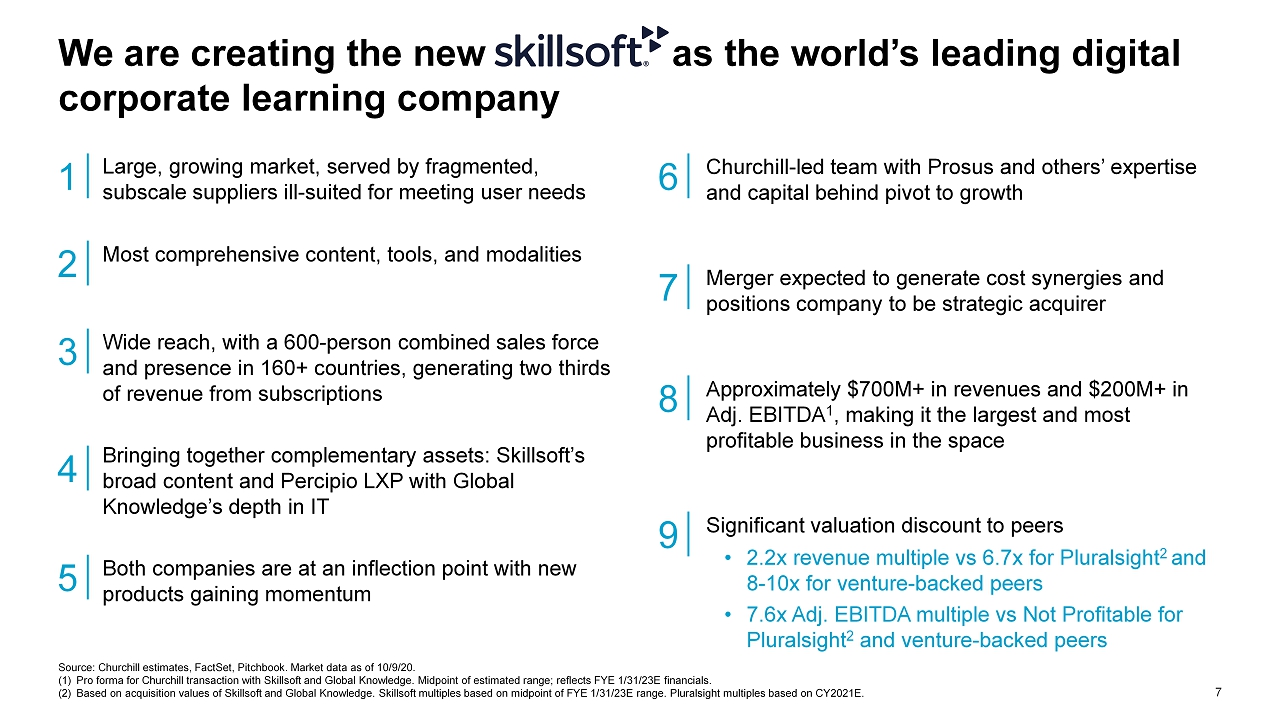

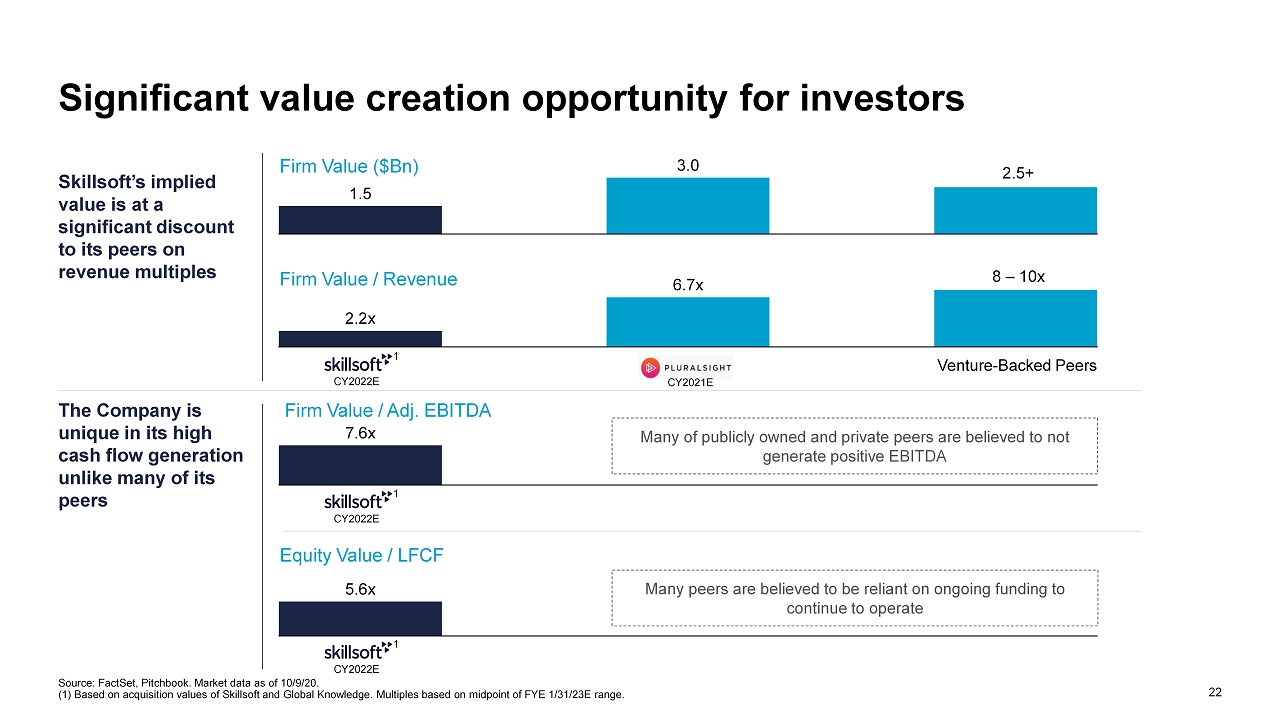

7 We are creating the new Skillsoft as the world’s leading digital corporate learning company Source: Churchill estimates, FactSet, Pitchbook. Market data as of 10/9/20. (1) Pro forma for Churchill transaction with Skillsoft and Global Knowledge. Midpoint of estimated range; reflects FYE 1/31/23E financials. (2) Based on acquisition values of Skillsoft and Global Knowledge. Skillsoft multiples based on midpoint of FYE 1/31/23E range. P lur alsight multiples based on CY2021E. Large, growing market, served by fragmented, subscale suppliers ill - suited for meeting user needs 1 Most comprehensive content, tools, and modalities 2 Wide reach, with a 600 - person combined sales force and presence in 160+ countries, generating two thirds of revenue from subscriptions 3 Bringing together complementary assets: Skillsoft’s broad content and Percipio LXP with Global Knowledge’s depth in IT 4 Both companies are at an inflection point with new products gaining momentum 5 Churchill - led team with Prosus and others’ expertise and capital behind pivot to growth 6 Merger expected to generate cost synergies and positions company to be strategic acquirer 7 Approximately $700M+ in revenues and $200M+ in Adj. EBITDA 1 , making it the largest and most profitable business in the space 8 Significant valuation discount to peers • 2.2x revenue multiple vs 6.7x for Pluralsight 2 and 8 - 10x for venture - backed peers • 7.6x Adj. EBITDA multiple vs Not Profitable for Pluralsight 2 and venture - backed peers 9

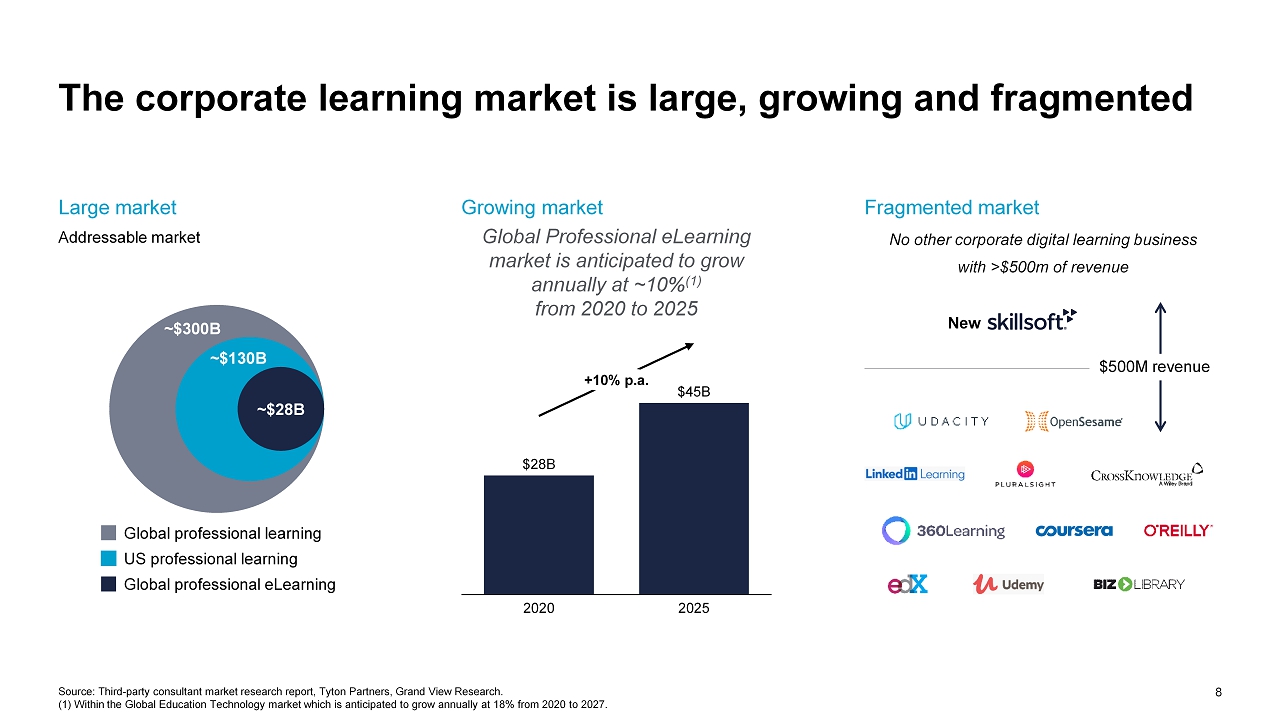

8 The corporate learning market is large, growing and fragmented No other corporate digital learning business with >$500m of revenue Large market Growing market Fragmented market Addressable market Source: Third - party consultant market research report, Tyton Partners, Grand View Research. (1) Within the Global Education Technology market which is anticipated to grow annually at 18% from 2020 to 2027. ~$28B ~$130B ~$300B Global professional eLearning US professional learning Global professional learning $500M revenue New Global Professional eLearning market is anticipated to grow annually at ~10% (1) from 2020 to 2025 2020 2025 $28B $45B +10% p.a.

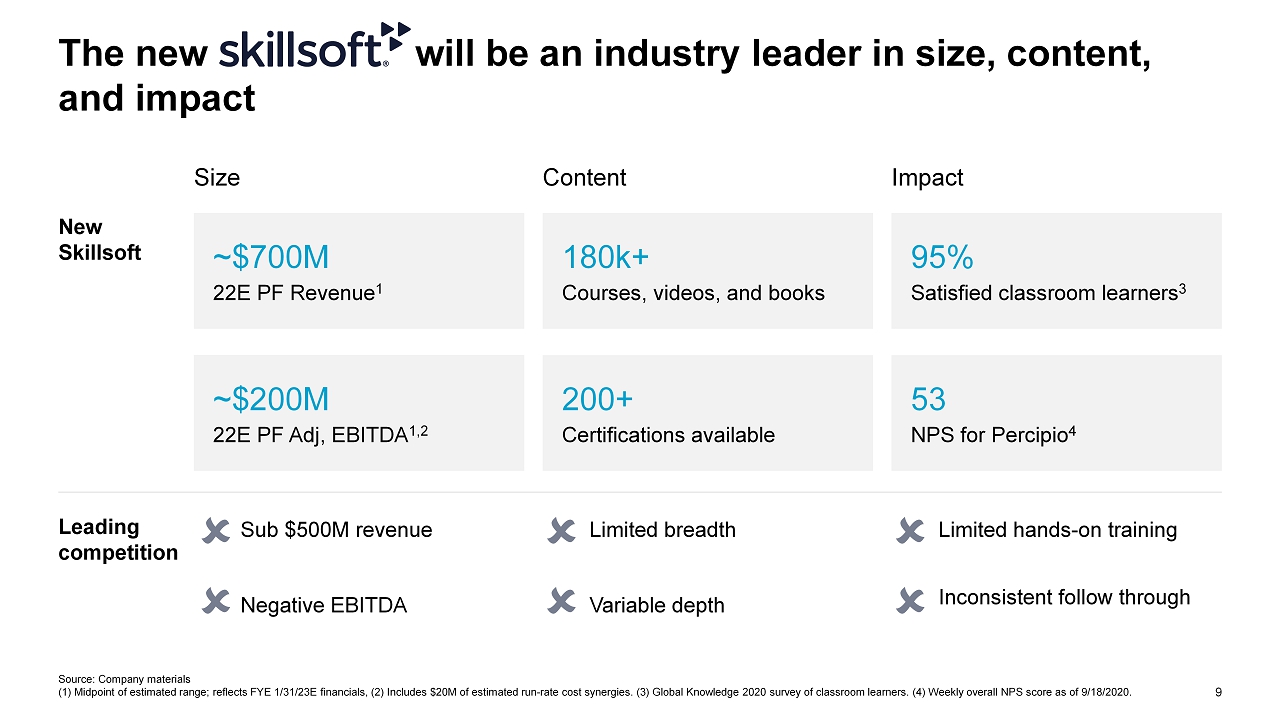

9 The new Skillsoft will be an industry leader in size, content, and impact Limited hands - on training Inconsistent follow through Sub $500M revenue Negative EBITDA Limited breadth Variable depth Impact Size Content ~ $700M 22E PF Revenue 1 ~$200M 22E PF Adj, EBITDA 1,2 53 NPS for Percipio 4 180k+ Courses, videos, and books 200 + Certifications available 95% Satisfied classroom learners 3 New Skillsoft Leading competition Source: Company materials (1) Midpoint of estimated range; reflects FYE 1/31/23E financials, (2) Includes $20M of estimated run - rate cost synergies. (3) G lobal Knowledge 2020 survey of classroom learners. (4) Weekly overall NPS score as of 9/18/2020.

10 The new Skillsoft will have expansive reach Sample of customers of combined company 160+ Countries worldwide >70% Of Fortune 1000 ~ 45M Learners worldwide ~600 Combined sales force 10 ~98 % Revenue from business customers

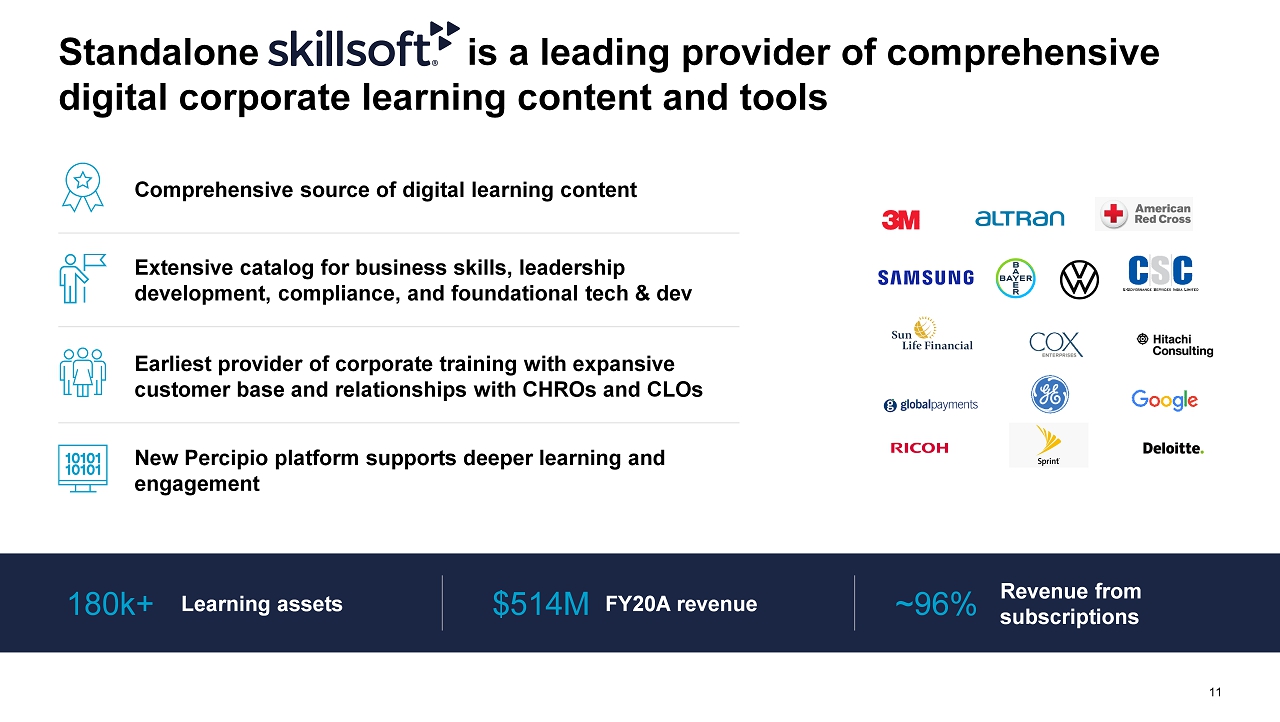

11 Standalone Skillsoft is a leading provider of comprehensive digital corporate learning content and tools Comprehensive source of digital learning content Earliest provider of corporate training with expansive customer base and relationships with CHROs and CLOs New Percipio platform supports deeper learning and engagement Learning assets 180k+ $514M FY20A revenue ~96% Revenue from subscriptions Extensive catalog for business skills, leadership development, compliance, and foundational tech & dev

12 Standalone Global Knowledge is a world leader in IT and business skills training Chosen IT trainer by most leading technology equipment and software suppliers Authorized and non - authorized content Hands - on, experiential learning led by expert instructors Available in the classroom, virtually, and on - demand (1) Global Knowledge 2020 survey of virtual classroom learners Direct to learner subscription Corporate subscription Virtual classroom courses On - demand courses 300+ 2,500+ Live virtual classroom courses 95 % 1 Customer satisfaction rate

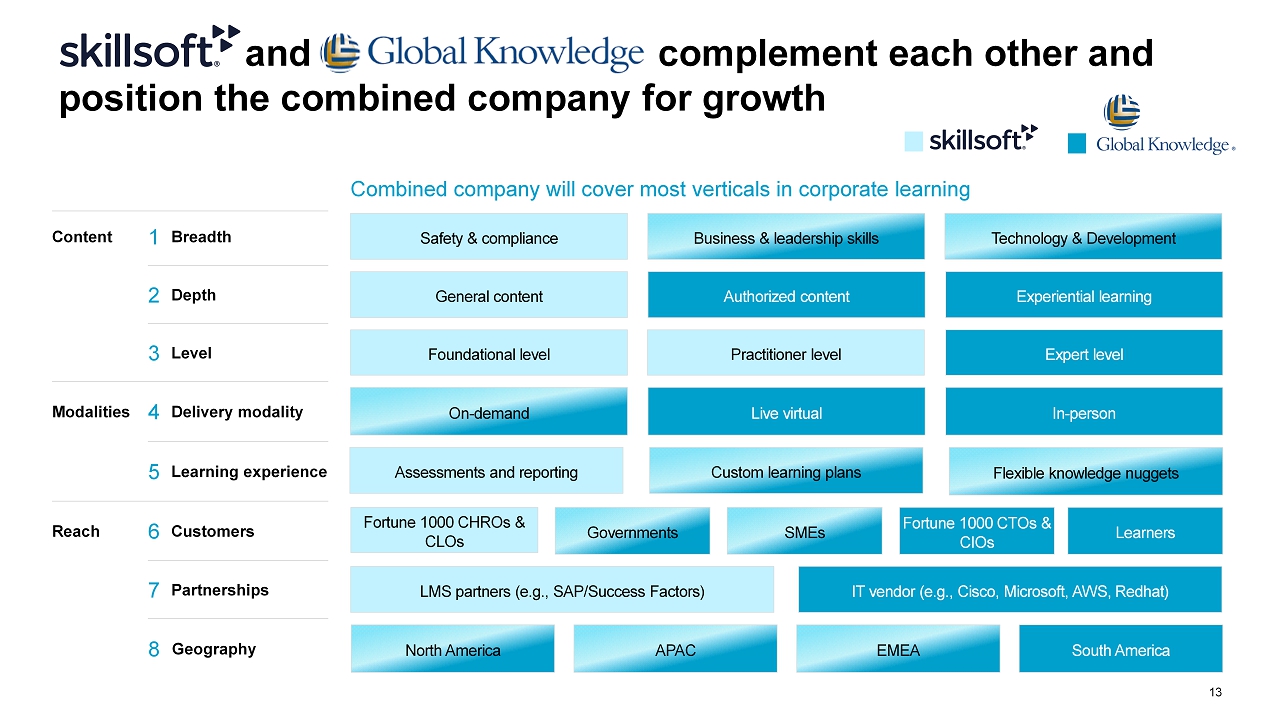

13 Skillsoft and Global Knowledge complement each other and position the combined company for growth Combined company will cover most verticals in corporate learning 8 Geography Content 1 Breadth 2 Depth 3 Level 7 Partnerships Modalities 4 Delivery modality 5 Learning experience Reach 6 Customers North America EMEA APAC Safety & compliance Technology & Development Business & leadership skills General content Foundational level Practitioner level LMS partners (e.g., SAP/Success Factors) On - demand Assessments and reporting Flexible knowledge nuggets Custom learning plans Fortune 1000 CHROs & CLOs SMEs Governments Fortune 1000 CHROs & CLOs SMEs Governments North America EMEA APAC Safety & compliance Technology & Development Business & leadership skills General content Foundational level Practitioner level LMS partners (e.g., SAP/Success Factors) On - demand Assessments and reporting Flexible knowledge nuggets Custom learning plans Authorized content Experiential learning Live virtual In - person Expert level IT vendor (e.g., Cisco, Microsoft, AWS, Redhat ) Fortune 1000 CTOs & CIOs Learners South America

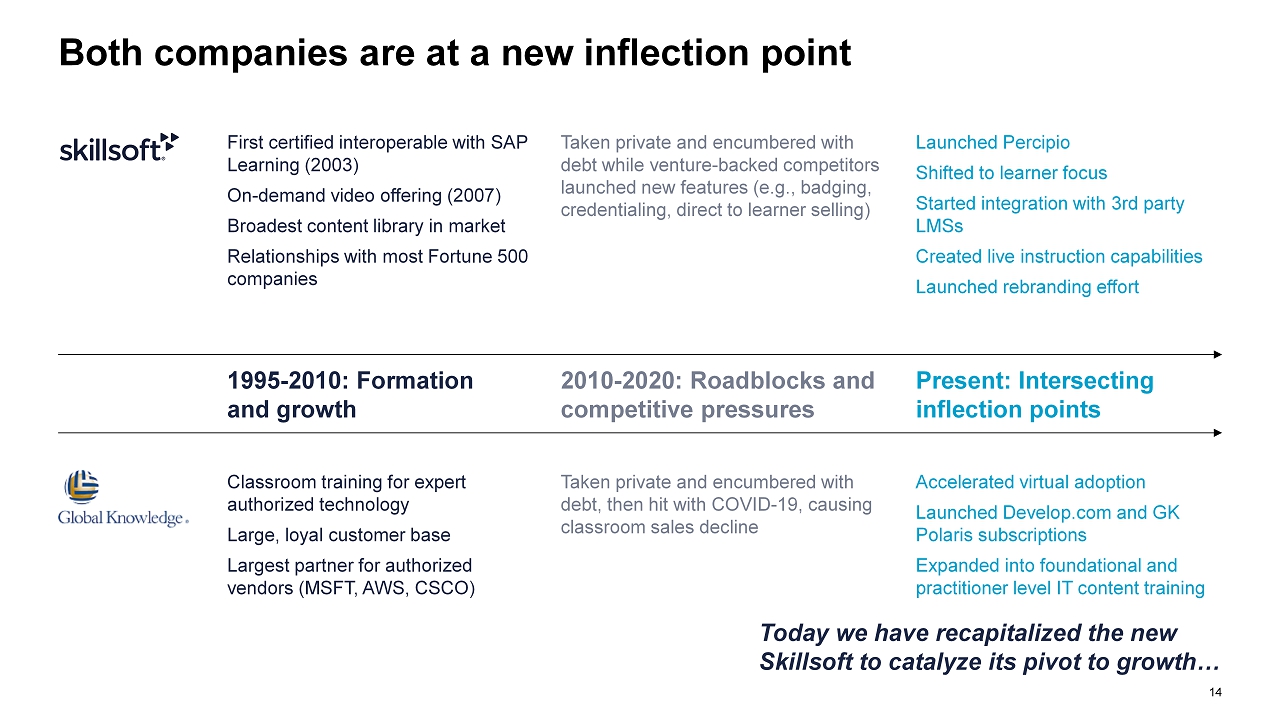

14 Both companies are at a new inflection point Present: Intersecting inflection points 2010 - 2020: Roadblocks and competitive pressures 1995 - 2010: Formation and growth Accelerated virtual adoption Launched Develop.com and GK Polaris subscriptions Expanded into foundational and practitioner level IT content training Taken private and encumbered with debt, then hit with COVID - 19, causing classroom sales decline Classroom training for expert authorized technology Large, loyal customer base Largest partner for authorized vendors (MSFT, AWS, CSCO) Launched Percipio Shifted to learner focus Started integration with 3rd party LMSs Created live instruction capabilities Launched rebranding effort Taken private and encumbered with debt while venture - backed competitors launched new features (e.g., badging, credentialing, direct to learner selling) First certified interoperable with SAP Learning (2003) On - demand video offering (2007) Broadest content library in market Relationships with most Fortune 500 companies Today we have recapitalized the new Skillsoft to catalyze its pivot to growth…

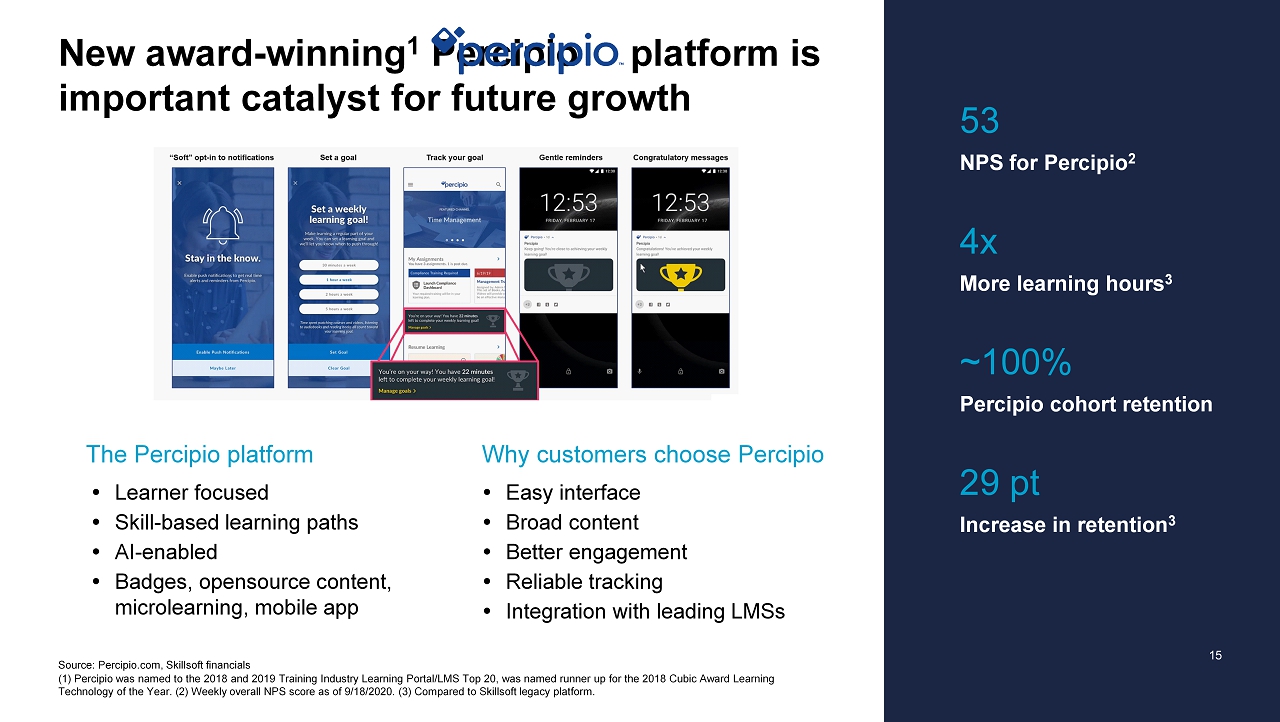

15 New award - winning 1 Percipio platform is important catalyst for future growth Source: Percipio.com, Skillsoft financials (1) Percipio was named to the 2018 and 2019 Training Industry Learning Portal/LMS Top 20, was named runner up for the 2018 Cubic Award Lea rn ing Technology of the Year. (2) Weekly overall NPS score as of 9/18/2020. (3) Compared to Skillsoft legacy platform. 29 pt Increase in retention 3 53 NPS for Percipio 2 4x More learning hours 3 15 Why customers choose Percipio Easy interface Broad content Better engagement Reliable tracking Integration with leading LMSs Learner focused Skill - based learning paths AI - enabled B adges , opensource content, microlearning, mobile app The Percipio platform ~100% Percipio c ohort retention

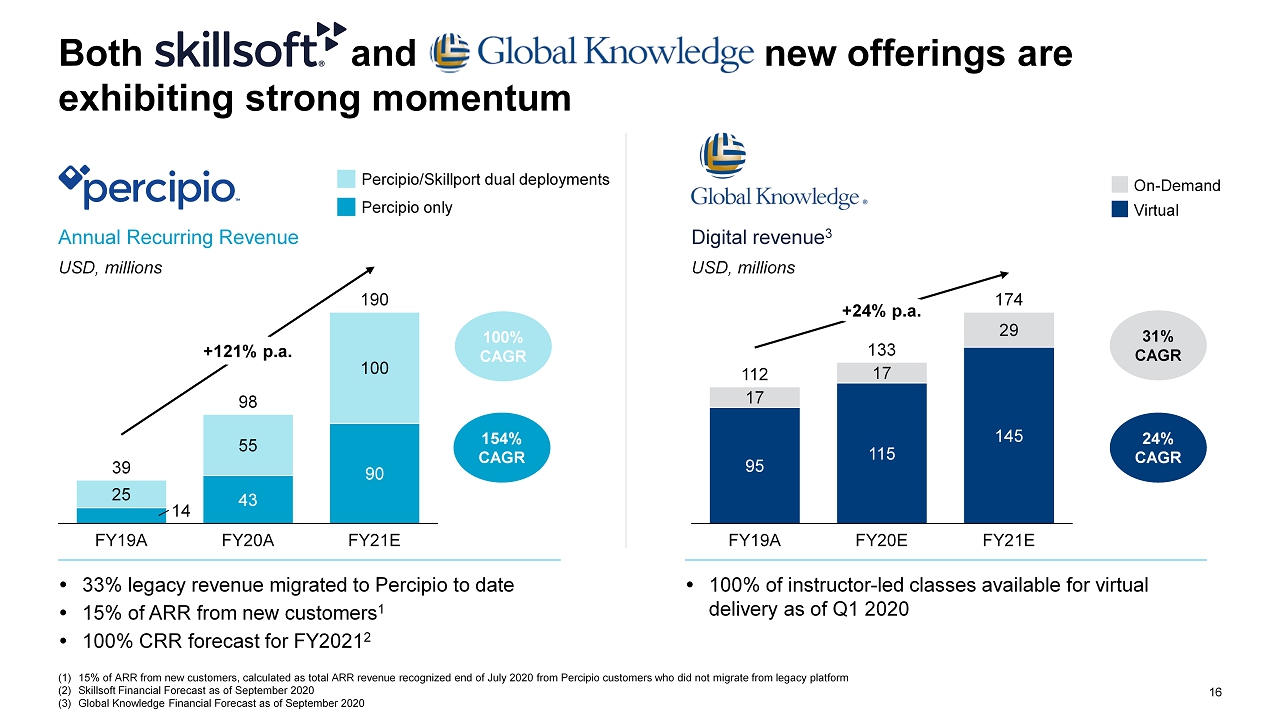

16 Both Skillsoft and Global Knowledge new offerings are exhibiting strong momentum 14 43 90 25 55 100 FY19A FY21E FY20A 190 39 98 +121% p.a. Annual Recurring Revenue USD, millions 95 115 145 17 17 29 FY21E 112 FY20E FY19A 133 174 +24% p.a. 33% legacy revenue migrated to Percipio to date 15% of ARR from new customers 1 100% CRR forecast for FY2021 2 100% of instructor - led classes available for virtual delivery as of Q1 2020 On - Demand Virtual 31% CAGR 24% CAGR Digital revenue 3 USD, millions 100% CAGR 154% CAGR (1) 15% of ARR from new customers, calculated as total ARR revenue recognized end of July 2020 from Percipio customers who did not migrate from legacy platform (2) Skillsoft Financial Forecast as of September 2020 (3) Global Knowledge Financial Forecast as of September 2020 Percipio only Percipio / Skillport dual deployments

17 Churchill - led investor group will accelerate the pivot to growth Partnership of Leading EdTech and Growth Investors Cash infusion supports investment in: Business optimization Mergers and acquisitions Product development and deployment Sales and marketing Talent and culture Contributing capital, expertise, and management talent Balance sheet restructuring repositions business (~$1B new equity invested and eliminating ~$1.5B debt and ~$1.0 sponsor equity) CHURCHILL CAPITAL +

18 Churchill strategy to transform the new Skillsoft Sales & marketing Complete sales transformation with staffing of customer acquisition teams Create integrated tech & dev sales team to cross - sell both companies’ offerings Increase marketing and product qualified lead generation Leverage digital selling tools and Global Knowledge e - commerce platform to engage learners directly Product development & deployment Accelerate Percipio migration with LMS integrations Integrate and expand tech & dev offerings Create multi - modal learning journeys with on - demand, virtual and classroom Continue to enhance tools, leveraging AI, adaptive learning, custom content development Invest in new content organically and through partnerships and M&A Mergers & acquisitions Expand corp dev team and leverage Churchill for opportunity sourcing Create capability to rapidly acquire and integrate tuck - ins Pursue large - scale, transformational opportunities Talent and culture Create high performance leadership team (best athlete) Transform culture, built upon an inspiring purpose, vision and values Attract and retain top talent at all levels using equity compensation where appropriate Business optimization Realize $20M+ in near - term cost synergies Leverage best cost locations Upgrade back office systems to realize efficiencies and integrate future acquisitions

19 Skillsoft will accelerate growth with strategic acquisitions New use cases Learning content & tools Platform capabilities P ositioned as the best acquirer with Percipio platform Balance sheet Size of salesforce Customer base More than 1000 venture - backed tuck - in acquisition targets with less than $100M in revenue

20 Financial Overview 7 – 10% Sector Growth Run - Rate Achieved During 2023 23 – 27% Short - Term Adj. EBITDA Margin 30 – 35% Target Long - Term Adj. EBITDA Margin 75 – 85% Long - Term LFCF Conversion 2.3x Net Leverage at Close 2,3 $ 185 M Minimum Cash on Balance Sheet 3 20 Key Metrics 66% Revenue from subscriptions Order intake ($M) Revenue ($M) EBITDA ($M) Levered free cash flow ($M) 660 - 690 710 - 760 675 - 725 645 - 675 155 - 175 180 - 220 CY2021 1 125 - 155 CY2022 1 65 - 95 (1) Reflects FYE January 31st financials (e.g., FYE 1/31/22 shown for CY2021). CY2021 includes $15mm of estimated cost synerg ies ; CY2022 includes $20mm of estimated cost synergies. (2) Based on FYE 1/31/2023E Adj. EBITDA midpoint. (3) Assumes no redemptions. 625 - 650 650 - 680 145 - 165 CY2020 1 NM

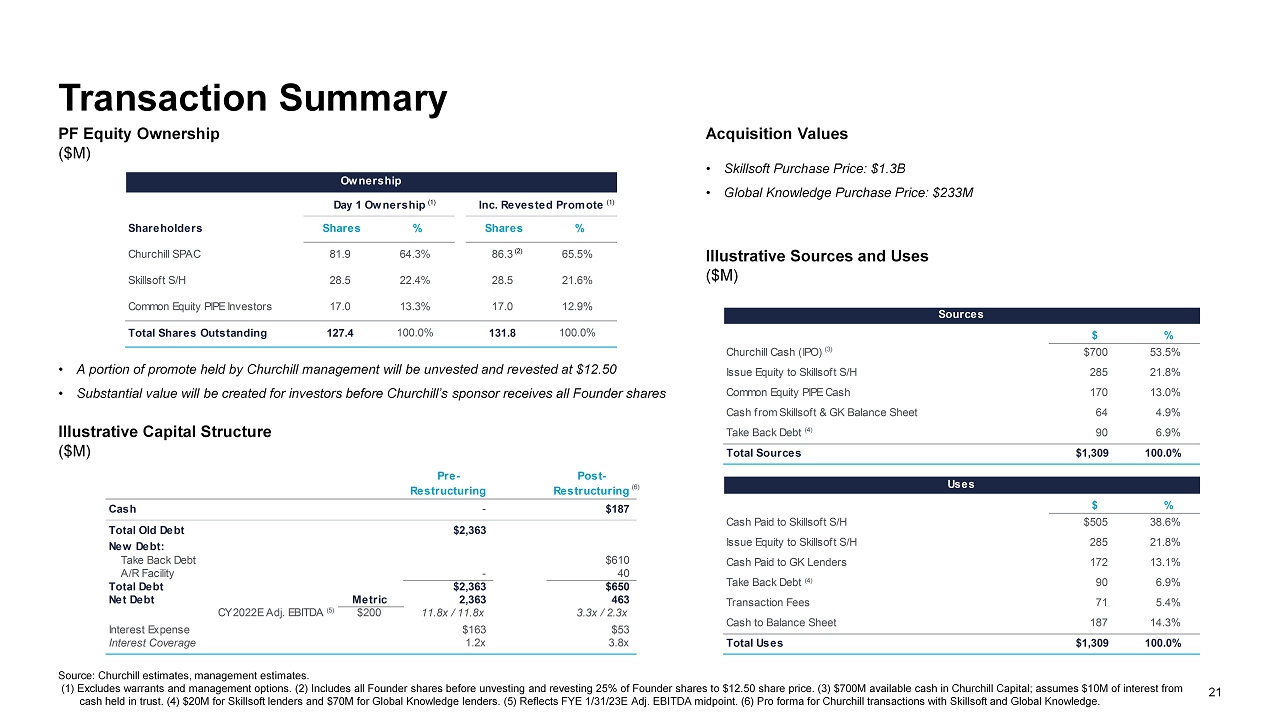

21 Sources $ % Churchill Cash (IPO) $700 53.5% Issue Equity to Skillsoft S/H 285 21.8% Common Equity PIPE Cash 170 13.0% Cash from Skillsoft & GK Balance Sheet 64 4.9% Take Back Debt 90 6.9% Total Sources $1,309 100.0% Uses $ % Cash Paid to Skillsoft S/H $505 38.6% Issue Equity to Skillsoft S/H 285 21.8% Cash Paid to GK Lenders 172 13.1% Take Back Debt 90 6.9% Transaction Fees 71 5.4% Cash to Balance Sheet 187 14.3% Total Uses $1,309 100.0% Transaction Summary PF Equity Ownership ($M) Illustrative Sources and Uses ($M) (3) Source: Churchill estimates, management estimates. (1) Excludes warrants and management options. (2) Includes all Founder shares before unvesting and revesting 25% of Founder shares to $12.50 share price. (3) $700M available cash in Churchill Capital; assumes $10M of int er est from cash held in trust. (4) $20M for Skillsoft lenders and $70M for Global Knowledge lenders. (5) Reflects FYE 1/31/23E Adj. EBIT DA midpoint. (6) Pro forma for Churchill transactions with Skillsoft and Global Knowledge. Ownership Day 1 Ownership Inc. Revested Promote Shareholders Shares % Shares % Churchill SPAC 81.9 64.3% 86.3 65.5% Skillsoft S/H 28.5 22.4% 28.5 21.6% Common Equity PIPE Investors 17.0 13.3% 17.0 12.9% Total Shares Outstanding 127.4 100.0% 131.8 100.0% (1) (1) (2) • A portion of promote held by Churchill management will be unvested and revested at $12.50 • Substantial value will be created for investors before Churchill’s sponsor receives all Founder shares (4) (4) • Skillsoft Purchase Price: $1.3B • Global Knowledge Purchase Price: $233M Acquisition Values Pre- Restructuring Post- Restructuring Cash - $187 Total Old Debt $2,363 New Debt: Take Back Debt $610 A/R Facility - 40 Total Debt $2,363 $650 Net Debt Metric 2,363 463 CY2022E Adj. EBITDA $200 11.8x / 11.8x 3.3x / 2.3x Interest Expense $163 $53 Interest Coverage 1.2x 3.8x Illustrative Capital Structure ($M) (5) (6)

22 7.6x Significant value creation opportunity for investors Skillsoft’s implied value is at a significant discount to its peers on revenue m ultiples The Company is u nique in its high cash flow g eneration u nlike many of its peers Equity Value / LFCF Many of publicly owned and private peers are believed to not generate positive EBITDA Many peers are believed to be reliant on ongoing funding to continue to operate 2.2x 6.7x Firm Value / Revenue 5.6x Firm Value / Adj. EBITDA Source: FactSet , Pitchbook. Market data as of 10/9/20. (1) Based on acquisition values of Skillsoft and Global Knowledge. Multiples based on midpoint of FYE 1/31/23E range. 1.5 3.0 Firm Value ($Bn) CY2021E 1 CY2022E 1 CY2022E 1 CY2022E 2.5+ 8 – 10x Venture - Backed Peers

23 Pluralsight July 2020 Investor Presentation

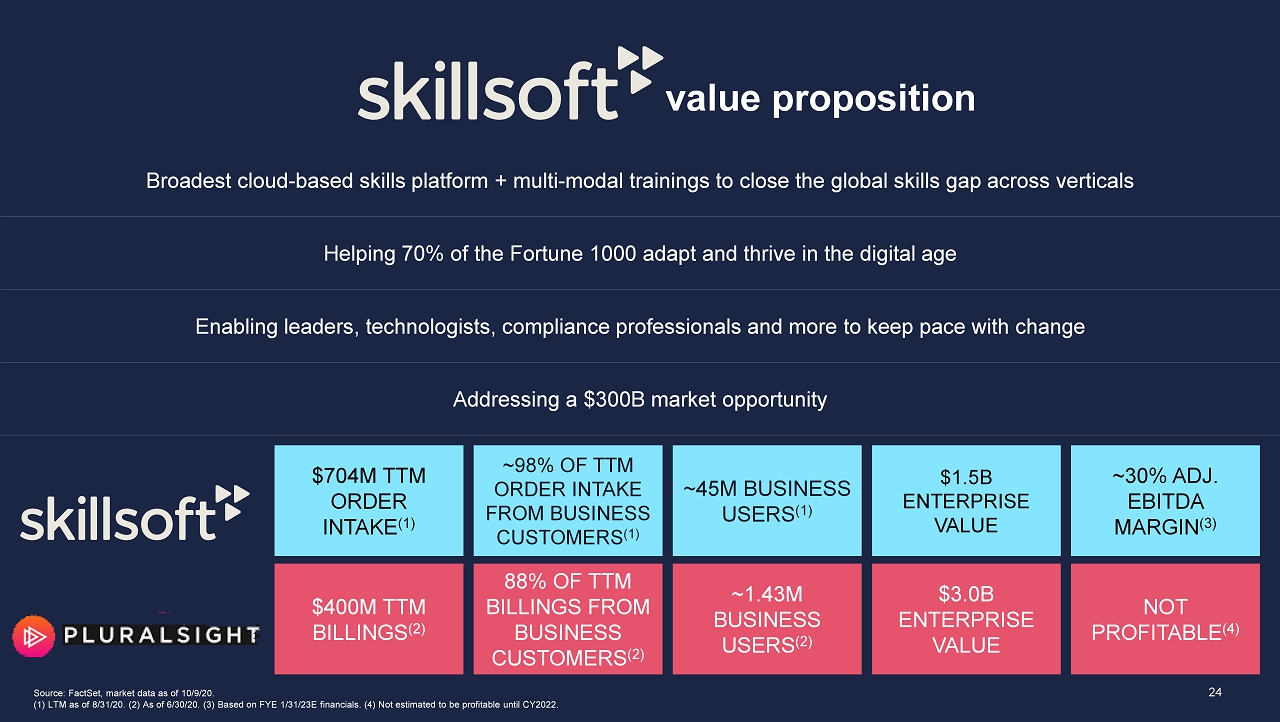

24 value proposition Broadest cloud - based skills platform + multi - modal trainings to close the global skills gap across verticals Helping 70% of the Fortune 1000 adapt and thrive in the digital age Enabling leaders, technologists, compliance professionals and more to keep pace with change Addressing a $300B market opportunity Source: FactSet, market data as of 10/9/20. (1) LTM as of 8/31/20. (2) As of 6/30/20. (3) Based on FYE 1/31/23E financials. (4) Not estimated to be profitable until CY20 22. $704M TTM ORDER INTAKE (1) ~98% OF TTM ORDER INTAKE FROM BUSINESS CUSTOMERS (1) ~45M BUSINESS USERS (1) $400M TTM BILLINGS (2) 88% OF TTM BILLINGS FROM BUSINESS CUSTOMERS (2) ~1.43M BUSINESS USERS (2) $1.5B ENTERPRISE VALUE ~30% ADJ. EBITDA MARGIN (3) $3.0B ENTERPRISE VALUE NOT PROFITABLE (4)